Unveiling the Secrets of Delta Vega: A Deeper Dive into Options Strategies

The world of options trading can be a complex and multifaceted realm, where sophisticated techniques and strategies often yield substantial rewards. Among these strategies, Delta Vega options trading stands out as a powerful tool for navigating market volatility. In this comprehensive guide, we will delve into the intricacies of Delta Vega, shedding light on its definition, calculation, and practical applications in options trading.

Image: www.youtube.com

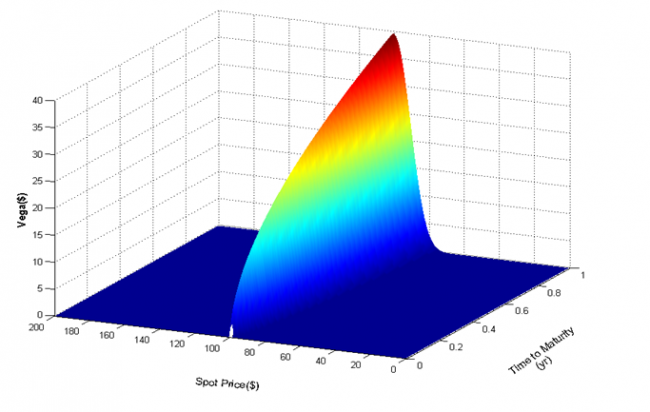

To begin, let’s establish a solid foundation by understanding Delta and Vega separately. Delta measures the sensitivity of the option’s price to changes in the underlying asset’s price. On the other hand, Vega gauges the option’s price sensitivity to changes in implied volatility. These two Greek letters provide valuable insights into how an option will behave under varying market conditions.

Delta Vega: A Dynamic Duo

Delta Vega is the product of the option’s Delta and Vega. This metric provides a comprehensive measure of the option’s price sensitivity to both the underlying asset’s price and implied volatility. A positive Delta Vega implies that the option’s price will increase with both rising stock prices and increased implied volatility. Conversely, a negative Delta Vega suggests that the option’s price will decrease when either the stock price or implied volatility rises.

The significance of Delta Vega lies in its ability to assess an option’s risk and potential reward. Options with high Delta Vegas are suitable for traders seeking aggressive strategies, as they offer significant leverage to market movements. However, these options also carry a higher level of risk due to their sensitivity to both price and volatility fluctuations.

Navigating Market Volatility with Delta Vega

Delta Vega plays a crucial role in managing risk and enhancing returns in volatile markets. By understanding the relationship between Delta Vega and market conditions, traders can tailor their strategies to exploit specific market environments. For instance, in periods of high volatility, traders may opt for options with positive Delta Vegas to capitalize on rapid price swings. Conversely, during periods of low volatility, options with negative Delta Vegas can provide downside protection while still offering modest gains.

Practical Applications of Delta Vega

The practical applications of Delta Vega extend beyond theoretical concepts. In the hands of seasoned traders, this metric serves as a valuable tool for implementing sophisticated trading strategies. By incorporating Delta Vega into their decision-making process, traders can:

- Identify optimal trade entries and exits, maximizing profit potential while minimizing risk.

- Construct customized hedging strategies, skillfully mitigating market volatility’s adverse effects.

- Enhance portfolio diversification by incorporating options with varying Delta Vegas, ensuring a balanced risk-reward profile.

Image: eazeetraders.com

Tips and Expert Advice: Mastering Delta Vega Trading

To achieve success in Delta Vega trading, it’s imperative to embrace the following tips and expert advice:

- Embrace Volatility: Recognize that volatility is an inherent characteristic of options trading; rather than shunning it, seek opportunities to capitalize upon market fluctuations.

- Mind Your Risk Tolerance: Carefully assess your risk appetite and allocate funds accordingly, being mindful that Delta Vega trading can amplify both potential rewards and risks.

Frequently Asked Questions about Delta Vega Options Trading

To provide clarity on commonly raised questions, we’ve compiled a comprehensive FAQ section:

- Q: How do I calculate Delta Vega?

A: Delta Vega is calculated by multiplying the option’s Delta and Vega values. - Q: What is a positive Delta Vega?

A: A positive Delta Vega indicates that the option’s price will rise with both increasing underlying asset price and implied volatility. - Q: What is the role of Delta Vega in volatility trading?

A: Delta Vega is a key metric for assessing risk and reward in volatile market conditions, allowing traders to tailor their strategies accordingly.

Delta Vega Options Trading

Image: www.insidefutures.com

Conclusion: Embracing the Complexity of Delta Vega

In the ever-evolving landscape of options trading, Delta Vega Optionen Trading emerges as a powerful tool for sophisticated traders seeking to navigate market volatility and enhance their strategies. By understanding the intricate relationship between Delta, Vega, and market conditions, traders can unlock a realm of possibilities for managing risk and maximizing returns. Whether you’re a seasoned professional or an aspiring trader, embracing Delta Vega options trading can elevate your trading journey to new heights.

Are you ready to explore the captivating world of Delta Vega options trading? Share your thoughts and insights in the comments below. Together, let’s unlock the full potential of this dynamic and rewarding trading technique.