In the high-stakes arena of financial markets, where fortunes are won and lost in a heartbeat, the daily trading volume of equity options stands as a testament to the incessant pulse of market sentiment. These complex financial instruments, which allow investors to speculate on the future price of stocks, have witnessed a surge in popularity, attracting a diverse cast of participants from seasoned professionals to aspiring traders. As we delve into the labyrinthine world of equity options, exploring the intricacies of market volume becomes paramount in deciphering the ebbs and flows of this ever-evolving ecosystem.

Image: www.investopedia.com

Deciphering Equity Options: A Crucible of Risk and Reward

Equity options are born from the intertwining of two fundamental principles: the right to buy (call) or sell (put) an underlying stock at a predetermined price (strike) and date (expiration). These contracts offer investors an arsenal of strategies, empowering them to wager on market trends, protect against downside risks, or generate income through option premiums. However, the inherent volatility of options coupled with the potential for substantial losses makes them a double-edged sword, demanding a thorough comprehension of market dynamics.

Market Volume: A Gauge of Market Participation

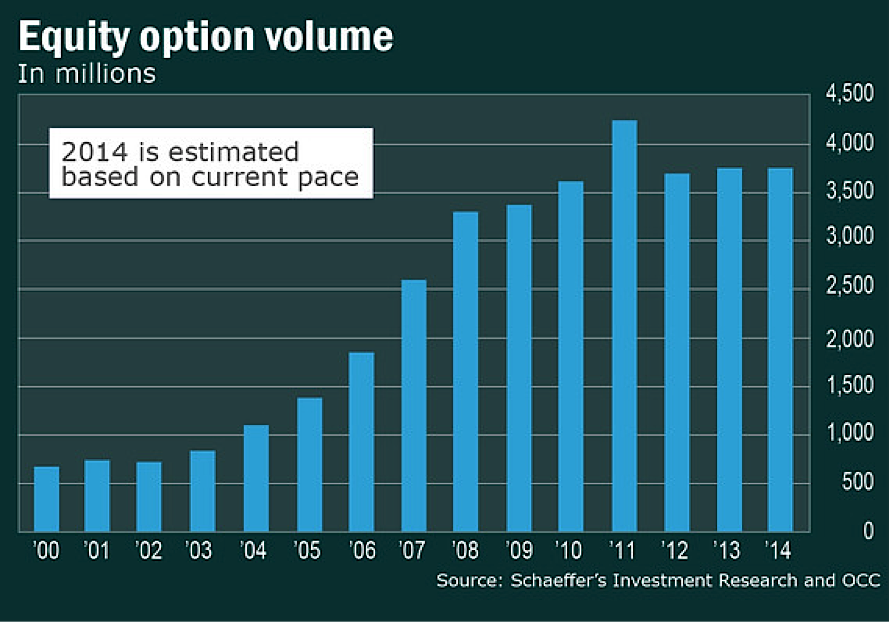

The daily trading volume of equity options serves as a vital indicator reflecting the aggregate number of contracts traded within a given trading day. It represents the collective actions of market participants, providing insights into the intensity of buying and selling pressure, investor sentiment, and the overall liquidity of the options market. High trading volumes often coincide with periods of heightened volatility, signaling elevated levels of fear, greed, or uncertainty among traders.

Tracking Volume Trends: Unraveling Market Sentiment

By meticulously tracking trading volumes over time, investors can glean valuable insights into prevailing market conditions. Surging volumes may suggest an influx of new participants or a shift in market sentiment, potentially signaling a trend reversal or a breakout. Conversely, dwindling volumes can indicate waning interest, a lack of liquidity, or a period of consolidation. Discerning these patterns and correlating them with other market indicators empowers traders with a formidable arsenal for informed decision-making.

Image: www.seeitmarket.com

Volatility’s Dance: The Fuel of Option Trading

Market volume and volatility are intertwined in a perpetual dance, each influencing the other in a complex choreography. High trading volumes often accompany heightened volatility, as investors seek to capitalize on rapid price movements or protect their portfolios against potential downturns. Volatility serves as a double-edged sword, amplifying potential gains while simultaneously magnifying risks. Understanding the relationship between volume and volatility is crucial for successful option traders, enabling them to adapt their strategies accordingly.

Liquidity and Market Efficiency: The Lifeline of Options Trading

The liquidity of the options market, directly influenced by trading volume, is a critical factor determining the ease and efficiency of executing trades. Ample liquidity ensures that traders can enter and exit positions swiftly, minimizing slippage and maximizing profit potential. Conversely, illiquid markets can lead to significant price discrepancies, reduced trading opportunities, and increased transaction costs. High trading volumes contribute to enhanced liquidity, allowing for smoother and more efficient trade execution.

The Virtuous Cycle: Volume’s Impact on Market Participants

The vibrant interplay between market volume, volatility, and liquidity creates a virtuous cycle that sustains the vitality of the options market. High trading volumes attract new participants, increase liquidity, and moderate volatility. This influx of activity further enhances market efficiency, attracting even more investors and fueling a self-perpetuating cycle of growth and opportunity. Understanding this virtuous cycle empowers option traders to identify and capitalize on favorable market conditions.

Daily Trading Volume Of Equity Options Market

Image: www.markethubonline.com

Conclusion: Navigating the Market’s Pulses

The daily trading volume of equity options serves as a crucial compass in the turbulent seas of the financial markets. By deciphering volume patterns, tracking volatility trends, and assessing liquidity conditions, investors gain invaluable insights into market sentiment and market dynamics. These insights empower them to refine their trading strategies, adapt to evolving conditions, and navigate the ever-changing landscape of the equity options market. As traders master the art of reading market volume, they unlock the potential for enhanced profits and reduced risks, transforming the market’s pulses into a symphony of opportunity.