Introduction: The Allure of Equity Options

Equity option trading offers an exhilarating and complex world where traders strive to capitalize on market movements. Understanding the intricacies of these financial instruments can empower investors with transformative tools to navigate market volatility and enhance their returns. This comprehensive guide will illuminate the fundamentals of equity option trading, empowering readers to unlock the potential of this dynamic market.

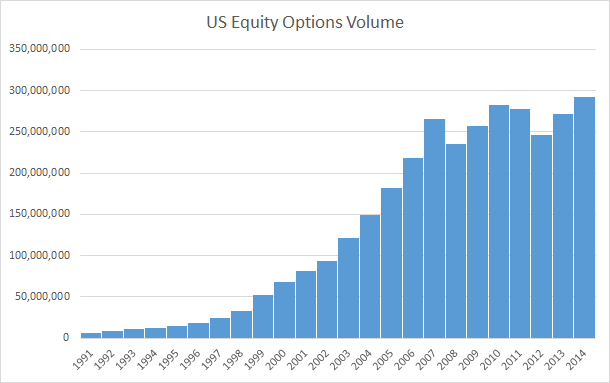

Image: admiralmarkets.com

Delving into the Anatomy of Equity Options

Options represent unique contracts that confer the right, but not the obligation, to buy (call options) or sell (put options) an underlying security at a specified strike price on or before a certain expiration date. The key advantage of options lies in their flexibility, empowering traders to capitalize on bullish or bearish market sentiments without assuming the full risk of owning or shorting the underlying asset.

Navigating the Core Concepts of Option Premiums

The price of an option, known as the premium, is determined by a confluence of factors, including the underlying security’s price, the time remaining until expiration, the strike price, and market volatility. Analyzing these variables is crucial for traders to gauge option pricing and make informed decisions.

Mastering the Art of Option Strategies

Equity options offer traders a diverse range of strategies, each tailored to specific market scenarios. Long calls seek to capitalize on rising prices, while long puts profit from declining markets. Sophisticated strategies like covered calls and protective puts enable traders to hedge their risks and generate income. Understanding the nuances of option strategies is paramount for maximizing profits and mitigating losses.

Image: www.optiontradingtips.com

Embracing Volatility and Utilizing Option Greeks

Market volatility plays a pivotal role in option pricing. Greek letters (Delta, Gamma, Theta, Vega, and Rho) quantify the sensitivity of option prices to changes in underlying price, time, volatility, and interest rates. Mastering the intricacies of Greeks enables traders to fine-tune their strategies and make precise adjustments to respond to evolving market conditions.

Deciphering the Options Market Data

Analyzing options market data provides vital insights into market sentiment and potential trading opportunities. Implied volatility, open interest, and volume are essential metrics that empower traders to gauge market expectations, identify potential trends, and make informed decisions.

Leveraging Technology and Platforms for Success

Technology plays a crucial role in modern-day option trading. Advanced platforms offer real-time data, sophisticated analytics, and automated execution capabilities. Leveraging these tools can enhance trading efficiency, optimize risk management, and empower traders to make timely decisions.

Risk Management: The Cornerstone of Responsible Trading

Equity option trading carries inherent risks. Understanding these risks and implementing a sound risk management strategy is paramount for long-term success. Stop-loss orders, position sizing, and hedging strategies can mitigate losses and protect capital in adverse market conditions.

Equity Option Trading

Conclusion: Empowering Investors with Option Mastery

Equipping oneself with a thorough understanding of equity option trading techniques can transform investment strategies. By delving into the intricacies of option premiums, strategies, and risk management, traders can navigate market dynamics and optimize their financial outcomes. Embracing the power of equity options empowers investors to unlock market potential and achieve their financial aspirations.