Delving into the World of Covered Call Options

Stock options trading, with its myriad of strategies, can be a lucrative endeavor. One popular and profitable strategy is covered call options trading, where investors combine the principles of stock ownership and options trading to generate income and hedge against potential losses. If you’re eager to delve into the world of covered call options trading, this comprehensive guide will equip you with the essential knowledge and strategies to navigate this fascinating domain.

Image: vantagepointsoftware.com

Understanding Covered Call Options Trading

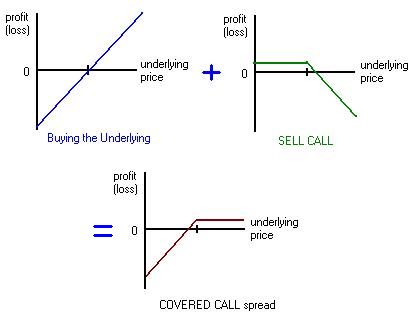

Covered call options trading involves selling (or “writing”) call options against a corresponding number of shares of the underlying stock that you already own. A call option grants the buyer the right, but not the obligation, to buy a specified number of underlying shares at a predetermined price (known as the strike price) before a specific expiration date. By selling (writing) a call option, you receive a premium in exchange for the obligation to sell the underlying shares if the option is exercised.

Maximizing Income Potential and Hedging Risk

Covered call options trading offers a unique blend of income generation and risk management. The premium received from selling the call option represents additional income, potentially enhancing your overall returns. Simultaneously, selling a call option with a strike price above the current stock price creates a buffer against potential losses. If the stock price falls below the strike price, the option will expire unexercised, and you retain ownership of your shares.

Expert Tips for Successful Trading

- Select stocks with strong fundamentals and high volatility: This strategy thrives on stocks with both strong growth potential and a measure of volatility to enhance premium revenue.

- Determine the appropriate strike price: Choose a strike price that provides a reasonable balance between premium revenue and downside protection.

- Manage option duration: Consider the time value decay of options and choose an expiration date that aligns with your trading goals.

- Dynamically adjust your positions: Monitor the market and adjust your positions as needed. This may involve rolling over options, adjusting strike prices, or exiting trades based on changing market conditions.

Image: urisofod.web.fc2.com

FAQ: Unraveling the Nuances

Q: What are the key risks of covered call options trading?

A: The primary risks include potential stock price declines and the possibility of being forced to sell your shares at the strike price if the option is exercised.

Q: How do I calculate the maximum potential return on a covered call?

A: The maximum potential return is limited to the premium received plus any appreciation in the stock price up to the strike price.

Q: Is covered call options trading suitable for all investors?

A: While this strategy can enhance returns and hedge risk, it’s generally not recommended for beginner or highly conservative investors.

Covered Call Options Trading Explained

/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

Image: cuartoymita.net

Conclusion: Embracing the Power of Covered Calls

Covered call options trading can be a compelling strategy for investors seeking income generation, risk mitigation, and diversification. By embracing the insights and tips outlined in this guide, you can confidently navigate the world of covered call options trading and unlock its potential rewards. As you deepen your understanding and experience, you’ll gain the ability to identify lucrative opportunities and make informed decisions that further enhance your financial goals.

Are you ready to explore the exciting world of covered call options trading? Let the journey begin!