Stock Options: A Comprehensive Overview

Stock options are a type of derivative contract that gives the holder the right but not the obligation to buy or sell an underlying asset at a predetermined price (strike price) on or before a certain date (expiration date). They allow investors to gain exposure to the price movements of a stock without having to purchase the underlying shares, offering both potential profits and limited risk.

Image: www.asktraders.com

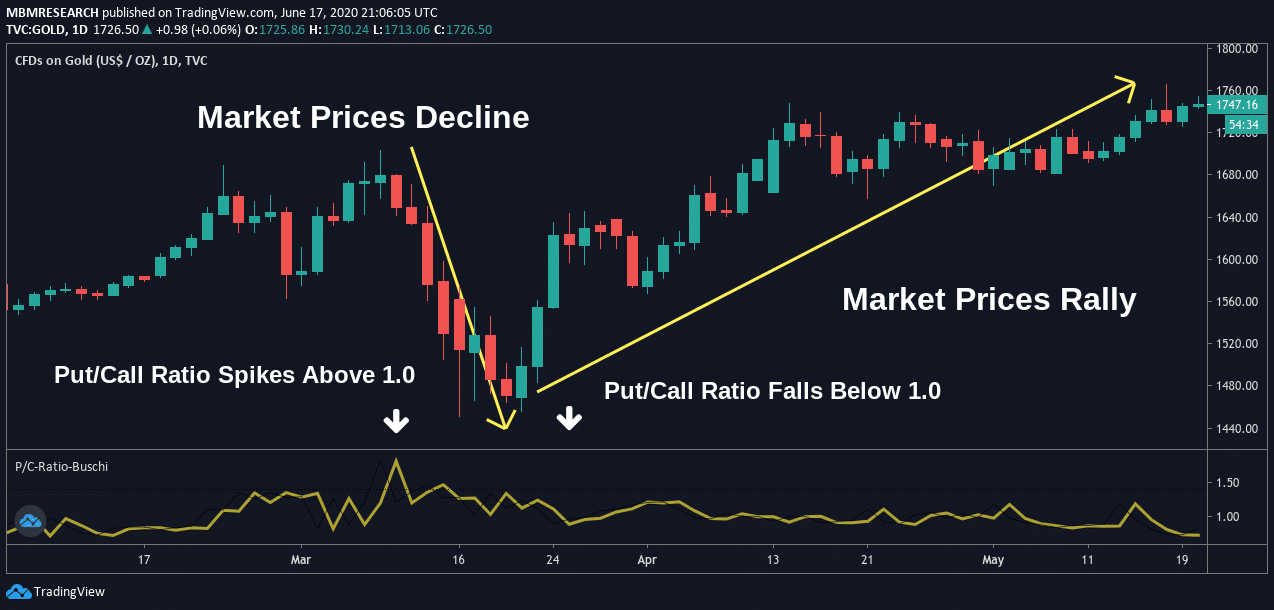

The Chicago Board Options Exchange (CBOE), the largest options exchange in the world, provides valuable data on stock options trading activity. This data offers insights into market trends, investor sentiment, and the overall health of the financial markets.

Recent Surge in Stock Options Trading

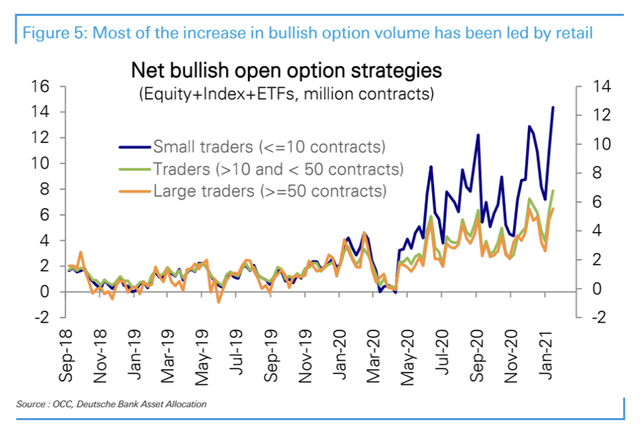

CBOE data indicates that stock options trading volume has surged in recent years, driven by:

- Increased market volatility: In uncertain markets, investors turn to options to hedge against risks or speculate on price movements.

- Growth of retail trading: Online platforms have made stock options trading more accessible to individual investors.

- Increased use of options in complex trading strategies: Options are used by professionals to enhance returns and manage risks.

Latest Trends and Developments

The CBOE data highlights several notable trends:

- Rise of call options: Investors are becoming more bullish, with call options (right to buy) outpacing put options (right to sell).

- Increased trading in individual stocks: Retail traders are increasingly focusing on individual stocks, rather than broad market indices.

- Growing popularity of short-term options: Monthly options, expiring in less than 30 days, have gained popularity due to their flexibility and potential for short-term gains.

Expert Insights and Tips

Industry experts recommend:

- Understanding the risks: Options are not suitable for all investors. It’s crucial to understand the potential risks and rewards before trading.

- Choosing appropriate strategies: Options offer a wide range of strategies to meet different objectives. Select strategies that align with your risk tolerance and investment goals.

- Monitoring the market: Stay informed about market news, events, and CBOE data to make informed trading decisions.

Image: seekingalpha.com

FAQ on Stock Options Trading

Q: What is the difference between a call and a put option?

A: A call option gives the right to buy, while a put option gives the right to sell the underlying asset at a specified price.

Q: What determines the price of an option?

A: Option prices are influenced by factors such as the underlying asset’s price, time to expiration, interest rates, and volatility.

Q: Is options trading suitable for everyone?

A: Options are complex and can be risky. They are not suitable for all investors. It’s essential to have a thorough understanding of options before trading.

Cboe Data On Stock Options Trading

Image: focus.world-exchanges.org

Conclusion

CBOE data provides unparalleled insights into stock options trading activity. By analyzing this data, investors can gain valuable information about market trends, investor sentiment, and the latest developments in options trading strategies. By understanding the risks, choosing appropriate strategies, and monitoring the market, investors can leverage stock options to enhance their returns and navigate market fluctuations.

Are you interested in further exploring the world of stock options trading? Stay tuned for additional articles and insights, or consult with a financial advisor to discuss your individual investment needs.