If you’ve ever wondered about stock options and how to get started with them, but were afraid to venture into the realm of finance, then buckle up! This stock options trading tutorial is designed explicitly for you, the novice in trading.

Image: moneypip.com

By the end of this tutorial, you’ll have a comprehensive grasp of stock options, empowering you to embark on your trading journey confidently. So, put on your trading cap and let’s dive right in!

Understanding Stock Options

What are Stock Options?

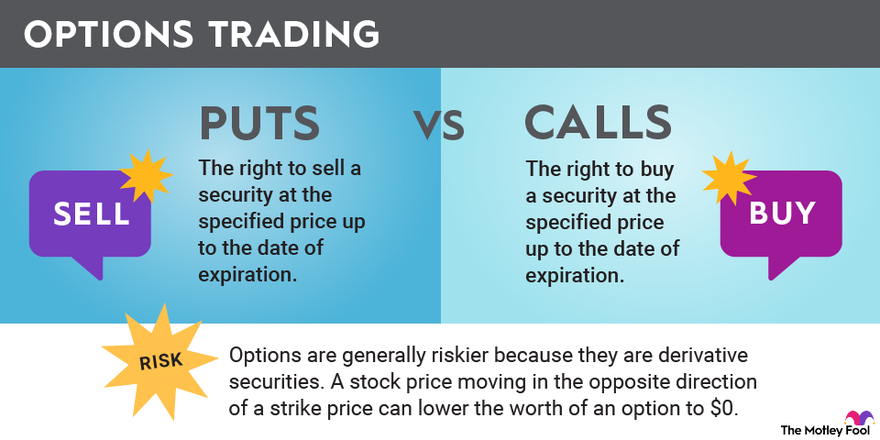

Essentially, stock options are contracts that grant the holder the right, but not the obligation, to either buy (call option) or sell (put option) a specific number of shares of an underlying asset (stock) at a predetermined price (strike price) on or before a specified date (expiration date).

The History and Significance of Stock Options

Stock options trace their roots back to the early 20th century. In 1973, the Chicago Board Options Exchange (CBOE) introduced standardized stock options, revolutionizing the way traders hedged risks and speculated on stock movements. Today, stock options represent a significant financial instrument used by individuals and institutions alike.

How Stock Options Trading Works

Trading stock options involves buying or selling contracts that represent the underlying asset. The buyer of an option contract pays a premium to the seller in exchange for the right to buy or sell the underlying asset at a specified price and time. Buyers stand to profit if the price of the underlying asset moves in the predicted direction while sellers profit when the price moves contrary to the buyer’s expectation.

Call Options: Call options give the buyer the right to acquire a certain number of shares of the underlying asset at the strike price on or before the expiration date. This is generally employed when the buyer anticipates an increase in the stock price.

Put Options: Put options endow the buyer with the right to sell a specific quantity of shares of the underlying asset at the strike price on or before the expiration date. This strategy is often utilized when the buyer anticipates a decrease in the stock price.

Factors to Consider in Stock Options Trading

Stock Price: The price of the underlying asset is a key factor in determining the value of an option contract. As the stock price moves, so does the value of the option.

Volatility: Volatility measures the magnitude of price fluctuations in the underlying asset. Higher volatility generally results in higher option premiums.

Time to Expiration: The time remaining until the option’s expiration date also influences its value. Options with longer durations have a higher time value than those nearing expiration.

Image: www.fool.com

Latest Trends and Developments

The stock options market is continuously evolving, with technology playing a pivotal role. The advent of electronic trading platforms and sophisticated analytical tools has made stock options trading more accessible and efficient.

In recent years, there has been a surge in the popularity of certain option strategies, such as covered calls and cash-secured puts, as investors seek alternative income streams and risk mitigation techniques.

Tips for Successful Stock Options Trading

Set Realistic Goals: Avoid aiming for overnight riches. Start with modest goals and gradually increase your trading volume as you gain experience.

Manage Risk: Stock options carry inherent risks. Determine your risk tolerance and allocate your capital accordingly. Use stop-loss orders to limit potential losses.

Frequently Asked Questions (FAQs)

Q: What is the difference between a call and a put option?

A: A call option gives you the right to buy, while a put option gives you the right to sell the underlying asset.

Q: How do I determine the value of an option contract?

A: Option value is influenced by factors such as the stock price, volatility, and time to expiration.

Stock Option Trading Tutorial

Image: www.asktraders.com

Conclusion

This beginner-friendly tutorial provides a comprehensive overview of stock options trading. If you are eager to delve deeper into this captivating world, continue exploring reliable resources, learning from experienced traders, and honing your trading skills through practice. Remember, knowledge and strategic decision-making are key to navigating the dynamic stock options market.

Are you ready to embark on your stock options trading adventure? Share your thoughts and questions in the comments below!