A Journey into the World of Market Speculation

In the realm of financial markets, options trading stands as an enigmatic yet potentially lucrative strategy. As a young investor, intrigued by the tales of market wizards making colossal fortunes through shrewd option trades, I ventured into this alluring domain. One fateful day, a risky call option bet left me facing a six-figure loss that forever etched into my memory the significance of understanding these complex instruments.

/call-and-put-options-definitions-and-examples-1031124-v5-8566395195f0403aaf5b4ad9e5cc9364.png)

Image: elearningensup.gifafrique.com

Options, as the name suggests, grant traders the option to buy or sell an underlying asset—a stock, bond, or commodity—at a predetermined price on or before a specific date. The two principal categories of options are calls and puts.

Calls: Betting on Ascending Prices

Calls endow the holder with the option to purchase an asset at a specified exercise price on or before the option’s expiration date. If the asset’s market price surges beyond the strike price, the call option gains value, offering a clear path to profit. However, if the price remains stagnant or plunges, the call option becomes worthless, resulting in a loss to the trader.

Puts: Profiting from Market Declines

In contrast to calls, puts provide the right to sell an asset at the set strike price. When the asset’s market value falls below the exercise price, the put option gains traction, enabling traders to profit from the price decline. Contrarily, when the price stays stable or escalates, puts expire worthless, leading to a financial loss.

The Anatomy of Options Trading

Each option contract represents 100 shares of the underlying asset. When purchasing an option, the trader pays a premium—the price of the contract—which is determined by several factors, including the asset’s volatility, time to expiration, and strike price.

Image: www.pinterest.com

Leveraging Volatility

Option traders can exploit market volatility to magnify potential gains and losses. When prices fluctuate erratically, option premiums tend to increase, offering opportunities for traders with a high tolerance for risk. Conversely, stable market conditions result in lower volatility and, consequentially, lower option premiums.

Harnessing Time Value

As options approach their expiration date, the time value component of their premiums diminishes. Traders can benefit from this time decay by selling options closer to expiration, potentially generating income even if the underlying asset’s price remains unchanged.

Tips from the Trading Trenches

Navigating the tumultuous waters of options trading requires a combination of skill, patience, and strategic finesse. Consider these tips from seasoned experts:

- Conduct Thorough Research: Meticulously study the underlying asset, market conditions, and historical trends before making any trades.

- Understand Delta: Delta measures the sensitivity of an option’s price to changes in the underlying asset’s price. This understanding is crucial for assessing risk and potential returns.

- Manage Risk: Options trading inherently carries significant risk. Prudently manage your trades by limiting the number of contracts you buy or sell and diversifying your portfolio.

FAQ Unlocking the Options Conundrum

Q: What is the difference between a call and a put option?

A: Calls grant the holder the option to buy an asset, while puts confer the right to sell.

Q: How is the premium for an option determined?

A: The premium is influenced by factors such as the asset’s volatility, time to expiration, and strike price.

Q: When should I buy a call option?

A: When you anticipate a rise in the underlying asset’s price. Conversely, buy a put option when you predict a price decline.

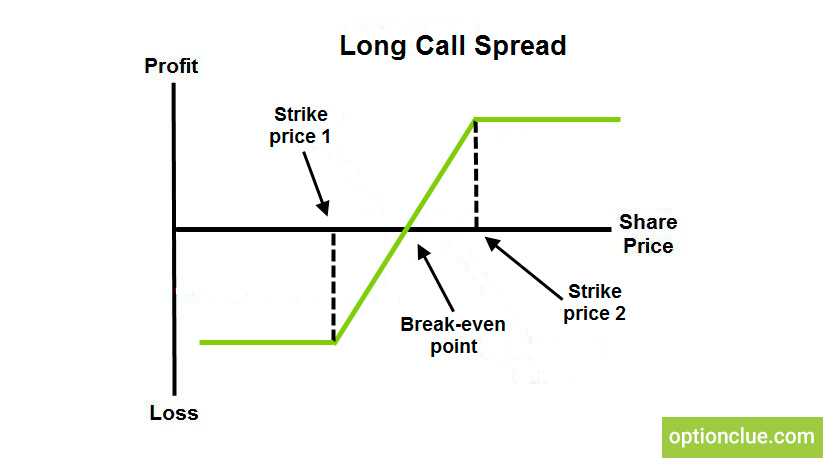

Calls And Puts Options Trading

Image: optionclue.com

Conclusion: Embracing the Power of Options

Options trading presents a powerful tool for savvy investors seeking to enhance their returns or mitigate risks. Grasping the nuances of calls and puts, utilizing market volatility, and employing sound trading strategies are keys to unlocking the potential of this complex yet exhilarating financial instrument.

So, are you ready to delve into the captivating world of options trading and experience the thrill of market speculation firsthand?