Introduction

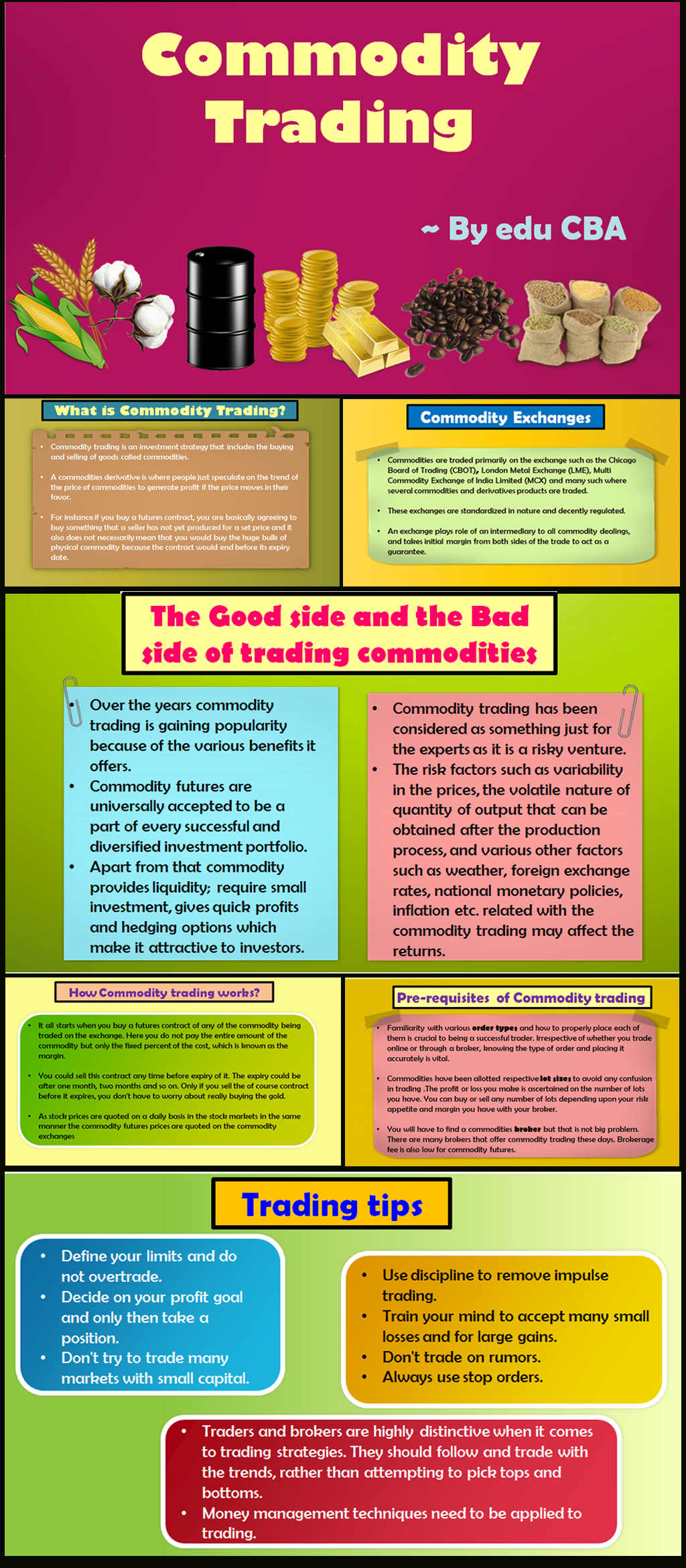

In the realm of financial markets, few instruments offer the depth, versatility, and profit potential of commodity trading options. These options empower traders with the ability to speculate on future price movements of commodities, such as oil, gold, wheat, and coffee. Understanding the intricacies of commodity trading options is essential for navigating this complex landscape and seizing lucrative market opportunities.

Unveiling Commodity Trading Options

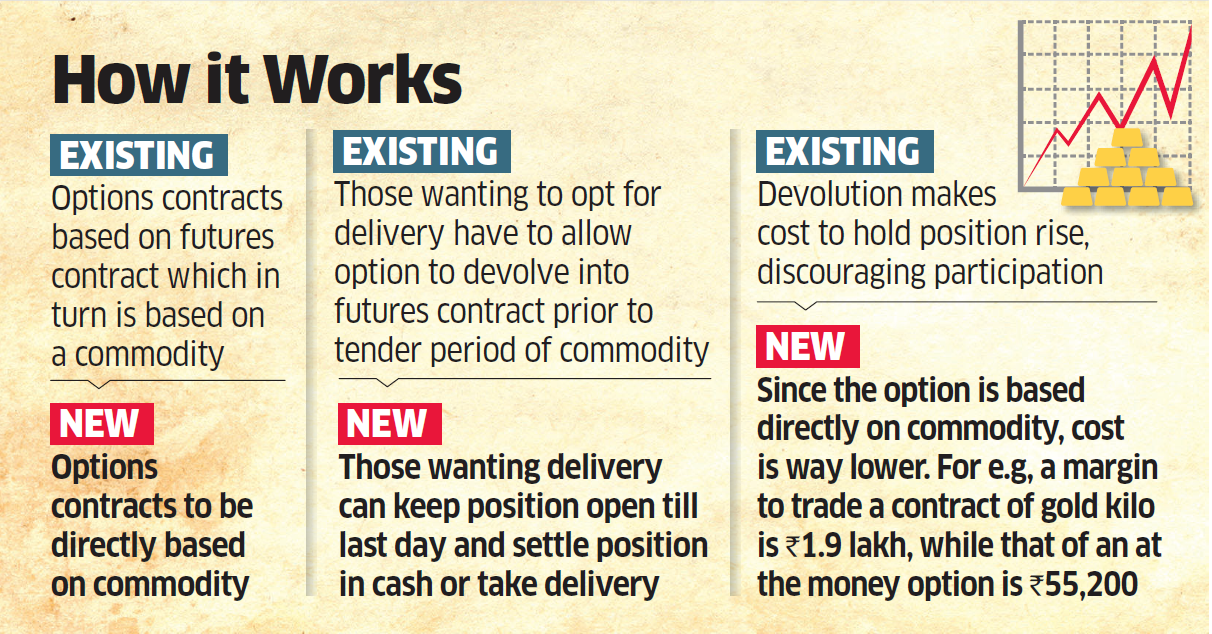

Commodity trading options are contracts that grant the holder the right but not the obligation to buy (call options) or sell (put options) a specific commodity at a predetermined price (strike price) on or before a particular date (expiration date). These contracts are traded on exchanges, providing a centralized venue for buyers and sellers to meet. The buyer of an option pays a premium to the seller, entitling them to the rights bestowed by the contract.

Striking the Balance: Calls vs Puts

Call options provide traders with the potential to profit from rising prices, as they allow the holder to buy the underlying commodity at a fixed strike price, irrespective of the market price at the expiration date. Conversely, put options offer the opportunity to gain from falling prices, granting the holder the right to sell the commodity at the predetermined strike price.

Delving into Option Portfolio Strategies

The versatility of commodity trading options shines through the diverse range of portfolio strategies they facilitate. These strategies allow traders to tailor their positions based on individual market outlooks and risk appetites. Some of the most prevalent strategies include:

- Covered Calls: Selling call options against an existing position in the underlying commodity to generate additional income.

- Protective Puts: Buying put options to hedge against downside price movement in the underlying commodity.

- Straddles and Strangles: Buying both a call and a put option with the same strike price and expiration date, offering potential profits in both rising and falling markets.

- Bull and Bear Spreads: Multi-legged strategies that involve buying and selling options of different strike prices to speculate on directional market movements.

Unveiling the Dynamics of Option Pricing

The price of a commodity trading option is determined by a complex interplay of factors, including:

* **Underlying Commodity Price:** The current market value of the underlying commodity.

* **Volatility:** The expected fluctuations in the commodity price.

* **Time to Expiration:** The remaining time until the option’s expiration date.

* **Interest Rates:** The current level of interest rates.

Navigating the Nuances of Option Trading

While commodity trading options open up a world of opportunities, they also carry inherent risks. To succeed in this market, traders must:

* **Understand the Mechanics:** Grasp the intricacies of option contracts, including exercise and assignment.

* **Manage Risk Prudently:** Employ stop-loss orders to limit losses and closely monitor market conditions.

* **Stay Informed:** Keep abreast of economic indicators, supply-demand dynamics, and geopolitical events that can impact commodity prices.

* **Seek Professional Advice:** Consider consultations with experienced brokers or advisors for guidance on suitable trading strategies.

Conclusion

Embarking on the journey of commodity trading options can unlock significant market potential for strategic traders. By comprehending the core concepts, embracing diverse portfolio strategies, and diligently managing risks, traders can navigate this dynamic landscape and harness the transformative power of these versatile financial instruments. Whether seeking to capitalize on price fluctuations, hedge against market uncertainty, or diversify portfolios, commodity trading options offer a path to financial success for those with unwavering determination and a thirst for market opportunities.

Image: elearningensup.gifafrique.com

Image: futuresoptionsetc.com

Commodity Trading Options

Image: www.educba.com