Options trading offers a powerful suite of strategies to enhance returns and manage risk. One such strategy is the break-even option trade, a versatile technique that empowers traders with unique profit potential. Understanding the intricacies of break-even options trading is essential for effective implementation and superior trading outcomes. This comprehensive guide delves into the concept, mechanism, and nuances of break-even options trades, equipping you with the knowledge to navigate this dynamic trading landscape with confidence.

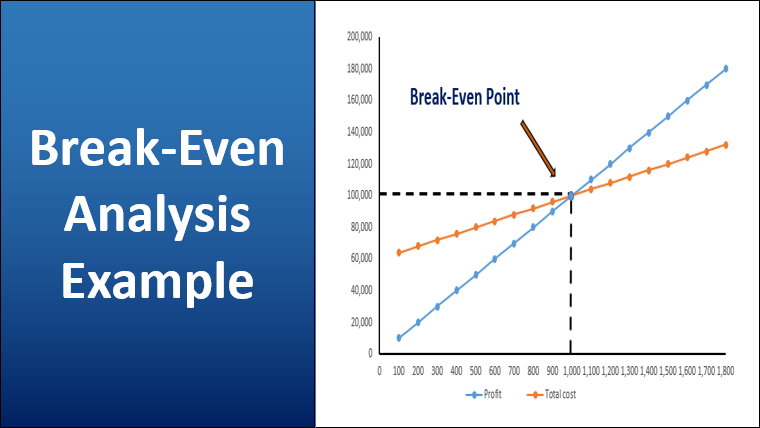

Image: www.youtube.com

Comprehending Break-Even Options Trading: A Strategic Overview

Break-even options trading is a strategic maneuver that involves the simultaneous purchase and sale of options contracts with the same underlying asset, strike price, and expiration date. The objective of this strategy is to structure the transaction such that the combined premium paid for the call option and the premium received from selling the put option results in a net premium of zero. This clever balancing act allows the trader to trade at the break-even point, where the potential profit or loss is contingent upon the movement of the underlying asset’s price relative to the strike price.

The essence of break-even options trading lies in the delicate equilibrium between the call and put options. The call option grants the trader the right but not the obligation to buy the underlying asset at the strike price on or before the expiration date. Conversely, the put option confers the right to sell the asset at the strike price during the same time frame. By carefully calibrating the number of contracts and the premiums, the trader can effectively neutralize the initial net cash flow, rendering the position cash-flow neutral.

Navigating the Break-Even Options Trading Landscape: Essential Steps

-

Establish the Trading Horizon: Identify the desired expiration date for the options contracts. This decision hinges on factors such as market volatility, the expected price movement of the underlying asset, and the trader’s risk tolerance.

-

Determine the Strike Price: Select a strike price that aligns with your market outlook and profit expectations. In most cases, the strike price is set at or near the current market price of the underlying asset.

-

Calculate the Premiums: Utilize an options pricing model or consult a broker to determine the premiums for both the call and put options. The goal is to achieve a net premium of zero, effectively eliminating any upfront cash outlay.

-

Execute the Trade: Place simultaneous orders to buy the call option and sell the put option. Ensure that the number of contracts purchased and sold aligns precisely to maintain the zero-net-premium structure.

-

Monitor the Position: Keep a watchful eye on the movement of the underlying asset’s price and the evolving premiums of the options contracts. Adjust the position as necessary to optimize profit potential and manage risk.

Understanding the Dynamics of Break-Even Options Trading: Profit Potential and Risk Management

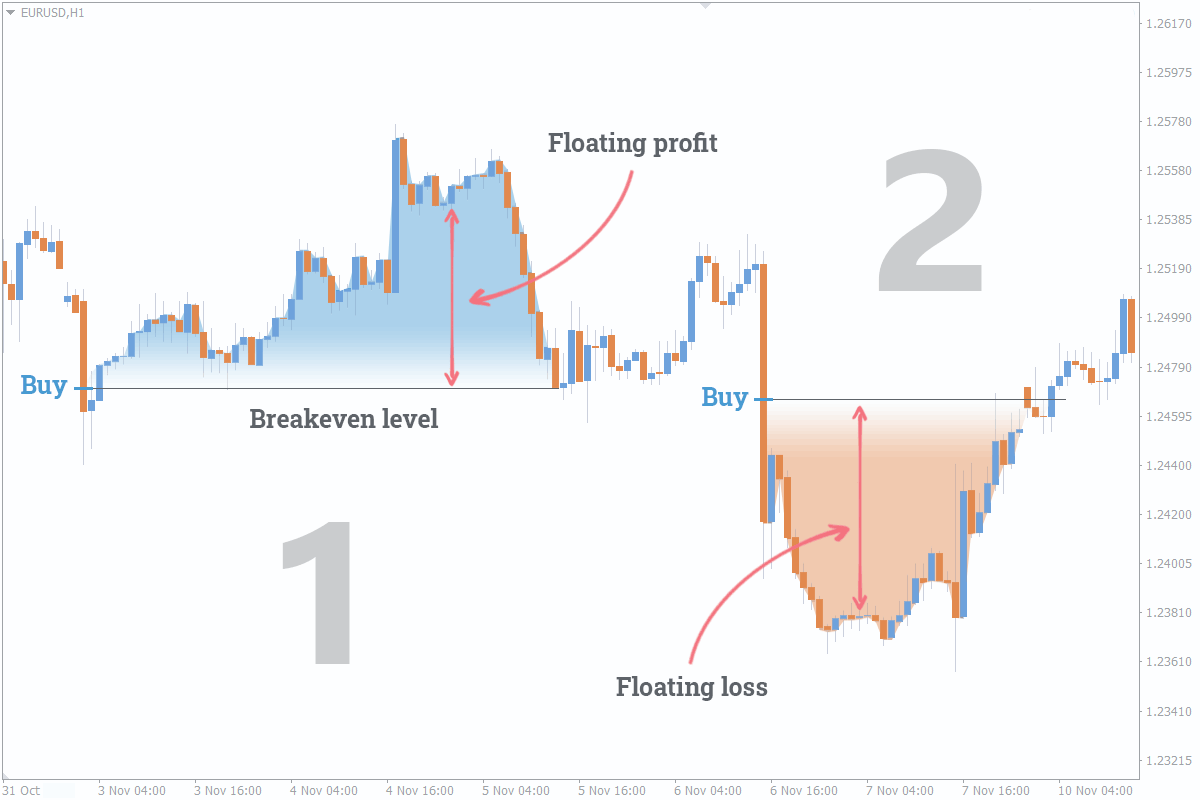

The profitability of a break-even options trade hinges on the movement of the underlying asset’s price relative to the strike price. If the price of the asset rises above the strike price, the call option gains value, while the put option loses value, leading to a potential profit. Conversely, if the asset’s price falls below the strike price, the put option gains value, and the call option loses value, potentially resulting in a loss.

Risk management is an integral aspect of break-even options trading. The trader’s risk exposure is primarily influenced by the volatility of the underlying asset and the time remaining until expiration. Higher volatility amplifies the potential for significant price swings, potentially leading to substantial gains or losses. Time decay, on the other hand, works against the trader as the value of the options contracts erodes over time, especially as expiration approaches.

Image: www.educba.com

Break-Even Options Trading: A Versatile Strategy for Diverse Market Conditions

The flexibility of break-even options trading makes it applicable in various market conditions. It can be utilized as:

-

A Neutral Strategy: When the trader anticipates minimal price movement in either direction, a break-even trade can generate a modest profit from the decay of the options premiums.

-

A Bullish Strategy: When the trader expects the underlying asset’s price to rise, a break-even trade can offer a higher profit potential compared to simply buying the call option.

-

A Bearish Strategy: If the trader anticipates a decline in the underlying asset’s price, a break-even trade provides a limited profit potential while managing the risk of a larger loss.

Break Even Options Trading Meaning

Image: fxssi.com

Conclusion

Break-even options trading is a versatile and powerful strategy that offers the potential for profitable trading outcomes. Through the simultaneous purchase of a call option and sale of a put option, traders can neutralize the initial net cash flow, enabling them to capitalize on price movements in either direction. Understanding the intricacies of break-even options trading