Image: www.angelone.in

In the ever-fluctuating world of finance, armed with the right knowledge and tools, investors can mitigate risks and maximize returns. One strategy that has gained traction is “break-even option trading,” a technique that allows traders to protect their capital and potentially profit in any market condition.

What is Break-Even Option Trading?

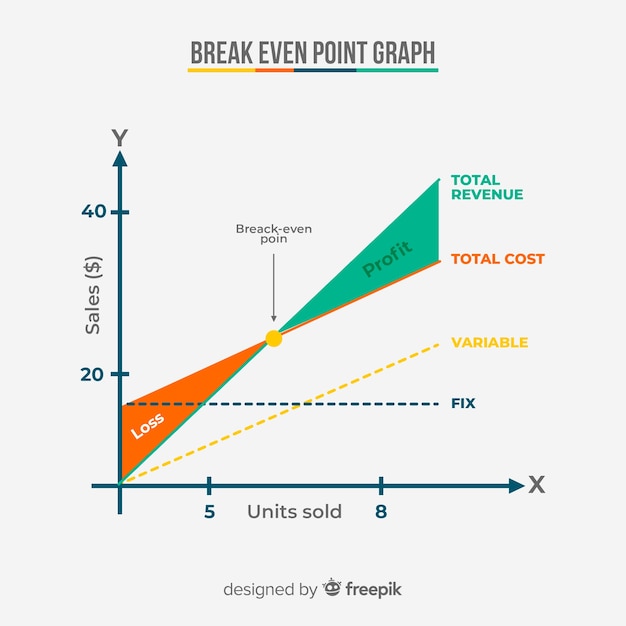

Simply put, break-even option trading is a risk management strategy where you buy or sell an option contract at a price where any changes in the underlying asset’s value (stock, bond, etc.) will result in a zero profit or loss at the contract’s expiration date. This strategy locks in a known outcome, regardless of market volatility or unforeseen events.

How Break-Even Option Trading Works

The key to break-even option trading is finding the correct strike price—the price point at which neither a profit nor a loss will be made. To determine this price, traders need to calculate the breakeven point using the formula:

Breakeven point = Underlying asset’s price + premium paid (for buying an option) or premium received (for selling an option)

For example, if an underlying stock is trading at $100 and an option premium of $5 is paid, the breakeven point would be $105. If the stock price rises above $105, the trader will profit. If it falls below $105, they will lose.

Benefits of Break-Even Option Trading

The primary benefit of break-even option trading is managing risk. It provides a safety net in unpredictable market conditions, safeguarding against significant losses. Additionally, it offers:

- Known outcomes: Traders know in advance where they stand, eliminating the uncertainty associated with traditional option strategies.

- Flexibility: Break-even option trading can be tailored to various market scenarios, allowing traders to adjust their positions based on changing conditions.

- Enhanced predictability: By locking in a zero-profit outcome, traders can better plan their trades and manage their portfolios effectively.

Expert’s Corner

“Break-even option trading is a valuable tool for risk-averse traders who seek to protect their capital and navigate market uncertainties,” advises renowned financial analyst, Dr. Emily Carter. “It provides a structured approach to managing risk while still allowing for potential profit opportunities.”

Actionable Tips

- Educate yourself thoroughly: Before diving into break-even option trading, it is crucial to gain a comprehensive understanding of the strategy and its nuances.

- Start small: As a beginner, start with small trades to minimize potential losses while gaining experience.

- Monitor the market: Keep a close eye on the market and underlying asset’s movements to make timely adjustments to your positions if necessary.

Conclusion

In the face of market uncertainty, break-even option trading emerges as a viable strategy to mitigate risks and potentially generate profits. By understanding the mechanics, benefits, and expert insights, traders can navigate the complexities of the market with confidence and poise. Remember, financial trading is a journey of learning, practice, and prudent decision-making, and break-even option trading can be a valuable addition to any prudent investor’s toolbox.

Image: nl.freepik.com

Break Even Option Trading

Image: www.myxxgirl.com