Imagine, for a moment, having the ability to harness the power of the global currency market, not by simply buying and selling, but by predicting its movements, and reaping rewards many times greater than your initial investment. That is the allure of options trading in forex, a world of complex strategies, calculated risks, and potentially massive returns. But before you dive headfirst into this exhilarating yet treacherous waters, a thorough understanding of the fundamentals is essential, as the risk of loss is just as real as the potential for profit.

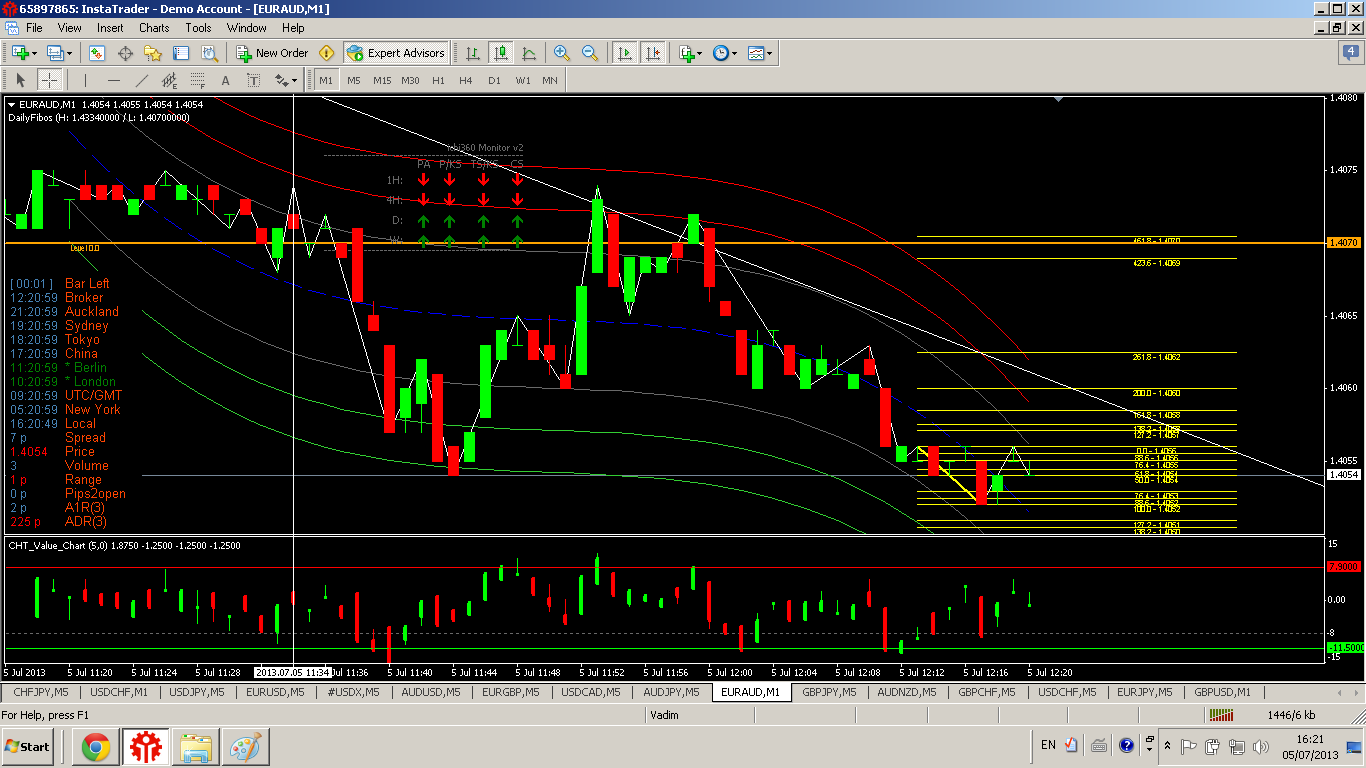

Image: www.forexbrokers.com

Options trading in forex revolves around buying or selling contracts that grant you the right, but not the obligation, to buy or sell a specific currency at a predetermined price within a set timeframe. It’s a game of predicting market movements and timing your entries perfectly. But, as we delve deeper, you’ll understand that it’s not just about chance; it’s about strategy, knowledge, and absolute control over your risk appetite.

Decoding the World of Forex Options: Essential Terms

Before we explore the intricacies of forex options trading, let’s first decipher the key terms that define this financial landscape:

- Option Contract: This is the foundational element in forex options trading. It gives you the right to buy (call option) or sell (put option) a specific currency pair at a predetermined price (strike price) within a defined timeframe (expiry date).

- Premium: You pay a premium to purchase an option contract. This premium is the price you pay for the right to exercise the option, and it’s influenced by factors like the strike price, time to expiry, and market volatility.

- Strike Price: This is the price at which you can buy or sell the currency pair when you exercise your option. Think of it as the agreed-upon exchange rate in the contract.

- Expiry Date: This is the deadline by which you must decide whether to exercise your option or let it expire worthless. The closer the expiry date, the higher the premium, as the time value of the option decreases.

- Underlying Asset: The underlying asset in forex options is the currency pair you’re trading. This could be EUR/USD, GBP/USD, or any other currency combination.

- Spot Price: The spot price represents the current market price of the currency pair at the time of trading. Unlike options, spot trading requires immediate execution.

- Leverage: Forex options trading, like many other forex derivatives, allows you to leverage your investment. This means you can control a larger position with a smaller capital outlay, potentially amplifying both profits and losses.

Types of Forex Options: A Diversification of Opportunities

Forex options offer a range of strategies tailored to different risk appetites and market outlooks. Some of the most common types include:

- Vanilla Options: These are the simplest and most basic type of forex options, allowing you to either buy or sell (call or put) a currency pair at the strike price. They are ideal for beginners seeking a fundamental understanding of options trading.

- Binary Options: In this style, you don’t receive the underlying asset. Instead, you predict the direction of the price movement (up or down) at the expiry time. You can either earn a fixed payout if your prediction is correct, or lose your initial investment if it’s wrong.

- Barrier Options: These options come with predefined price thresholds or “barriers.” They provide payouts only if the price of the underlying asset breaches these barriers before the expiry date. They offer a higher potential return, but with a higher level of risk.

- Exotic Options: These are non-standard options with unique payoff structures and payout profiles. They are complex and usually customized, often used by sophisticated traders to tailor their strategies for specific market conditions.

The Advantages and Disadvantages of Forex Options

Options trading offers a vast set of benefits for traders who can navigate its complexities. But like any financial instrument, it comes with its share of disadvantages.

Image: s3.amazonaws.com

Advantages of Forex Options:

- Limited Risk: Your maximum potential loss is defined upfront by the premium you pay. This fixed risk allows you to control your exposure and potentially mitigate significant losses.

- High Potential Profits: Options trading allows you to generate profits that can exceed your initial investment. This leverage potential can generate attractive returns, especially in volatile markets.

- Flexibility: You have the flexibility to choose the expiry date and strike price that match your investment horizon and risk tolerance. Tailoring your strategy to specific market opportunities is easier.

- Hedging Opportunities: Forex options can be used to hedge your existing market positions, safeguarding your portfolio against adverse price movements.

Disadvantages of Forex Options:

- Time Decay: Options lose value as their expiration date approaches. This time decay, also known as “theta,” diminishes the potential profit over time.

- Premium Cost: Purchasing an option incurs an upfront cost (the premium). This cost can eat into your potential profits, especially if the market moves in your favor.

- Complexity: Options trading involves understanding complex concepts and strategies. It’s not for beginners, requiring significant time to learn and practice.

- Market Volatility: Options pricing is highly influenced by market volatility. While volatility can lead to substantial profits, it can also result in rapid losses.

Essential Strategies for Successful Forex Options Trading

While options trading can offer immense potential, a structured approach is essential to ensure success. Here are some strategies commonly employed by successful options traders:

- Covered Options Selling: In this strategy, you sell options and own the underlying asset (currency pair) to reduce potential losses. You profit from the premium received, but your downside is limited by the underlying asset’s value.

- Selling Straddles: This involves simultaneously selling both call and put options on the same currency pair with the same strike price and expiry date. This strategy thrives when the underlying asset remains relatively stable, as both options lose value.

- Buying Straddles: This involves buying both a call and put option, profiting from large price movements (volatility). This strategy is risky but can yield high profits in volatile markets.

- Covered Call: A covered call strategy involves selling call options and owning the underlying asset. This strategy aims to generate income from the premium received, but limits potential profit from the underlying asset’s appreciation.

Risk Management: The Bedrock of Successful Options Trading

The potential profit in options trading is directly linked to the risk you’re willing to take. Proper risk management is the cornerstone of a sustainable strategy. Here are key principles for managing risk effectively in options trading:

- Define your risk tolerance: Before entering any trade, determine the maximum amount you’re willing to lose. This self-assessment is crucial for setting realistic trade sizes and avoiding emotional decisions.

- Use stop-loss orders: These orders automatically close your position when the underlying asset price reaches a predefined trigger point, limiting your potential loss in case of unfavorable market movements.

- Position sizing: Allocate your capital strategically to control the percentage of your portfolio exposed to each position. Limit your overall risk by controlling your investment size for individual trades.

- Diversify your portfolio: Don’t put all your eggs in one basket. Spread your investments across different currency pairs, options types, and strategies to mitigate overall risk and benefit from the potential for diversification.

Navigating the Forex Options Landscape: Choosing the Right Platform

The right trading platform can make all the difference in your forex options journey. Look for platforms that offer:

- User-friendly interface: A simple and intuitive design that allows you to easily navigate the platform and execute trades.

- Comprehensive options trading tools: Access to real-time market data, charting tools, advanced analytical features, and order types that support your options trading strategies.

- Competitive fees and commissions: Fair pricing structures that don’t erode your profits. Look for low trading commissions and transparent fees.

- Secure and reliable infrastructure: Ensure the platform operates on a secure and reliable server infrastructure to protect your funds and ensure uninterrupted access to the market.

- Top-notch customer support: A responsive and helpful customer support team to answer your questions and resolve any issues you encounter.

Expert Insights: Unlocking Success in Forex Options

Successful options traders emphasize the importance of continuous education and adaptability. They constantly refine their strategies, adapt to market volatility, and capitalize on opportunities. Experts advise:

- “Knowledge is power”: Invest time in understanding the intricacies of forex options, their pricing models, and different trading strategies. Continuous learning is essential for staying ahead in this dynamic market.

- “Discipline is key”: Emotional decisions can lead to disastrous outcomes. Stick to your risk management plan and avoid impulsive trades based on short-term market fluctuations.

- “Embrace the volatility”: While volatility can be challenging, it also offers excellent opportunities for profitable trades. Learn to exploit market swings strategically by adapting your strategies.

Options Trading Forex

Your Journey Begins: Embracing the Challenge

Options trading in forex is an exhilarating ride, filled with potential and risk. While it can be a lucrative venture for those who master its intricacies, it demands dedication, discipline, and a willingness to learn continuously. The journey begins with understanding the fundamentals and building a robust risk management strategy. As شما embark on your forex options journey, remember that consistent learning, strategic planning, and unwavering discipline are the keys to unlocking the true potential of this dynamic and rewarding market.

Have you ever considered incorporating forex options into your trading strategy? Share your thoughts and experiences in the comments below. Together, we can decipher the complexities and harness the power of this dynamic market.