I always remember my first encounter with after hours option trading. It was a cold winter evening, just after dinner, when I noticed an unusual surge in activity on my trading platform. Curious, I decided to investigate, and what I found was a whole new world of trading possibilities. The thrill of trading after hours has stayed with me ever since.

Image: chronohistoria.com

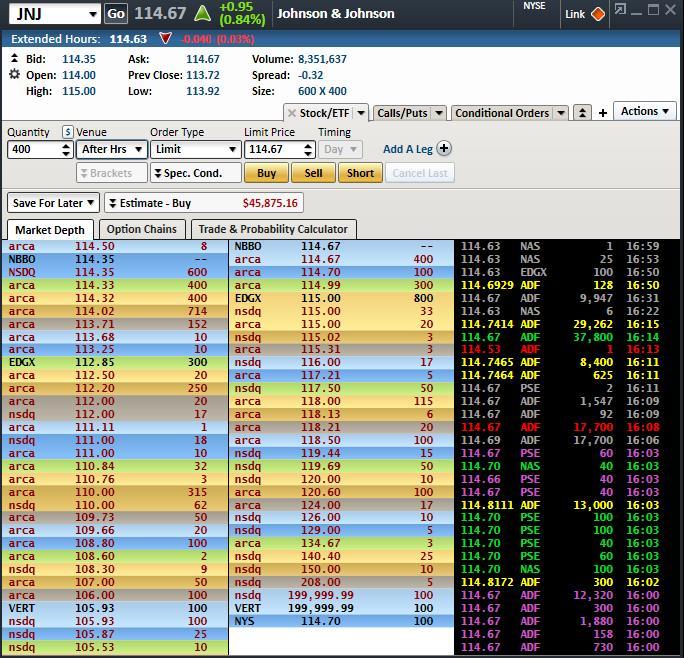

After hours option trading, as the name suggests, refers to the trading of options contracts outside of regular market hours. This unique market provides investors with extended trading opportunities, allowing them to capitalize on market movements even when the primary exchanges are closed. However, it is important to note that after hours option trading comes with its own set of risks and rewards.

Entering the After Hours Trading Arena

To venture into the world of after hours option trading, you will need a brokerage firm that offers this service. Once you have an account, you can begin trading options contracts during the extended hours session, which typically runs from 4:00 pm to 8:00 pm EST. The availability of specific options contracts may vary depending on the brokerage firm.

In many ways, after hours option trading resembles regular market trading. Traders can buy and sell options contracts, utilizing various strategies to manage risk and potentially profit from market movements. However, there are some key differences that set after hours trading apart:

- Lower liquidity: After hours trading volume is generally lower than during regular market hours. This can lead to wider bid-ask spreads, making it more challenging to enter and exit trades at favorable prices.

- Increased volatility: The after hours market can be more volatile than the regular market, as fewer participants are actively trading. This volatility can create opportunities for quick profits, but it also exposes traders to greater risks.

- Limited availability of information: During regular market hours, traders have access to real-time news, company announcements, and other market data. This information is often limited during after hours trading, which can make it more challenging to make informed trading decisions.

The Lucrative Allure of After Hours Option Trading

Despite the challenges, after hours option trading offers several compelling advantages. For one, it provides traders with the opportunity to capitalize on market movements that occur outside of regular trading hours. For example, a trader who expects a company to release positive earnings after the market closes can buy call options on that company during the after hours session, potentially profiting from any post-earnings surge in the stock price.

Moreover, after hours option trading allows traders to adjust their positions or exit losing trades outside of regular market hours. This can be especially valuable if a trader has concerns about significant price movements or wants to manage risk overnight.

Expert Insights: Tips for After Hours Option Trading

Seasoned traders have developed a wealth of knowledge and insights to help aspiring after hours option traders navigate the unique challenges and opportunities of this market. Here are a few tips to consider:

- Choose liquid options: Focus on trading options contracts with high trading volume to ensure you can enter and exit positions quickly and efficiently.

- Manage risk prudently: Remember that after hours trading can be volatile. Use stop-loss orders to limit potential losses and protect your capital.

- Stay informed: Even though information may be limited, try to stay abreast of any relevant news or events that may impact the market.

- Practice patience: After hours trading can be slow-paced at times. Be prepared to wait for favorable trading opportunities and avoid making impulsive decisions.

Image: seekingalpha.com

FAQs: Answering Your Questions

Q: What are the risks of after hours option trading?

A: Lower liquidity, increased volatility, and limited availability of information are the primary risks associated with after hours option trading.

Q: What types of options strategies are suitable for after hours trading?

A: Short-term strategies with clearly defined risk-reward profiles are generally more appropriate for after hours trading due to the unique characteristics of the market.

Q: How can I get started with after hours option trading?

A: Open an account with a brokerage firm that offers after hours option trading services. Familiarize yourself with the unique aspects of the market and develop a sound trading plan.

After Hour Option Trading

Conclusion: A Thrilling Frontier for the Bold

After hours option trading is an exciting but challenging discipline that can provide significant opportunities for experienced traders. By understanding the risks and rewards involved, adopting a disciplined trading approach, and leveraging the expertise of seasoned traders, you can harness the potential of this unique market while navigating its inherent complexities.

Are you ready to explore the thrilling world of after hours option trading? Start your journey today by finding a reliable brokerage firm and immersing yourself in the intricacies of this dynamic market. Trade wisely and may the odds be ever in your favor!