In the fast-paced and ever-evolving realm of cryptocurrency, options present an intriguing frontier, offering traders a potent tool to navigate market volatility and seize opportunities for profit. Despite their complexities, cryptocurrency options hold immense potential for savvy investors eager to elevate their trading strategies. Dive into this comprehensive guide to unlock the secrets of trading cryptocurrency options and embark on a journey towards financial empowerment.

Image: bfi.uchicago.edu

Delving into the Nuances of Cryptocurrency Options

Cryptocurrency options, similar to their traditional counterparts, grant traders the right but not the obligation to buy (call option) or sell (put option) a specified amount of a particular cryptocurrency at a predetermined price known as the strike price, before or on a fixed expiration date. These versatile instruments open a world of possibilities, allowing investors to hedge against risks, speculate on price movements, and generate passive income.

Decoding the Dynamics of Crypto Options Trading

Trading cryptocurrency options involves a unique set of mechanics. Each option contract comprises a premium, the price paid to secure the option, and an underlying asset, the cryptocurrency it pertains to. The interplay of market forces, including cryptocurrency prices, volatility, and time to expiration, influences the premium. By understanding these dynamics, traders can optimize their strategies and make informed trading decisions.

Embracing the Power of Volatility

Volatility lies at the heart of cryptocurrency options trading. When markets fluctuate wildly, options offer an effective means to capitalize on price movements by enabling traders to profit from both bullish and bearish trends. The dynamic nature of cryptocurrency markets presents ample opportunities to utilize options to mitigate risks and enhance returns.

Image: coin-informer.com

Navigating the Crypto Options Landscape

The crypto options market encompasses a diverse range of platforms, each offering its distinct features and functionalities. From centralized exchanges to decentralized marketplaces, traders must carefully evaluate the available options to align with their investment objectives and risk tolerance. Understanding the pros and cons of each platform is crucial for maximizing trading outcomes.

Unveiling the Secrets of Successful Crypto Options Trading

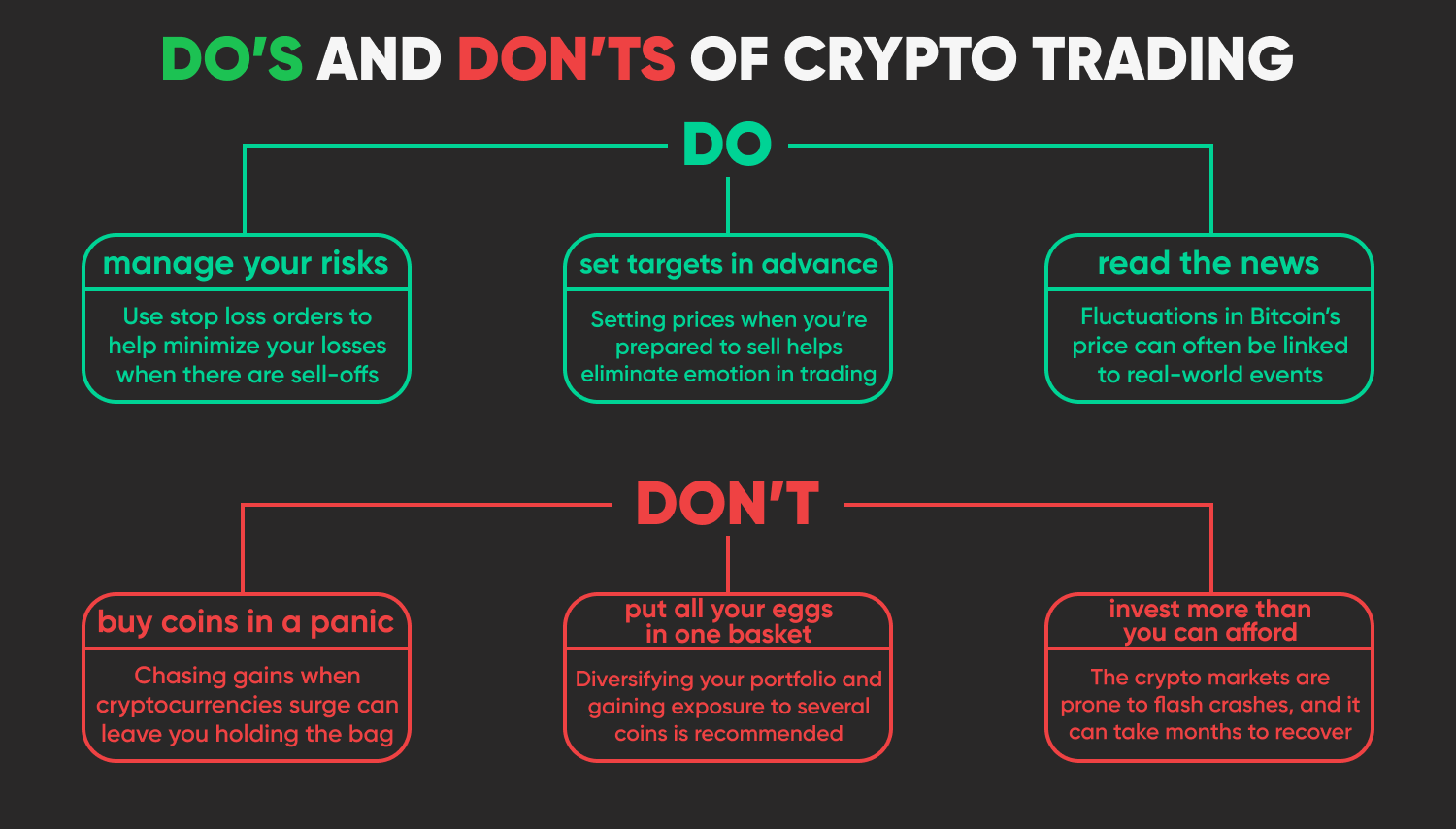

Mastering the complexities of crypto options trading requires a multifaceted approach. In-depth research, constant monitoring of market trends, and a deep understanding of risk management are essential pillars of success. Additionally, incorporating technical analysis and employing trading bots can augment strategies and improve decision-making.

Expert Insights: Unlocking the Secrets of Crypto Options

“Crypto options offer a potent tool to navigate market volatility and enhance trading opportunities. By embracing the power of these instruments, investors can unlock unprecedented levels of financial flexibility and profitability,” asserts Dr. Emily Carter, a renowned crypto analyst.

“To excel in crypto options trading, a disciplined approach is paramount. Traders must meticulously analyze market dynamics, manage risks prudently, and have a clear understanding of option strategies. This rigorous approach can lead to consistent and substantial returns,” adds Mr. Ethan James, a leading crypto options trader.

Trading Cryptocurrency Options

Conclusion: Embracing the Cryptocurrency Options Odyssey

Cryptocurrency options represent a game-changer in the world of digital asset trading. Their ability to enhance portfolio performance, manage risks, and enable speculative gains makes them an indispensable tool for both seasoned investors and those seeking to elevate their trading prowess. By embracing the insights and strategies outlined in this comprehensive guide, traders can confidently navigate the complexities of cryptocurrency options trading and pave the way for financial success in this dynamic market.