Introduction

In the high-stakes world of options trading, navigating through volatile market conditions becomes paramount for successful traders. As an indispensable risk management tool, a stop loss order serves as your financial guardian, automatically executing trades when predefined market levels are reached. In this comprehensive guide to stop loss option trading, you’ll delve into the intricacies of this pivotal technique, empowering you to protect your capital and maximize trading profits.

Understanding the Essence of Stop Loss Orders

A stop loss order functions as an insurance policy for your options contracts. You establish a predetermined price point at which your broker automatically sells (for long positions) or buys (for short positions) to pare potential losses. Foundational to risk management strategies, stop-loss orders act as a safety net, ensuring that your losses do not spiral out of control amidst unforeseen market fluctuations.

Types of Stop Loss Orders

- Standard Stop Loss Order: The most straightforward form, this order executes a trade when the underlying asset’s price touches or surpasses your specified trigger price.

- Trailing Stop Loss Order: A dynamic variant, it adjusts the stop loss price as the underlying asset moves in your favor, trailing a predefined percentage or dollar amount behind the asset’s price.

- Mental Stop Loss Order: A non-automated approach, it requires traders to monitor market conditions and manually place stop loss orders or exit positions when specific price levels are reached.

Selecting Optimal Stop Loss Levels

The key to effective stop loss order placement lies in striking a balance between protecting your capital and granting your trades ample room to grow. Here’s how to determine optimal stop loss levels:

Image: www.babypips.com

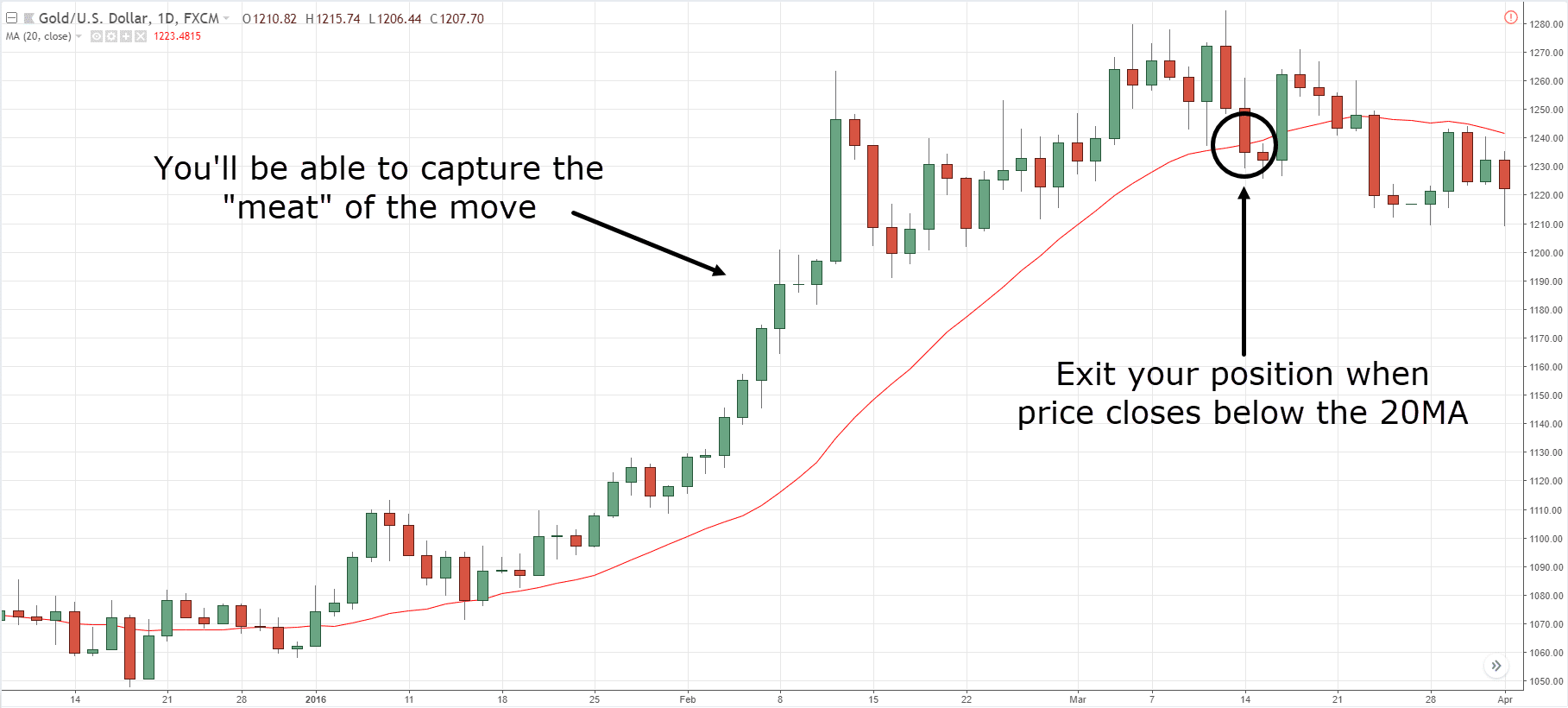

- Technical Analysis: Identify technical levels such as support and resistance levels, moving averages, or Fibonacci retracements that might indicate likely reversal points.

- Volatility: Assess the historical volatility of the underlying asset to determine a reasonable price range within which your trade can fluctuate without triggering a stop loss.

- Risk Tolerance: Consider your personal risk appetite and the potential impact of a large price move on your overall trading strategy.

Implementing Stop Loss Orders in Option Trading

Applying stop loss orders in option trading follows a straightforward process:

- Define Your Strategy: Determine the type of stop loss order that aligns with your trading plan and risk management goals.

- Set Your Trigger Price: Decide on the specific price point that will trigger the execution of your stop loss order.

- Place the Order: Enter your stop loss order through your brokerage platform, ensuring accuracy and proper parameters.

- Monitor and Adjust: Regularly monitor your positions and adjust your stop loss levels as market conditions evolve.

- Multiple Stop Loss Orders: Utilizing multiple stop loss orders at different price levels can reduce the risk of premature stop-outs during market volatility.

- Stop-Limit Orders: These hybrid orders combine stop loss and limit orders, ensuring that trades are executed at favorable prices even during extreme market movements.

Advanced Stop Loss Strategies

Seasoned traders employ sophisticated stop loss techniques to enhance risk management further:

Image: www.tradingwithrayner.com

Stop Loss Option Trading

Conclusion

Mastering the art of stop loss option trading empowers you to navigate market risks with confidence, realizing the full potential of your investments. This robust risk management tool protects your capital, maximizes profits, and instills a sense of tranquility amidst volatile trading conditions. Always remember to thoroughly research, adjust your stop loss strategies as needed, and continuously refine your approach over time to optimize your trading outcomes.