Unveiling the Compensation Landscape for Financial Industry Elite

The front office sales and trading desk is the epicenter of financial markets, where high-stakes transactions are made and fortunes are won and lost. As such, compensation within this realm is a subject of intense scrutiny and intrigue. The Front Office Sales and Trading Desk Pay Report Options Group endeavors to shed light on this opaque area, offering insights into the myriad pay structures and bonus schemes that drive this elite workforce.

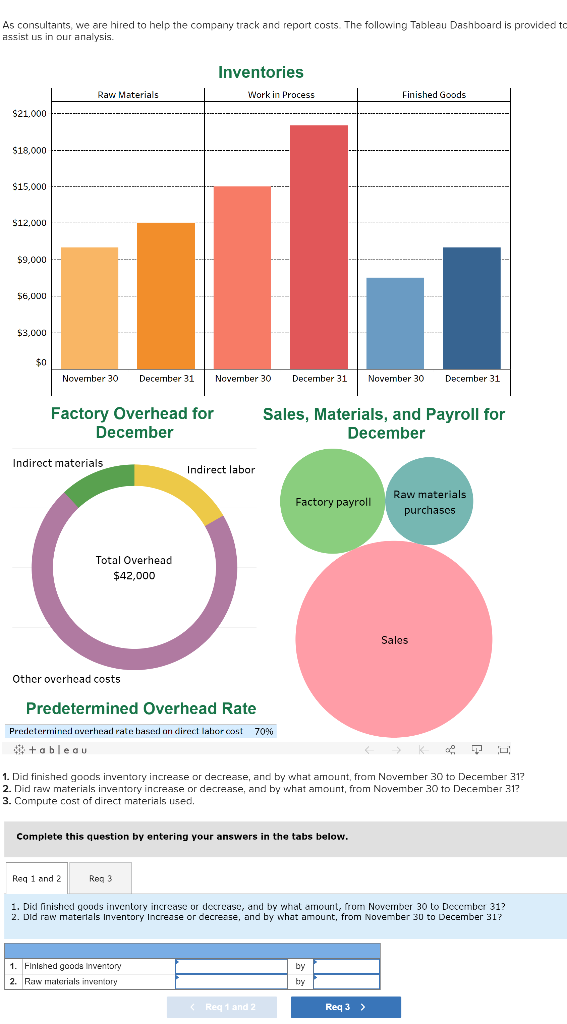

Image: www.chegg.com

Origins of Front Office Compensation Structures

The genesis of today’s intricate front office pay structures can be traced back to the early days of investment banking. In the 1980s, the industry underwent a transformative shift toward commission-based compensation models, aligning incentives between brokers and their clients. This shift rewarded sales success and fueled a boom in proprietary trading desks, further entrenching the commission-based approach.

Compensation Pillars: A Tripartite Approach

Contemporary front office compensation typically comprises three primary pillars: base salary, bonus, and stock options. Base salaries provide a guaranteed foundation, varying widely based on seniority, experience, and firm size. Bonuses reflect performance and can constitute a significant portion of total income, with traders often receiving annual bonuses exceeding their base salary. Stock options offer the chance to participate in the firm’s long-term equity appreciation, further incentivizing retention and performance.

Incentivizing Performance: The Bonus Conundrum

Bonus structures are a key determinant of front office compensation. These bonuses are typically calculated as a percentage of revenue generated, with top performers earning substantial payouts. However, the downside potential is equally significant, as bonuses can be reduced or eliminated during periods of underperformance. The volatility inherent in bonus schemes can create intense pressure and drive unhealthy risk-taking behaviors.

Image: www.youtube.com

The Role of Stock Options: Aligning Interests

Stock options are a form of equity compensation that grant employees the right to purchase company shares at a preset price within a specified timeframe. By linking compensation to the firm’s performance, stock options align the interests of employees with those of shareholders, incentivizing long-term growth and stability.

Reporting Options: A Mosaic of Metrics

The Front Office Sales and Trading Desk Pay Report Options Group provides granular reporting options to cater to different stakeholders. For brokerage firms, the report enables comprehensive analysis of compensation trends, benchmarking against industry benchmarks, and identifying potential areas for optimization. Investors gain insights into the financial health and compensation structure of publicly traded firms, informing investment decisions and risk assessment.

Transparency and Corporate Governance

Enhanced transparency in front office compensation has become increasingly important, fostering investor confidence and mitigating excessive risk-taking. The Dodd-Frank Wall Street Reform and Consumer Protection Act mandates the disclosure of certain compensation-related information, promoting accountability and reducing information asymmetry.

Front Office Sales And Trading Desk Pay Report Options Group

Image: www.news.overbond.com

Conclusion: Unlocking Success in Sales and Trading

The front office sales and trading desk pay landscape is a multifaceted arena where ambitious individuals can excel and reap substantial rewards. By understanding the intricacies of compensation structures, reporting options, and the latest industry trends, aspiring sales and trading professionals can position themselves for success in this competitive and lucrative field.

The Front Office Sales and Trading Desk Pay Report Options Group remains an indispensable resource, empowering stakeholders with the knowledge necessary to navigate the complexities of front office compensation. By embracing transparency, encouraging alignment, and rewarding performance, this industry can continue to attract and retain the best and brightest minds, driving financial innovation and sustainable growth.