Option traders, like martial artists, must cultivate the discipline, precision, and strategic thinking required to thrive in the volatile world of financial markets. Option trading kung fu, a fusion of time-tested wisdom and advanced techniques, empowers traders to navigate market complexities with confidence and precision.

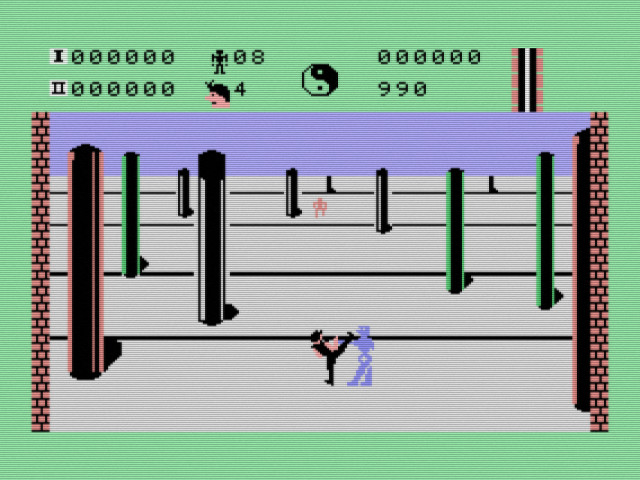

Image: thegamesdb.net

What is Option Trading Kung Fu?

Option trading involves the art of buying and selling options contracts, financial instruments that grant the holder the right to buy (call option) or sell (put option) an underlying asset at a specified price on or before a certain date. The allure of options lies in their versatility, allowing traders to profit from various market conditions and mitigate risks.

Mastering the Basics:

Like any kung fu form, option trading kung fu starts with the fundamentals. Understanding option types, exercise dates, and strike prices is crucial. Beginners must also master the art of calculating option premiums, which determine the cost of acquiring options contracts. This knowledge provides a solid foundation for building a robust trading strategy.

Advanced Techniques for Precision:

As traders progress, they refine their techniques, employing advanced strategies such as vertical spreads, iron condors, and butterfly spreads. These methodologies involve combining multiple options contracts to create tailored positions that enhance potential gains while managing risks. It is in these advanced maneuvers that the precision of option trading kung fu truly shines.

Image: www.finnotes.org

Trading with Discipline and Patience:

Like a seasoned martial artist, successful option traders adhere to a disciplined and patient approach. They avoid impulsive trades and instead rely on thorough analysis and a clear understanding of market dynamics. Patience allows traders to identify optimal entry and exit points, preserving capital and maximizing profits.

Finessing the Art of Risk Management:

Risk management is the cornerstone of option trading kung fu. Traders must master techniques to protect their portfolios from market fluctuations. Stop-loss orders, position sizing, and hedging strategies are indispensable tools in the arsenal of any skilled option trader.

Staying Abreast of Market Dynamics:

The financial markets are constantly evolving, necessitating continuous learning and adaptation. Seasoned option traders stay abreast of the latest market trends, economic data, and geopolitical events. This vigilance enables them to anticipate market movements and adjust their strategies accordingly.

The Path to Option Trading Mastery:

Embarking on the path of option trading kung fu requires a commitment to learning, practice, and refinement. Consistent study, mentorship from experienced practitioners, and real-world trading experience are essential ingredients for developing proficiency. The rewards of this endeavor are immense, as mastery of option trading kung fu empowers traders to navigate market complexities with confidence, precision, and the potential for significant financial gains.

Option Trading Kung Fu

Image: www.ebth.com

Conclusion:

Option trading kung fu is a transformative discipline that equips traders with the skills and knowledge to excel in the dynamic world of financial markets. Like martial arts masters, option traders must cultivate discipline, precision, and strategic thinking. By embracing advanced techniques, managing risks prudently, and staying abreast of market dynamics, you can elevate your trading to new heights and achieve financial precision in the ever-evolving landscape of option trading.