The Struggle for Options Trading Approval

Embarking on my financial journey, I yearned to explore the lucrative realm of options trading. However, my aspirations were met with a disheartening realization: I was repeatedly denied approval. Frustrated and determined, I sought answers, uncovering a myriad of reasons why I couldn’t get approved for options trading. In this article, I’ll share my insights and guide you through the intricacies of options trading approval, providing valuable tips and expert advice to help you navigate this challenge.

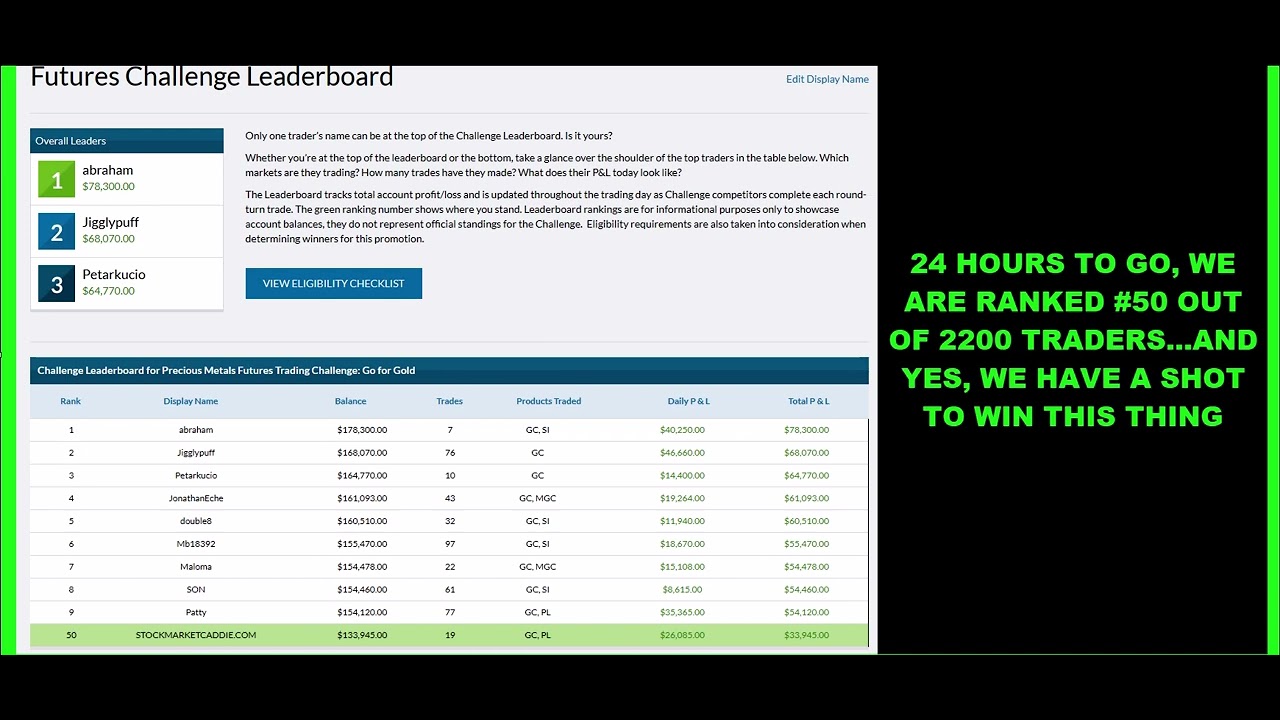

Image: www.reddit.com

Understanding Options Trading Approval

Options trading involves the buying and selling of options contracts, which are derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price. To participate in options trading, individuals must obtain approval from a licensed broker-dealer. This approval process assesses your investment knowledge, experience, and financial situation to ensure you have the necessary qualifications to engage in this complex investment strategy.

Criteria for Options Trading Approval

- Investment Knowledge: Brokers will evaluate your understanding of options trading concepts, including options terminology, trading strategies, and risk management.

- Trading Experience: Prior experience in trading stocks, bonds, or other financial instruments can demonstrate your competence in managing investments.

- Financial Stability: Brokers assess your financial situation to ensure you have sufficient capital to cover potential losses and meet margin requirements.

- Risk Tolerance: Options trading carries inherent risks, and brokers need to gauge your willingness and ability to withstand market fluctuations.

Navigating the Approval Process

To increase your chances of getting approved for options trading, consider the following tips:

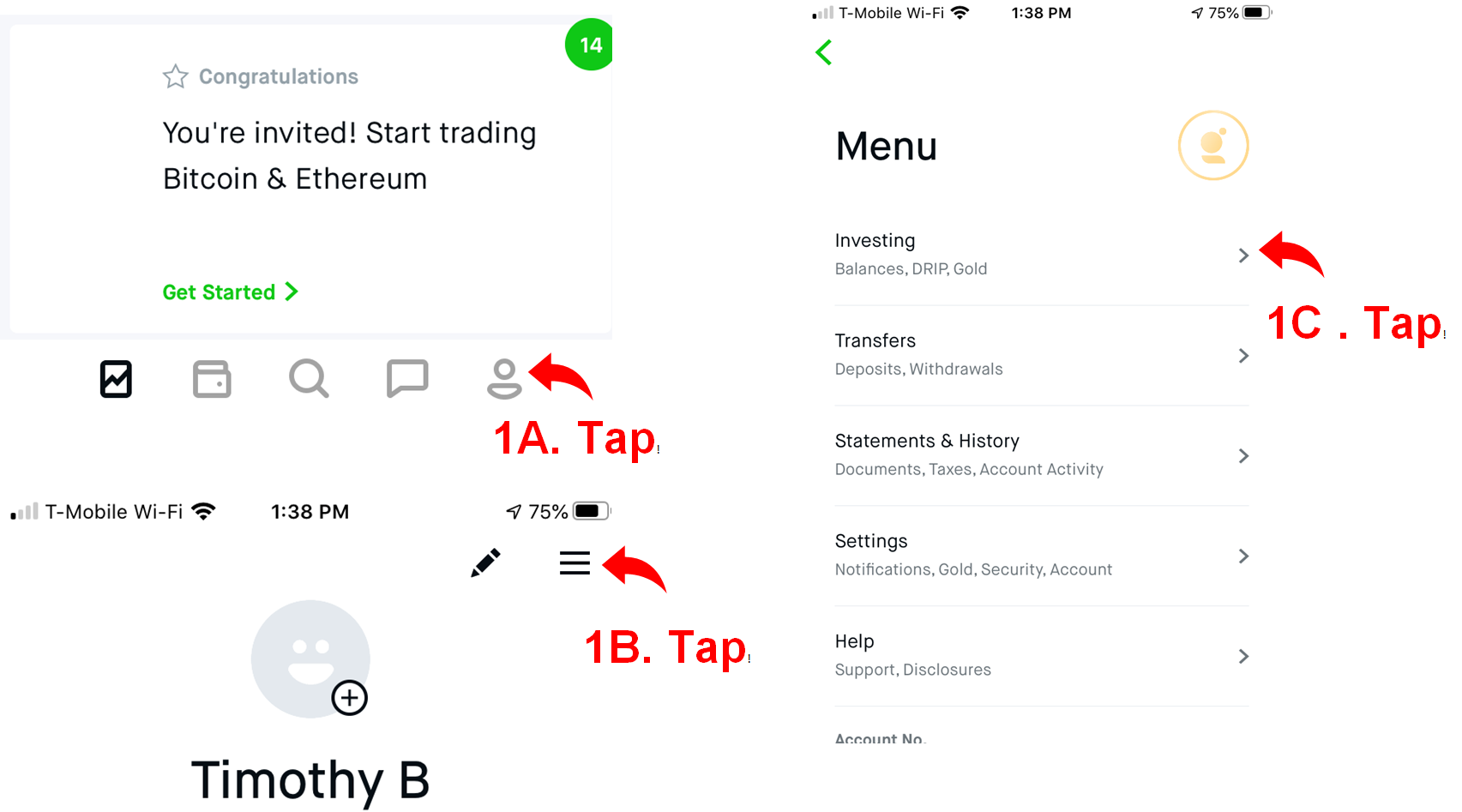

Image: stockmarketcaddie.com

1. Enhance Your Knowledge and Experience

- Take courses or webinars on options trading.

- Read books and articles about options trading strategies.

- Practice paper trading to gain experience before trading with real money.

2. Build a Solid Financial Position

- Maintain a healthy balance in your brokerage account.

- Avoid excessive debt or financial obligations.

- Demonstrate a track record of financial responsibility.

3. Seek Guidance from a Financial Advisor

- Consult a registered investment advisor to develop an options trading plan.

- Discuss your financial situation and risk tolerance with an advisor.

- Obtain a letter of recommendation from an advisor confirming your suitability for options trading.

4. Apply with Multiple Brokers

- Don’t limit yourself to a single broker; apply with multiple platforms.

- Compare different brokers’ approval requirements and fees.

- Choose a broker that aligns with your trading style and experience level.

Frequently Asked Questions about Options Trading Approval

- Q1: Why am I still denied after following the tips?

- A1: Your application may not have adequately demonstrated your understanding of options trading or your financial stability. Consider seeking more experience or seeking a second opinion from a financial advisor.

- Q2: Is there an age or income requirement for options trading approval?

- A2: Age and income requirements vary by broker but generally do not play a significant role in the approval process. Focus on demonstrating your knowledge and financial preparedness.

- Q3: Can I trade options illegally without approval?

- A3: Trading options illegally is highly discouraged and can result in significant penalties. Always seek approval from a licensed broker-dealer before engaging in options trading.

I Can’T Get Approved For Options Trading

Image: learnwealthwise.com

Conclusion

Gaining approval for options trading requires a combination of knowledge, experience, financial stability, and understanding of the risks involved. By following the tips and advice outlined in this article, you can increase your chances of securing approval. Remember that getting denied should not discourage you from pursuing your trading goals; instead, view it as an opportunity to further develop your skills and financial position. Are you interested in options trading and seeking guidance on the approval process?