In the realm of finance, the term “scalping” refers to a high-frequency trading strategy that aims to generate profits from tiny price fluctuations over a short period.

Image: www.brookstradingcourse.com

When applied to option trading, scalping involves buying and selling options with the goal of quickly capturing small gains rather than holding them for a substantial period.

The Essence of Scalping in Option Trading

Unlike traditional option trading strategies that seek long-term appreciation, scalping focuses on exploiting short-term price movements within a given trading session.

Scalpers aim to make numerous small trades throughout the day, entering and exiting positions quickly with minimal risk. The profit margins on individual trades are typically small, but the volume and frequency of trades contribute to overall profitability.

Advantages and Hazards of Scalping

Benefits:

- Potential for substantial returns due to the high number of trades

- Limited downside risk as trades are closed quickly

- Enhances trading discipline and forces traders to focus on short-term market movements

Risks:

- Can be highly stressful due to the constant monitoring and decision-making required

- Traders must possess excellent technical analysis skills to identify trading opportunities

- Commissions and fees can add up over time, affecting profitability

Tips for Effective Option Scalping

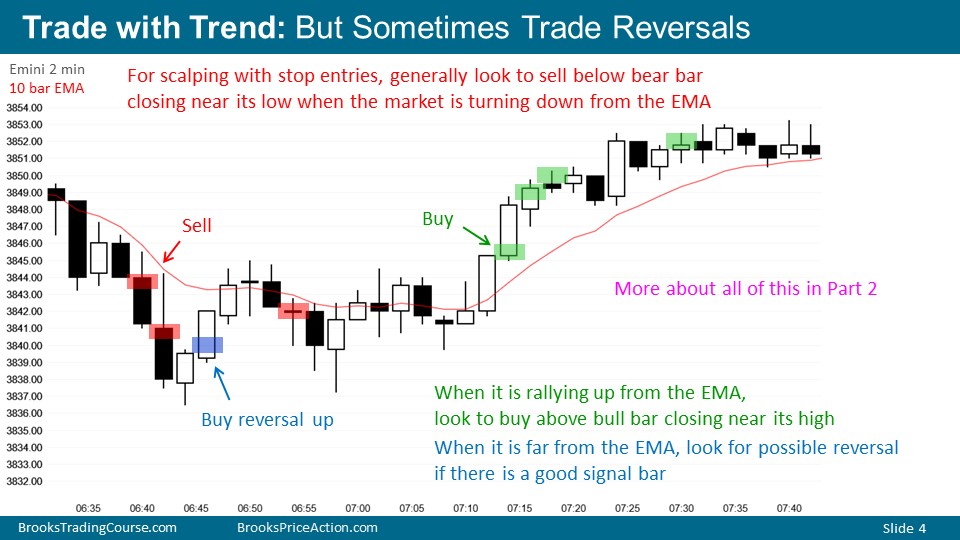

Master Technical Analysis:

Scalpers rely heavily on technical analysis to identify trading opportunities. They study charts, indicators, and market data to gauge price movements and predict potential entry and exit points.

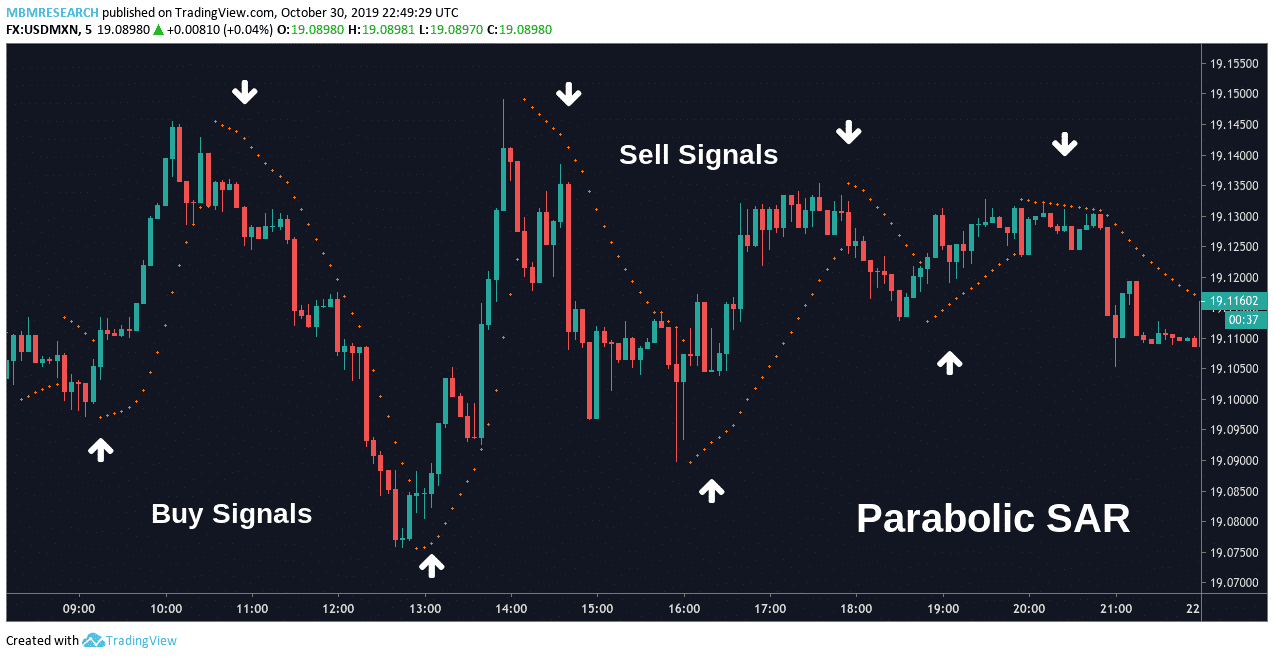

Manage Risk Prudently:

Risk management is crucial in scalping. Scalpers typically use stop-loss orders to limit potential losses and position sizing to minimize the impact of adverse price movements.

Image: www.bank2home.com

FAQs on Option Scalping

Q: Is option scalping suitable for all traders?

A: No, scalping is not appropriate for all traders. It requires a specialized skill set, a high level of experience, and the ability to tolerate stress and risk.

Q: What is the best trading platform for scalping?

A: Scalpers prefer platforms with lightning-fast execution speeds, low latency, and advanced charting capabilities. Popular platforms include NinjaTrader, TradingView, and Interactive Brokers.

Scalping In Option Trading

Conclusion

Scalping in option trading is a demanding yet potentially lucrative strategy that requires traders to possess both technical expertise and a tolerance for risk.

By implementing the tips shared in this article, scalpers can improve their chances of success in this fast-paced trading arena.

Are you ready to embark on the thrilling world of option scalping?