In the ever-dynamic world of finance, savvy investors seek sophisticated strategies to navigate market fluctuations. Options trading, particularly put options, presents a lucrative avenue for those seeking to profit from stock price declines. This comprehensive guide unravels the mechanics of put options, empowering beginners to navigate this complex yet rewarding trading strategy.

Image: www.tradethetechnicals.com

Demystifying Put Options

Put options are financial contracts that grant investors the right to sell a specified number of shares of an underlying asset at a predetermined price, known as the strike price, by a specific expiration date. Unlike their counterparts, call options, which convey the right to buy shares, put options capitalize on the downside potential of assets.

Unlocking the Benefits of Put Options

Understanding the value proposition of put options is paramount for aspiring traders. These versatile instruments provide numerous strategic advantages:

-

Protection against downturns: Put options serve as an effective hedge against portfolio losses when underlying asset prices plunge. By selling puts, investors offset potential losses on existing stock holdings.

-

Income generation: Premium sellers can generate income by selling put options to other market participants willing to pay for the downside protection they offer.

-

Market directionality: Put options enable traders to speculate on negative market movements. By accurately predicting price declines, savvy traders can profit handsomely.

Excavating the Mechanics

Navigating the intricacies of put options trading requires a firm grasp of the underlying mechanics:

-

Option Premium: Each put option contract has an associated premium that buyers must pay sellers to acquire the right to sell the underlying asset.

-

Expiration Dates: Put options have definitive expiration dates, indicating the last day on which the contract can be exercised.

-

Strike Prices: Strike prices vary, offering traders a range of options to align with their speculative tactics.

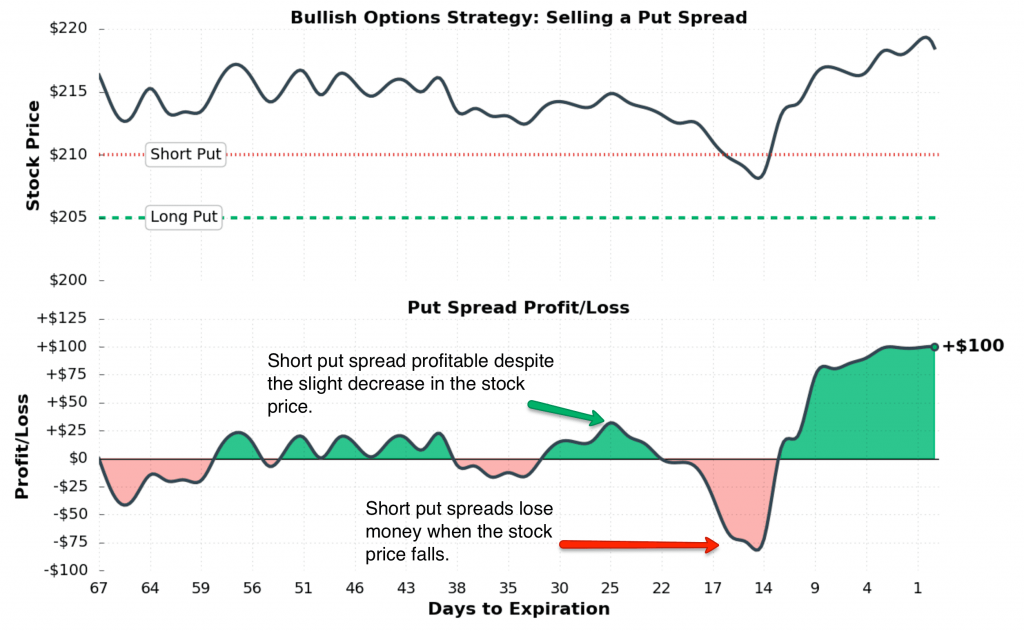

Image: www.projectoption.com

Crafting a Comprehensive Strategy

Effective put options trading hinges on meticulous strategy development. Consider these crucial factors:

-

Market Assessment: Accurately gauging market sentiment and identifying potential price declines is essential for maximizing profitability.

-

Volatility Analysis: Higher market volatility typically translates into higher put option premiums, potentially enhancing returns.

-

Time Decay: Put option premiums erode over time as expiration nears, impacting the potential value of the investment.

Leveraging Real-World Examples

To solidify the concepts discussed, let’s delve into a hypothetical example. Imagine a trader expects a decline in the stock price of XYZ Inc. They purchase a one-month put option contract with a strike price of $45 for a premium of $2 per share.

If the stock price of XYZ Inc. drops to $40 before the option’s expiration, the trader can exercise their right to sell 100 shares at the strike price of $45. They will pocket a profit of $5 per share or $500 for the contract ($5 x 100 shares).

Put Options Trading For Beginners

Conclusion

To summarize, put options trading offers a compelling strategy for profit-seeking investors who anticipate market downturns. By mastering the core concepts, market dynamics, and trading mechanics, beginners can unlock the full potential of this versatile financial instrument. As always, thorough research, prudent investment decisions, and a comprehensive understanding of the market are crucial for successful trading. Embrace the world of put options with confidence and uncover the path to investment success.