Get Ready to Conquer the Dow with Options Trading Strategies

Investing in the stock market can be a thrilling rollercoaster ride, and trading options on the Dow Jones Industrial Average (DJIA) can amplify both the excitement and potential rewards. Options trading empowers investors with the ability to speculate on the future direction of the market, hedge against risks, and potentially generate substantial returns. Join us as we embark on an in-depth exploration of options trading in the DJIA, unlocking the secrets to informed decision-making and maximizing your trading prowess.

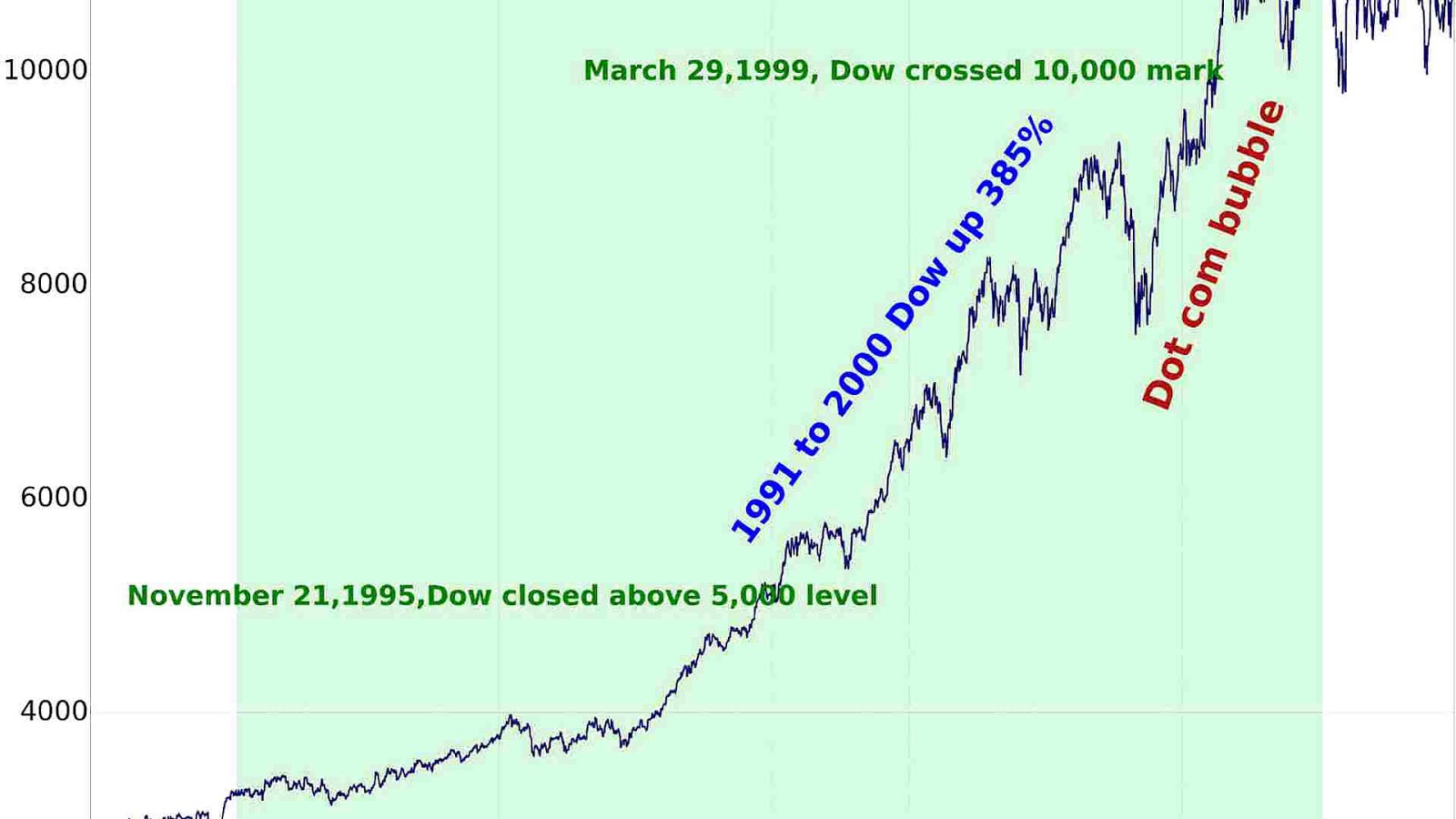

Image: indexchoices.blogspot.com

A Crash Course on Option Trading: Unraveling the Basics

Options are versatile financial instruments that grant traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. The underlying asset can be stocks, indices, currencies, or commodities, and in our case, it’s the Dow Jones Industrial Average. Understanding the different types of options is crucial: call options give you the right to buy the DJIA at the strike price, while put options allow you to sell it.

Traders can choose between two main trading strategies: buying or selling options. By buying calls, you bet that the DJIA will rise, while buying puts signifies your expectation of a decline. Selling options, on the other hand, involves collecting a premium from other traders who are willing to buy your options. You can sell calls if you believe the DJIA will remain stable or decline, and sell puts if you anticipate a rise.

Navigating the DJIA Option Market: Strategies and Considerations

The Dow Jones Industrial Average is an influential stock market index that tracks the performance of 30 leading US companies. Trading options on the DJIA offers several unique advantages, including high liquidity, low transaction costs, and the ability to leverage the index’s overall market trend.

When venturing into DJIA option trading, it’s essential to consider various factors, including the current market sentiment, economic indicators, and technical analysis. Monitoring the news and staying informed about upcoming events can provide valuable insights into potential market movements. Additionally, studying historical price patterns and using technical indicators can help you make informed decisions about entry and exit points.

Mastering Option Selection: The Key to Profitable Trading

The key to successful options trading lies in selecting the right options. Consider the strike price, expiration date, and implied volatility when choosing an option. The strike price represents the price at which you can buy or sell the underlying asset, while the expiration date determines the length of time you have to exercise your option. Implied volatility gauges the market’s expectations of future price swings, influencing the option premium.

Image: ibankcoin.com

Option Trading In Dow Jones

Managing Risk and Maximizing Returns: The Pillars of Success

Managing risk is paramount in options trading, as even seasoned traders can incur losses. Implement stop-loss orders to limit potential losses, and consider using protective strategies such as spreads or hedging to minimize downside risk. Additionally, managing your trades actively is crucial. Monitor market conditions regularly and adjust your strategies as needed to maximize returns.

Armed with the knowledge and tips shared in this comprehensive guide, you’re well-equipped to conquer the world of options trading in the Dow Jones Industrial Average. By embracing both the thrill and discipline required, you can navigate the complexities of the market, reap the rewards of calculated risks, and achieve your investment goals. Remember, the road to success in options trading is paved with perseverance, adaptability, and a relentless pursuit of knowledge.