Harnessing the Power of Informed Options Trading

In today’s dynamic financial landscape, option trading emerges as a potent tool for savvy investors seeking to navigate market volatility and enhance their investment returns. By skillfully employing options calls, traders can gain flexibility, potentially magnify profits, and offset risks. Understanding the nuances of option trading is paramount to maximizing its benefits, and this comprehensive guide delves into the complexities of this multifaceted strategy.

Image: www.stockinvestor.com

Decoding Option Trading Calls: A Fundamental Overview

An option call grants the buyer the right, but not the obligation, to purchase an underlying asset, such as a stock or commodity, at a predefined price (strike price) on or before a specific date (expiration date). Option trading calls empower investors with the potential for substantial gains in exchange for a premium paid to the seller.

Striking a Balance: Call Premium and Expiration Dynamics

The value of an option call premium fluctuates based on various factors, including the underlying asset’s price, time until expiration, volatility, and interest rates. As the underlying asset’s price approaches or exceeds the strike price, the call premium tends to increase, reflecting the enhanced likelihood of the option being exercised. Conversely, time decay erodes the call premium as expiration nears, emphasizing the pivotal role of astute timing in option trading.

Exploring Market Trends and Industry Developments

The option trading landscape is constantly evolving, influenced by macroeconomic factors, technological advancements, and regulatory changes. Staying abreast of the latest trends and developments is crucial for informed decision-making. Recent advancements in data analytics and trading platforms have empowered traders with sophisticated tools to analyze market dynamics and identify promising opportunities.

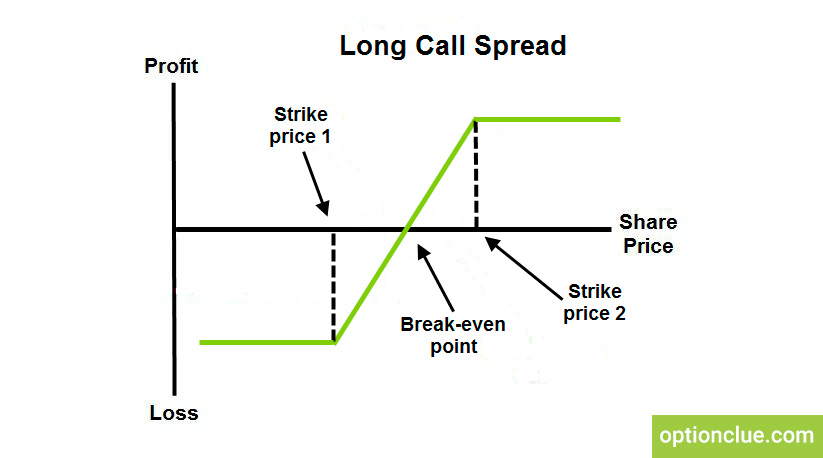

Image: optionclue.com

Real-World Applications: Unlocking Option Trading Strategies

Option trading calls offer a versatile array of strategies tailored to diverse investor objectives. Whether seeking income generation through covered calls, hedging downside risk with protective puts, or exploiting volatility through straddles and strangles, a deep understanding of these strategies empowers traders to navigate market complexities.

Embracing Informed Option Trading: A Path to Empowered Investing

By harnessing the power of option trading calls, investors can elevate their investment strategies to the next level. Through a thorough understanding of option dynamics, careful risk assessment, and strategic implementation, option traders can unlock the potential for enhanced returns while mitigating risk exposure. Embracing informed option trading practices opens up a world of opportunities for savvy investors seeking to master the complexities of today’s financial markets.

Option Trading Calls Today

Additional Insights and Resources

To further enhance your understanding of option trading calls, consider exploring the following resources:

- Options Industry Council

- The Options Playbook by Brian Overby

- Coursera’s Options Trading Specialization

By delving into these resources, you can refine your knowledge, stay abreast of industry developments, and confidently navigate the dynamic world of option trading.