Introduction

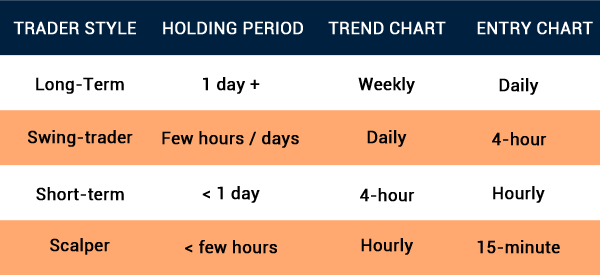

In the realm of options trading, the choice of time frame plays a pivotal role in determining the success and profitability of your endeavors. Understanding the nuances of each time frame, from short-term scalping to long-term investing, empowers traders with the necessary knowledge to optimize their strategies and maximize their profits. Embark on this informative journey as we delve into the intricacies of option trading time frames, unveiling the secrets to success in this dynamic and lucrative market.

Image: theadvisermagazine.com

Short-Term Time Frames: The Fast Lane

For traders seeking heart-pounding action and lightning-fast profits, short-term time frames beckon. Scalping, day trading, and intraday options strategies fall under this category, promising rapid returns over periods ranging from minutes to a few hours. The allure of short-term time frames lies in their potential for high leverage and quick reactions to market movements. However, these time frames also demand constant attention, lightning-fast decision-making, and a deep understanding of technical analysis.

Challenges of Short-Term Time Frames

While short-term time frames offer the thrill of rapid profits, they also present unique challenges:

- Emotional Trading: Short time frames amplify emotions, making it difficult to remain disciplined and control impulsive trading decisions.

- Erratic Trades: Quick market movements can lead to volatile trades, making it challenging to sustain consistent profits.

- High Risk: The fast-paced nature of short-term time frames amplifies risks, especially for traders who lack proper technical analysis skills.

Intermediate-Term Time Frames: Striking a Balance

Traders seeking a balance between the volatility of short-term time frames and the slower pace of long-term investing often gravitate towards intermediate time frames. These strategies typically span from a few days to several weeks, allowing traders to capture market momentum while reducing the risk and emotional intensity associated with short-term trading. Swing trading, for instance, involves holding positions for multiple days or weeks, capitalizing on price fluctuations that occur within larger trends.

:max_bytes(150000):strip_icc()/dotdash_Final_Multiple_Time_Frames_Can_Multiply_Returns_Sep_2020-02-6be5c91190214029b744f7815fe9194c.jpg)

Image: cryptoguiding.com

Advantages of Intermediate-Term Time Frames

- Reduced Volatility: Intermediate time frames offer a respite from the extreme volatility of short-term time frames, allowing traders to survive market fluctuations more effectively.

- Pattern Recognition: Longer holding periods provide a broader perspective, making it easier to identify and capitalize on technical patterns.

- Less Emotional Trading: Unlike short-term time frames, intermediate time frames allow for more deliberate decision-making and less reliance on split-second instincts.

Long-Term Time Frames: The Marathon Approach

For those valuing preservation of capital and steady, albeit slower, growth, long-term time frames offer a prudent path. These strategies span from a few months to multiple years and are often employed by investors seeking portfolio diversification and capital appreciation. Covered call strategies, for example, involve selling covered calls on existing stocks, generating income over time while capping potential gains on the underlying asset.

Option Trading Best Time Frame

Benefits of Long-Term Time Frames

- Reduced Volatility: Long-term time frames significantly reduce market volatility, making them ideal for risk-averse traders and portfolio managers.

- Clear Trends: Extended holding periods unravel long-term price trends, making it easier to ride economic cycles and emerging industry catalysts.

- Minimal Trading Costs: Due to infrequent trading, long-term time frames minimize brokerage fees and trading slippage, translating into higher net profits.