In the labyrinthine world of financial markets, option flow trading stands as a beacon, illuminating the intentions of institutional investors and propelling savvy traders to unparalleled profits. By delving into the intricate network of options transactions, traders gain a telescopic lens into the future direction of stock prices, allowing them to anticipate market movements and exploit inefficiencies to maximize returns.

Image: quantinaintelligenceforexnewstrade1.blogspot.com

Harnessing the power of option flow trading is akin to unlocking a treasure chest of actionable insights. Through the meticulous analysis of massive datasets encompassing options orders, traders can decipher the collective sentiment of market behemoths, such as hedge funds and proprietary trading firms. This elite class of investors wields immense market-moving capabilities, and by aligning their strategies with these titans, traders can amplify their own returns.

Unraveling the Dynamics of Option Flow Trading

Option flow trading revolves around the meticulous observation and interpretation of options orders, particularly those executed by institutional players. These behemoths wield significant capital and possess unparalleled market intelligence, making their trading decisions pivotal in shaping stock price trajectories. By decoding the intricate patterns embedded within these orders, traders can identify potential market inflection points and capitalize on emerging trends before they materialize.

The allure of option flow trading lies in its ability to provide traders with a glimpse into the future. Options contracts, by their very nature, embody market expectations regarding the underlying stock’s price movements. By analyzing the volume, strike prices, and expiration dates of options orders, traders can glean valuable insights into the collective market sentiment and anticipate impending price shifts.

Deciphering the Language of Option Flows

Mastering option flow trading demands a proficiency in interpreting the nuanced language of options orders. Each order conveys a distinct message, revealing the underlying intentions of the trader who placed it. Understanding these subtleties is paramount for successful option flow trading.

For instance, a large influx of call options (options that confer the right to buy the underlying stock) often indicates bullish sentiment, suggesting that institutional investors anticipate an upward price movement. Conversely, a surge in put options (options that grant the right to sell the underlying stock) may signal bearish sentiment, indicating expectations of a price decline.

Real-World Applications: Unlocking the Gates of Profit

Option flow trading has proven to be a potent force in the arsenals of savvy traders. By harnessing the insights gleaned from institutional trading activity, traders can make informed decisions that propel them towards substantial profits.

Consider the following real-world example: a renowned hedge fund places a sizable order for call options on a particular stock. This order transmits a clear signal of bullish sentiment, indicating that the hedge fund anticipates an impending price surge. By aligning their own trading strategy with this institutional giant, astute traders can capitalize on the expected price appreciation, reaping handsome returns.

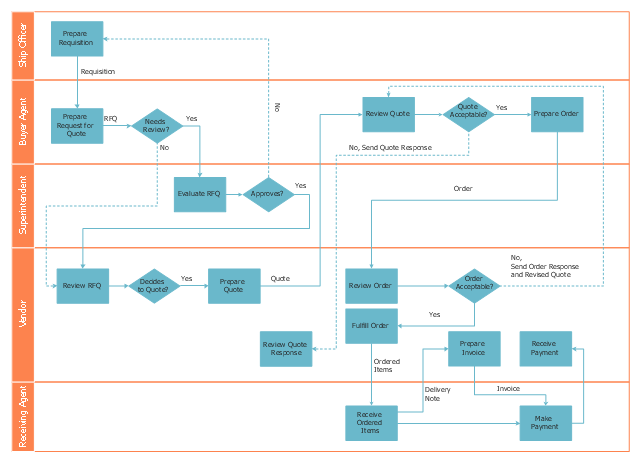

Image: www.lupon.gov.ph

Embracing the Latest Advancements in Option Flow Analytics

The landscape of option flow trading is constantly evolving, with the advent of cutting-edge technologies further empowering traders. Sophisticated analytical tools and algorithms have emerged, automating the intricate process of options order analysis and expediting the identification of lucrative trading opportunities.

These advanced analytics leverage machine learning and artificial intelligence to sift through vast volumes of data, uncovering hidden patterns and correlations that might elude the naked eye. By embracing these technological advancements, traders can elevate their option flow trading strategies to unprecedented heights.

Option Flow Trading

Conclusion: Ascending to Trading Mastery Through Option Flow Trading

Option flow trading, when mastered, unlocks a world of possibilities for traders seeking to elevate their performance. By deciphering the intricacies of options orders and aligning their strategies with institutional investors, traders gain a decisive edge in the relentless pursuit of profit. Embracing the latest advancements in option flow analytics further amplifies their capabilities, propelling them towards financial triumph.

As you embark on this captivating journey, remember to approach option flow trading with a blend of analytical rigor and an unyielding pursuit of knowledge. Immerse yourself in the subject matter, engage with fellow traders, and continuously seek new insights to sharpen your trading acumen. With unwavering dedication and a relentless thirst for market mastery, you will undoubtedly ascend to the summit of trading excellence.