Imagine yourself as a seasoned options trader, navigating the bustling floor of a trading exchange. Amidst the cacophony of orders and flashing screens, you notice a flurry of activity centered around a particular stock. Traders cluster around a pit, their eyes fixed on a whiteboard displaying the latest market data. It’s there that you catch sight of the term “open interest,” a key metric that holds the power to shape your trading decisions.

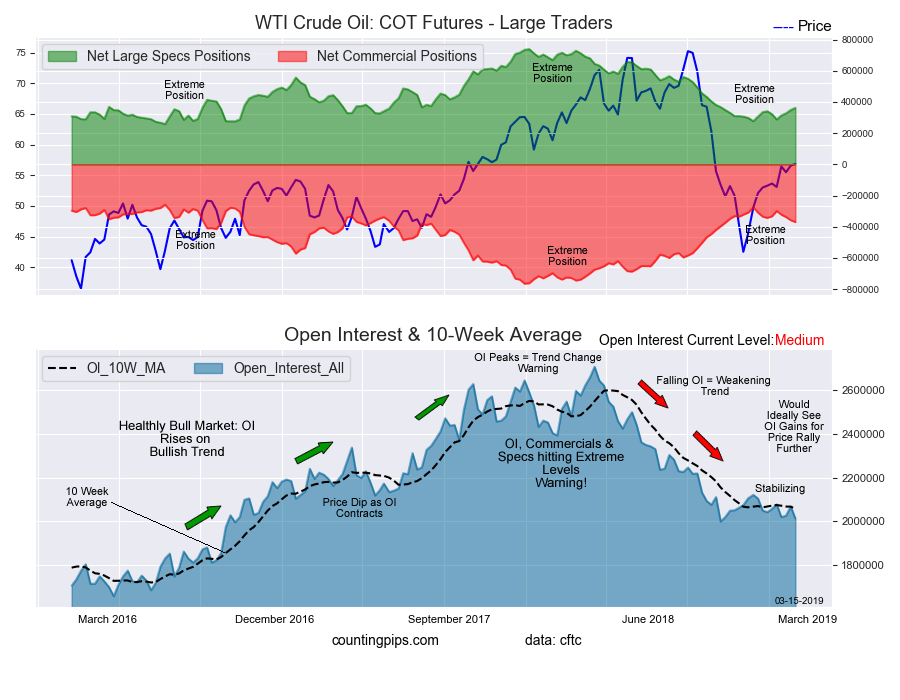

Image: www.investmacro.com

Understanding Open Interest

Open interest refers to the total number of outstanding contracts for a specific options contract on a particular day. It’s like a real-time snapshot of the market’s sentiment towards that underlying asset. A high open interest indicates that there’s significant interest in trading the option, either for speculation or hedging purposes. Conversely, a low open interest suggests that there’s relatively little activity in the contract.

Importance of Open Interest

Open interest plays a vital role in options trading for several reasons:

- Gauge Market Sentiment:

Open interest can serve as a barometer of market sentiment. A rising open interest indicates increasing interest in the underlying asset, while a declining open interest may suggest decreasing demand. - Predict Future Price Movement:

Changes in open interest can often foreshadow future price movements. A surge in open interest ahead of an earnings report or a key economic event can be a sign of anticipation for significant market movement. - Determine Contract Liquidity:

Open interest is directly related to the liquidity of an options contract. A high open interest typically indicates that the contract is liquid and easy to trade, while a low open interest may result in execution difficulties and higher transaction costs.

Recent Trends and Developments in Open Interest

Open interest has been witnessing some key trends and developments in recent years:

- Impact of Real-Time Data:

The availability of real-time open interest data has significantly enhanced traders’ ability to monitor market sentiment and make informed decisions. - Increased Institutional Involvement: Institutional investors have become increasingly active in options trading, contributing to the overall growth in open interest.

- Rise of Retail Traders:

The democratization of trading platforms has enabled retail traders to participate in options trading, further fueling the rise in open interest.

Tips and Expert Advice

Based on my experience as a blogger and active options trader, here are some expert tips:

- Monitor Open Interest Regularly:

Tracking open interest over time can provide valuable insights into market sentiment and potential price movements. - Combine Open Interest Data with Other Indicators:

Open interest analysis should be complemented by other technical indicators, such as price charts and trading volume, to gain a comprehensive understanding of market conditions. - Beware of False Signals:

Sudden spikes in open interest can sometimes be misleading. Examine the context of the broader market and consider other factors before making trading decisions based solely on open interest.

FAQ on Open Interest

- What does a high open interest signify?

A high open interest indicates significant trading activity in a particular options contract, suggesting strong market sentiment and liquidity. - How does open interest affect option prices?

Changes in open interest can influence option prices by increasing or decreasing the supply and demand for the contract. - Can open interest be used to predict future price movements?

While not a perfect predictor, changes in open interest can provide insights into market sentiment and potential future price movements.

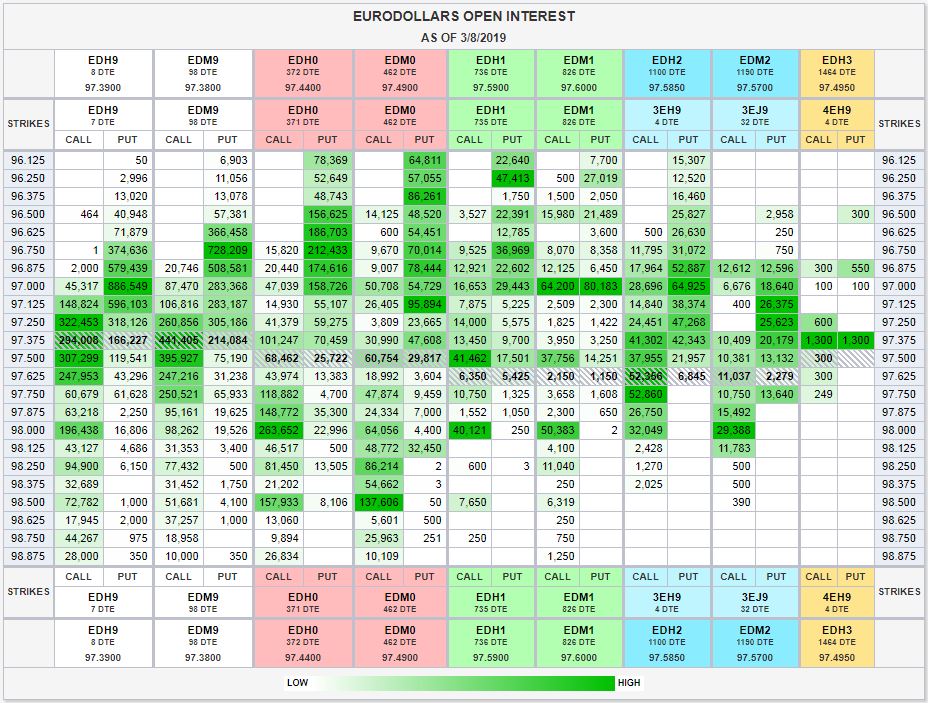

Image: www.cmegroup.com

Open Interest In Options Trading

Conclusion

In the world of options trading, open interest holds immense significance, serving as a crucial indicator of market sentiment and liquidity. By understanding open interest and its implications, traders can refine their trading strategies, boost their decision-making process, and navigate the choppy waters of the financial markets with greater confidence and success.

So, dear readers, are you ready to dive into the realm of open interest and unlock its secrets? Embrace the knowledge and insights contained within this article, and witness your options trading journey soar to new heights.