Introduction

Unlocking the world of options trading can be an alluring prospect for investors seeking greater financial flexibility and potential returns. However, delving into this complex financial instrument comes with associated fees that can vary from broker to broker. Understanding these costs is crucial for informed decision-making and maximizing your trading profits. In this comprehensive guide, we will delve into the realm of Wells Fargo option trading fees, illuminating their structure, ramifications, and strategic implications for aspiring and seasoned traders alike.

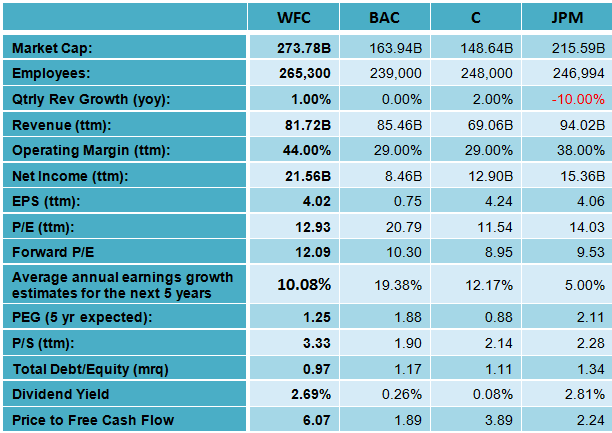

Image: seekingalpha.com

Demystifying Wells Fargo Option Trading Fees: A Blueprint for Navigating the Market

Wells Fargo, a financial institution renowned for its extensive banking and investment offerings, provides a robust platform for options traders. Comprehending their fee structure is imperative for astute investors looking to minimize expenses and optimize their trading strategies. Wells Fargo’s option trading fees encompass distinct charges, each catering to specific aspects of the trading process. Recognizing these individual components will empower you to make informed decisions and enhance your trading profitability.

Exploring the Spectrum of Fees

-

Option Contract Fee: Initiating an options contract involves an upfront cost, known as the option contract fee. This charge is levied every time a trader enters or exits an options position. Wells Fargo sets this fee at $\$0.65 per contract, a competitive rate within the industry.

-

Exercise and Assignment Fees: Exercise fees arise when an options trader chooses to exercise their right to buy or sell the underlying asset. Assignment fees, on the other hand, apply when an options contract is assigned to the trader, obligating them to buy or sell the underlying asset. Wells Fargo’s exercise fee is $\$0.15 per contract, while its assignment fee stands at $\$0.10 per contract.

-

Early Termination Fees: In the event of terminating an existing options position before its expiration date, Wells Fargo imposes an early termination fee. This fee typically ranges from $0 to $0.50 per contract, contingent on the remaining time until the contract’s expiry.

-

Account Maintenance Fees: Wells Fargo charges account maintenance fees to traders who hold margin accounts or engage in frequent trading activities. These fees vary based on the account type and trading volume, serving as a cost to maintain access to advanced trading features.

Optimizing Your Fees: Strategies for Cost-Effective Trading

-

Negotiating Lower Fees: Seasoned traders with substantial trading volume may have the leverage to negotiate lower fees with Wells Fargo. Contacting the brokerage firm and presenting your trading history and account size can lead to reduced fee arrangements.

-

Bundling Services: Wells Fargo offers bundled service packages that combine multiple trading products and services. Participating in these packages can result in fee reductions for traders who utilize a wider range of offerings.

-

Minimizing Trading Frequency: Reducing the frequency of your options trades can help lower overall fees. Strategic trading, such as focusing on longer-term options contracts and avoiding excessive contract rollovers, can mitigate costs.

-

Exploring Alternative Brokers: Comparing the fee structures of different brokers is prudent. Other financial institutions may offer more competitive fee rates or tailored programs for options traders.

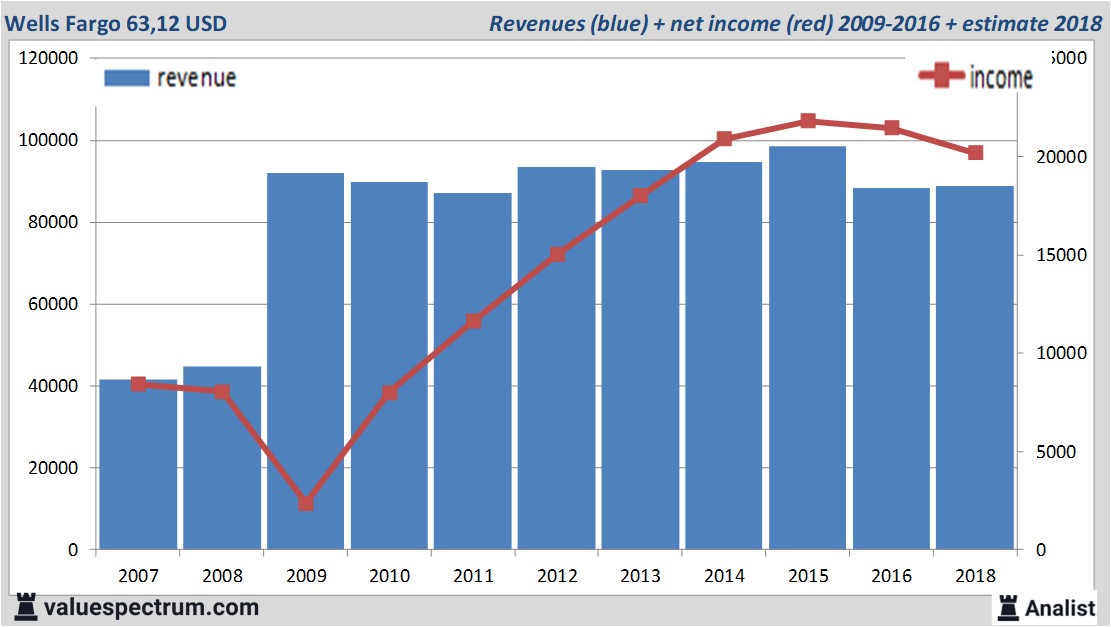

Image: www.valuespectrum.com

Wells Fargo Option Trading Fees

https://youtube.com/watch?v=llL0rxOjl3E

Conclusion

Understanding Wells Fargo option trading fees is a cornerstone of successful trading. By recognizing the different components of the fee structure and implementing strategic approaches to minimization, investors can optimize their trading profitability and navigate the market with greater confidence. Remember, the key to effective trading lies in informed decision-making and the ability to balance costs with potential rewards. Embark on your options trading journey with Wells Fargo, armed with the knowledge to mitigate expenses and maximize your financial returns.