A Journey into the Dynamic World of Option Trading

In the realm of financial markets, option trading stands out as a powerful instrument for investors seeking both risk and reward. Options provide traders the flexibility to speculate on the future price direction of an underlying asset, empowering them with the ability to magnify profits while managing risk. As the Indian stock market continues its ascent, option trading has emerged as an indispensable tool for traders looking to navigate the dynamic market landscape. In this article, we embark on an in-depth exploration of the best option trading strategy in India, offering a detailed analysis of its concepts, strategies, and expert insights to equip you for success in this captivating financial realm.

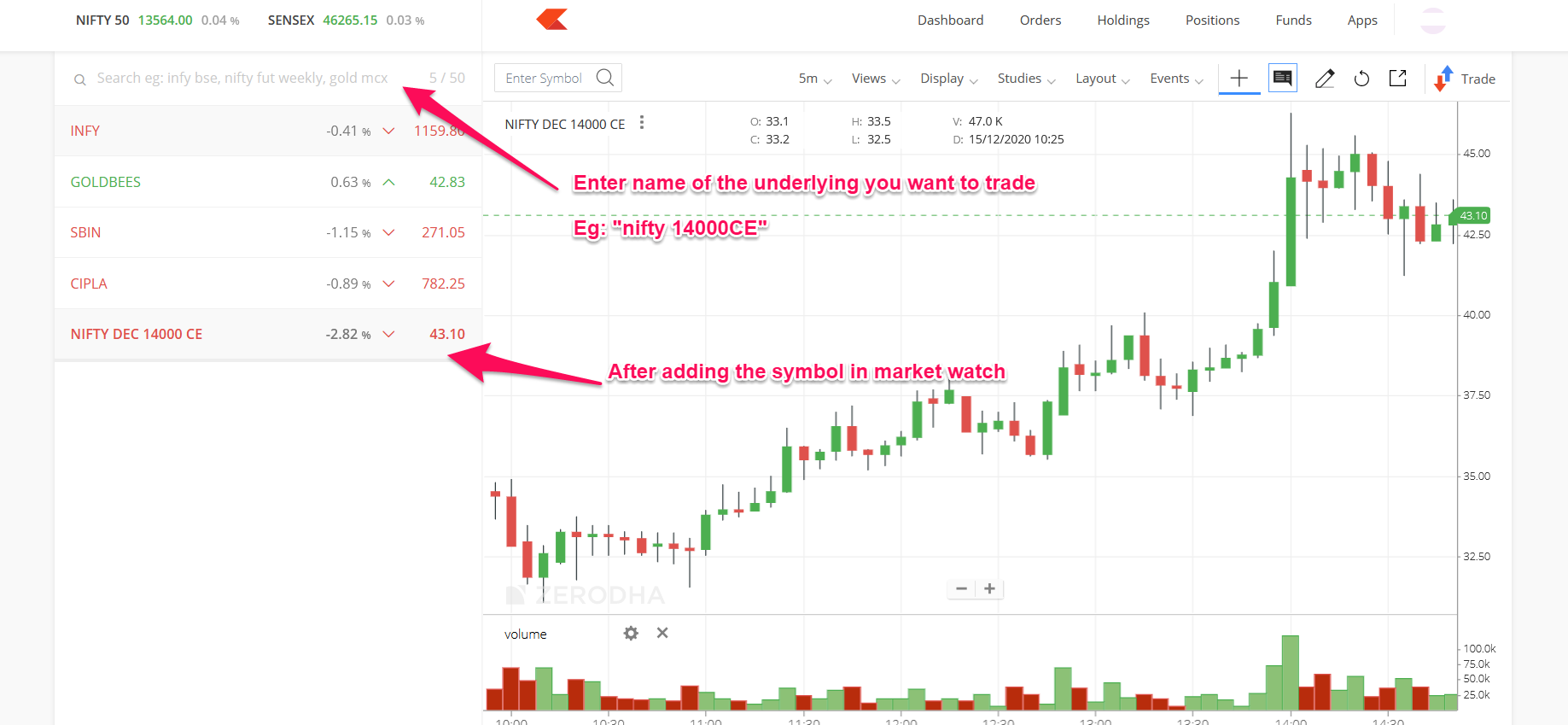

Image: equityblues.com

Delving into the Nuances of Option Trading

Simply put, options are financial contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock, index, or commodity, at a specified price (strike price) on or before a specific date (expiration date). This flexibility makes options a powerful tool for tailoring strategies based on market expectations and individual risk tolerance. Whether you anticipate a stock’s price to rise or fall, options provide avenues to capitalize on market movements while managing risk exposure.

The Strategic Landscape of Option Trading

Navigating the option trading landscape requires a deep understanding of the intricate strategies employed by seasoned traders. From conservative covered calls to daring naked puts, the strategic arsenal available to option traders is vast. Covered calls involve selling (writing) a call option against an underlying stock that you own, providing downside protection while generating premium income. Conversely, naked puts entail selling a put option without owning the underlying asset, a strategy suitable for traders anticipating a rise in stock price while accepting the potential obligation to buy. The strategic landscape extends beyond these examples, encompassing a myriad of combinations that cater to diverse market conditions and individual risk profiles.

Decoding the Art of Option Pricing

Understanding option pricing is pivotal for successful option trading. The Black-Scholes model, a widely accepted pricing formula, takes into account factors such as the underlying asset’s price, strike price, time to expiration, and implied volatility. Implied volatility, a key determinant of option premiums, reflects market expectations of future price fluctuations. Grasping the intricacies of option pricing enables traders to make informed decisions, assess potential profitability, and manage risk effectively.

Image: www.talkdelta.com

Expert Insights: The Alchemy of Option Trading

Seasoned option traders attribute their success to a combination of knowledge, experience, and strategic acumen. They emphasize the importance of thorough research, continuous learning, and meticulous risk management. Adapting strategies to suit individual risk tolerance and market conditions is paramount. Experts recommend starting with conservative strategies and gradually expanding the repertoire as experience and confidence grow. They also stress the significance of understanding the underlying asset’s fundamentals and technical indicators to make informed trading decisions.

Embracing Option Trading: A Path to Financial Empowerment

Embarking on the path of option trading can be both rewarding and challenging. Traders must possess a sound understanding of market dynamics, option pricing, and risk management principles. Patience, discipline, and a willingness to learn are essential traits for those seeking success in this demanding arena. Numerous resources are available to начинающие, including online courses, webinars, and mentorship programs, empowering traders to develop their skills and knowledge base.

Best Option Trading Strategy India

Conclusion: A Strategic Edge in a Competitive Marketplace

Option trading presents a dynamic and rewarding opportunity for traders to navigate the Indian stock market. By mastering the nuances of option strategies, understanding option pricing, and gleaning insights from expert traders, individuals can equip themselves with the tools necessary to succeed in this captivating financial arena. Embracing the principles and strategies outlined in this article will provide traders with a firm foundation, enabling them to harness the power of options to maximize profits while managing risk. Remember, the journey to financial success is an ongoing pursuit, and the pursuit of knowledge and continuous improvement is the key to unlocking the vast potential that option trading offers.