In the dynamic world of finance, stock options have emerged as a powerful tool for managing business growth and rewarding employees. As businesses navigate the complexities of stock option trading, leveraging accounting software like QuickBooks becomes essential for accurate tracking and reporting. This article will delve into the comprehensive process of creating classes and subclasses within QuickBooks specifically tailored for stock option transactions.

Image: www.youtube.com

Introduction: Demystifying QuickBooks Class and Subclass Structure

QuickBooks’ class and subclass feature allows businesses to categorize and track specific financial activities. By establishing classes and subclasses for stock option trading, you can effectively manage transactions, generate accurate reports, and simplify tax preparation processes.

Creating Classes: The Foundation of Stock Option Accounting

Classes serve as the primary level of categorization in QuickBooks. When it comes to stock option trading, it is recommended to create a separate class titled “Stock Options.” This class will act as a parent category, encompassing all specific types of stock option transactions.

Subclasses: Refining Stock Option Tracking

Subclasses add an additional layer of granularity to the class structure, allowing for more precise tracking of different types of stock options. Consider creating subclasses for each type of stock option plan, such as:

- Incentive Stock Options (ISO)

- Non-Qualified Stock Options (NQSO)

- Employee Stock Purchase Plans (ESPP)

Image: solatatech.com

Detailed Transaction Tracking: The Importance of Spliting

For each subclass, set up separate accounts to track the following transactions associated with stock options:

- Grants: Records the issuance of stock options.

- Exercises: Captures the exercise of options, transferring shares from the option pool to employee ownership.

- Forfeitures: Tracks options that expire unexercised.

- Expenses: Accounts for compensation expenses related to stock option grants.

Reporting and Analysis: Leveraging QuickBooks Insights

With the appropriate classes and subclasses set up, QuickBooks empowers you to generate insightful reports tailored to stock option trading activities. These reports provide invaluable information for:

- Tracking option grants and exercises over time.

- Calculating compensation expenses associated with stock options.

- Assessing the performance and impact of stock option plans.

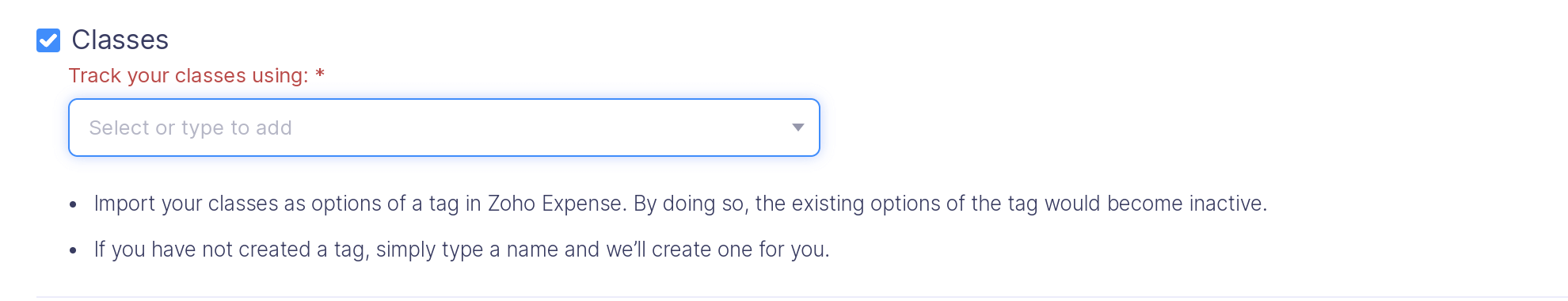

Create Classes And Subclasses In Quickbooks Stock Option Trading

Image: www.zoho.com

Conclusion: Enhancing Stock Option Management with QuickBooks Expertise

By meticulously creating classes and subclasses within QuickBooks, businesses can effectively manage the intricate world of stock option trading. This structured approach enables accurate tracking of transactions, simplifies reporting processes, and provides valuable insights for informed decision-making. Embracing this knowledge will empower you to harness the full potential of QuickBooks and streamline your stock option trading operations with precision and confidence.