Unlock the Power of Options Trading

Delve into the world of options trading and unlock its potential benefits with this comprehensive guide. Our expert insights from updates, news platforms, forums, and social media networks will equip you with the knowledge and strategies to navigate this dynamic market successfully.

Image: alphabetastock.com

What is Options Trading?

Options are financial instruments that provide investors with the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a predetermined date. They offer flexibility and leverage, making them suitable for a wide range of investment strategies.

Types of Options

Call Options: Give the buyer the right to buy the underlying asset at the strike price on or before the expiration date.

Put Options: Grant the buyer the right to sell the underlying asset at the strike price on or before the expiration date.

Key Features and Terms

Understanding options trading requires familiarity with key terms and features:

- Strike Price: The predetermined price at which an option can be bought or sold.

- Expiration Date: The final day when an option can be exercised.

- Premium: The price paid to purchase an option.

- Volatility: A measure of price fluctuations.

- Intrinsic Value: The difference between the strike price and the underlying asset’s current market price.

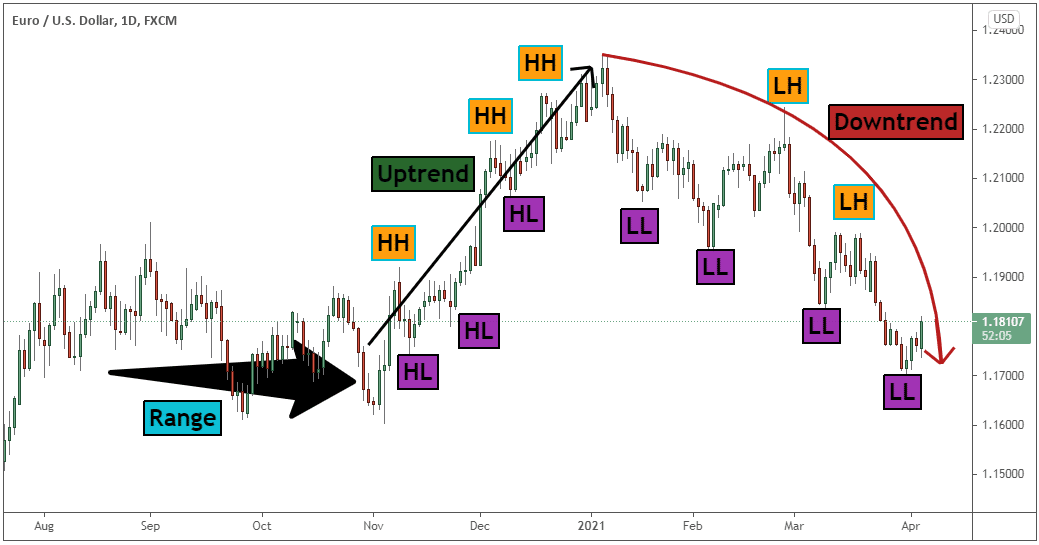

Image: tradingstrategyguides.com

Benefits and Strategies

Options offer several benefits, including:

- Flexibility: Traders can tailor strategies to suit their risk appetite and market outlook.

- Income Generation: Options provide opportunities to generate passive income through selling premium.

- Hedging: Options can help manage risk exposure by reducing downside potential.

Expert Tips and Advice

To succeed in options trading, consider these expert tips:

- Understand Your Strategy: Determine your goals, risk tolerance, and trading horizon before executing any trades.

- Research the Underlying: Thoroughly analyze the underlying asset’s historical performance and future prospects.

- Manage Risk: Implement risk management techniques, such as position sizing, to minimize losses.

FAQs About Options Trading

Q: What factors influence option prices?

A: Key factors include the underlying asset’s price, volatility, time to expiration, and interest rates.

Q: How do I choose the right options strategy?

A: Your strategy should align with your investment objectives, risk profile, and market outlook.

Q: What is a Delta-neutral strategy?

A: A strategy involving buying and selling different options to maintain exposure to price movements while neutralizing the overall impact of delta on the portfolio.

Trading Options Pdf

https://youtube.com/watch?v=ZsrSa9cpwiE

Conclusion

Options trading presents opportunities for income generation, risk management, and investment flexibility. Embracing the knowledge shared in this guide and adopting expert advice empowers you to navigate this exciting market with confidence. Do you have any further questions or considerations related to options trading? Share your thoughts and let’s continue the conversation.