Trading options can be a lucrative endeavor, enabling investors to potentially generate significant returns by speculating on the price movements of underlying assets. Interactive Brokers (IB) stands out as a premier platform for options traders, offering an array of tools and features to empower their trading strategies. This comprehensive guide will delve into the intricacies of options trading in IB, arming you with the knowledge and skills necessary to navigate this market with confidence.

Image: gfmasset.com

Understanding Options: A Primer

Options are financial instruments that derive their value from an underlying asset, such as a stock, bond, or futures contract. They grant the holder the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at a specified price (strike price) before the expiration date. Options trading involves buying or selling these contracts, speculating on whether the underlying asset will move above or below the strike price by the expiration date.

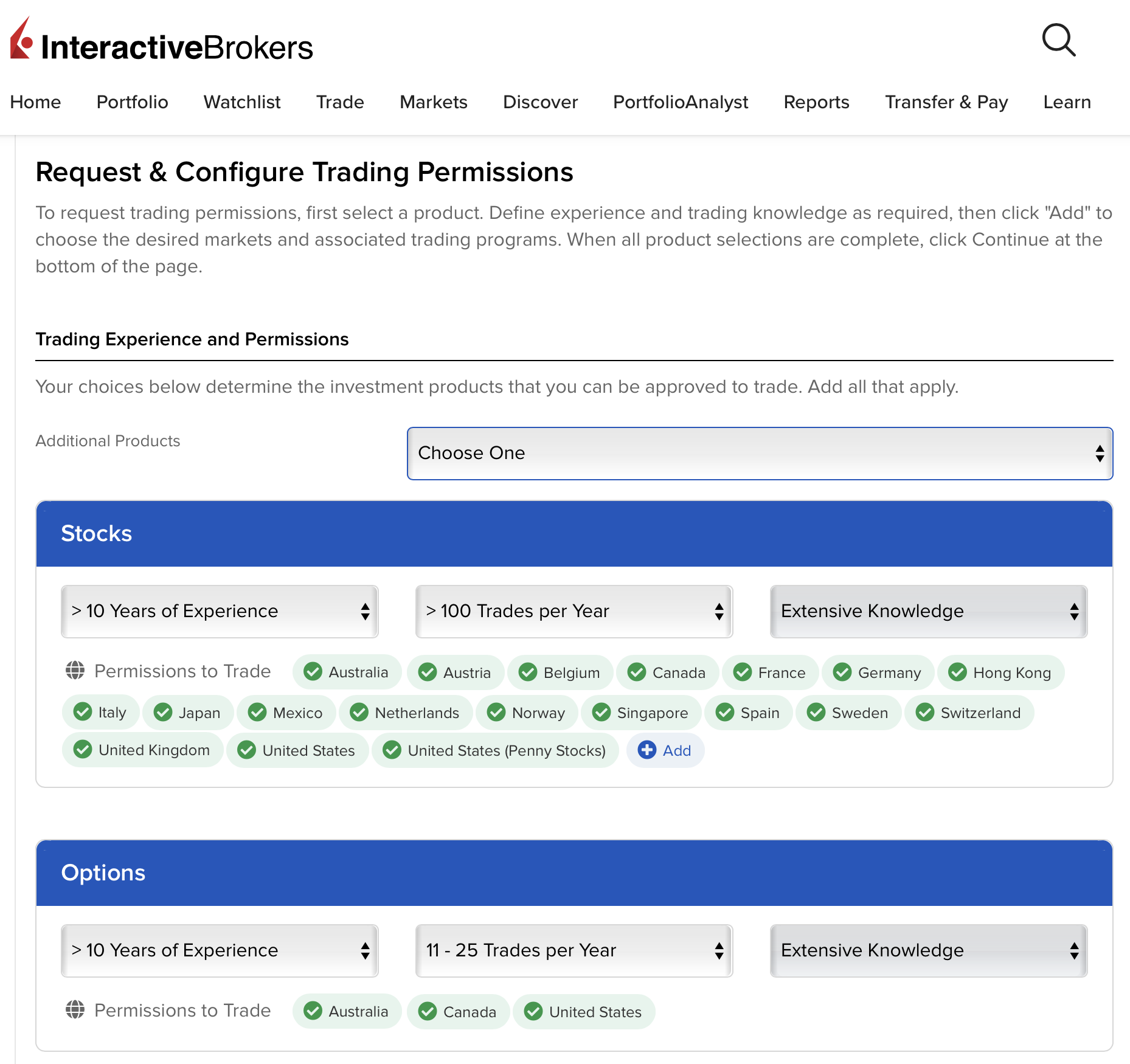

Interactive Brokers: The Platform of Choice

IB has established itself as a leading provider of options trading services, catering to a diverse clientele ranging from retail investors to professional traders. Its user-friendly Trader Workstation (TWS) platform offers a comprehensive suite of features, including:

- Extensive market data and analytics

- Real-time price quotes and charting

- Advanced order entry and management tools

- Position and risk monitoring

- Margin and options capabilities

Navigating the Options Market with IB

Image: investingintheweb.com

Types of Options

IB offers a wide variety of options contracts, meeting the needs of traders with varying strategies. These include:

- Standard Options: Options expiring within the next few months, suitable for short-term trading or hedging positions.

- Weekly Options: Options with weekly expirations, providing increased flexibility for capturing rapid price movements.

- Complex Options: Combinations of multiple options contracts, such as spreads and butterflies, allowing traders to develop sophisticated trading strategies.

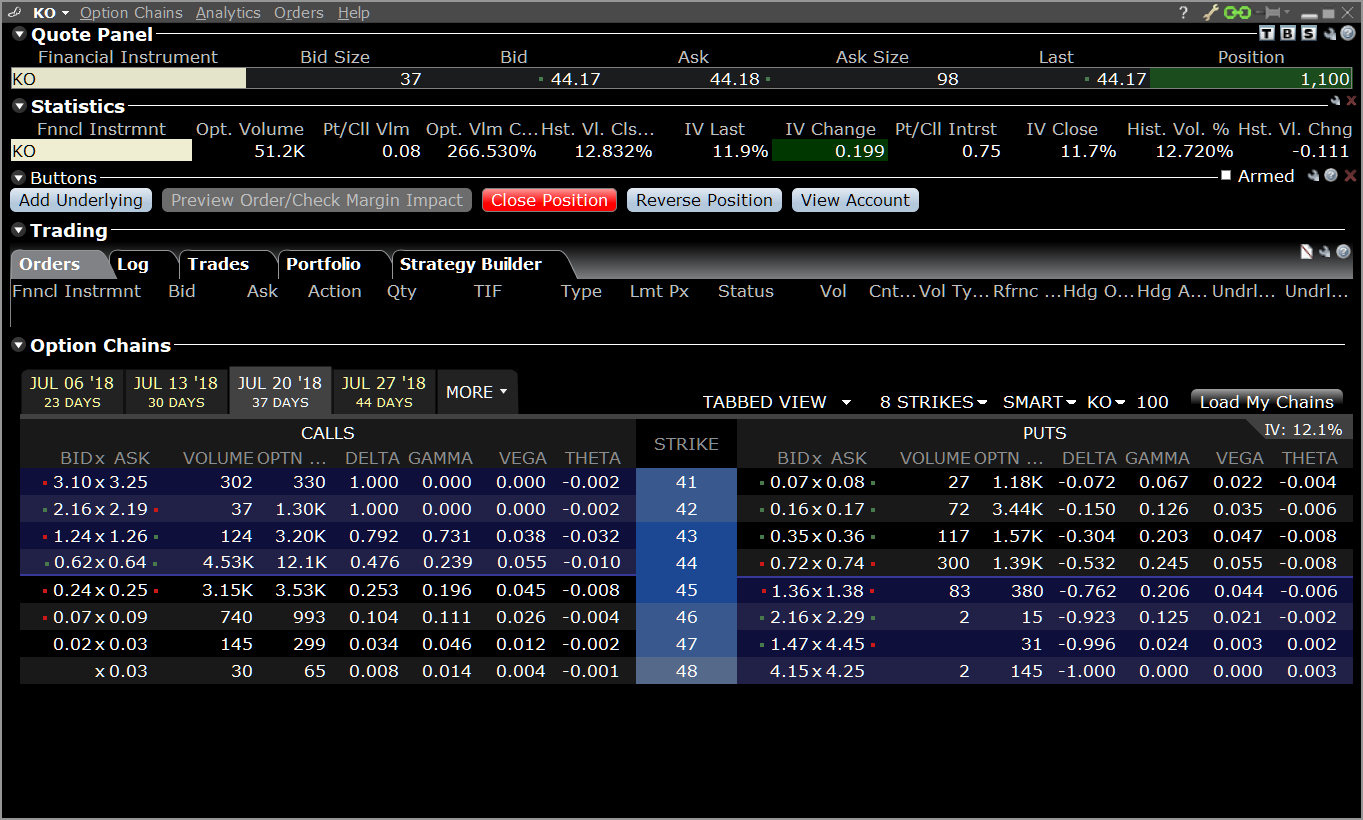

Tools for Effective Options Trading

IB provides a plethora of tools to enhance traders’ options trading experience, including:

- Option Analytics: Real-time analysis of implied volatility, Greeks, and historical price data, empowering traders with insights for informed decision-making.

- Charting Tools: Advanced charting capabilities with technical indicators, trend analysis, and pattern recognition, enabling traders to identify potential trading opportunities.

- Margin Calculations: Convenient margin calculators that provide an accurate estimate of the margin requirements for specific options positions, ensuring adequate liquidity for trading.

Strategies for Successful Options Trading

Bullish Strategies

- Long Call: Profitable if the underlying asset’s price rises above the strike price, providing leverage to upside potential.

- Vertical Call Spread: Buying one call option at a higher strike price and selling one call option at a lower strike price, limiting potential losses while maintaining upside potential.

Bearish Strategies

- Long Put: Profitable if the underlying asset’s price falls below the strike price, providing downside protection.

- Vertical Put Spread: Selling one put option at a lower strike price and buying one put option at a higher strike price, limiting potential profits while mitigating downside risk.

Neutral Strategies

- Straddle: Buying both a call option and a put option at the same strike price, benefiting from high volatility in either direction.

- Strangle: Buying a call option and a put option with different strike prices, profiting from moderate volatility in a specified range.

Trading Options In Interactive Brokers

Conclusion

Trading options in Interactive Brokers can be a rewarding endeavor for those who embrace knowledge and develop a disciplined trading approach. By leveraging the advanced capabilities of IB’s platform, coupled with a thorough understanding of the concepts and strategies discussed in this guide, traders can navigate the options market with confidence, potentially achieving significant financial returns. Remember, while the potential rewards can be substantial, so too are the risks, necessitating careful risk management practices. As you embark on your options trading journey, it is imperative to conduct thorough research, continually seek knowledge, and monitor market trends to maximize your trading efficiency.