As a seasoned trader, I’ve witnessed firsthand the transformative power of leveraging deep in the money (DITM) options in my trading endeavors. DITM options provide an edge by mitigating risk and enhancing profit potential. Delving into the complexities of DITM options, this comprehensive guide aims to empower traders with an in-depth understanding of their nuances.

Image: www.youtube.com

Understanding DITM Options

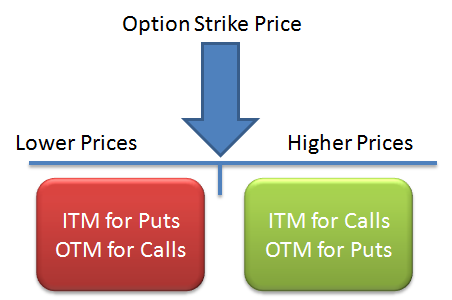

DITM options, unlike near-the-money or out-of-the-money options, are options with a strike price significantly lower (for call options) or higher (for put options) than the underlying asset’s spot price. They are inherently “in the money” at the time of purchase, meaning they have intrinsic value due to their likelihood of being exercised and profiting from the underlying asset’s price movement.

This intrinsic value grants DITM options several unique characteristics. Firstly, they exhibit reduced sensitivity to fluctuations in implied volatility, making them less susceptible to sudden market shifts. Secondly, DITM options boast a higher probability of profitability, as they require only a modest movement in the underlying asset’s price to realize a return.

Trading Strategies for DITM Options

Incorporating DITM options into trading strategies opens up a world of possibilities. One prevalent strategy involves buying DITM call options to leverage bullish market expectations. This approach offers limited but predictable upside potential, while downside risk is capped by the premium paid for the option.

Conversely, traders anticipating a market downturn can employ DITM put options. By selling DITM put options, they aim to capitalize on the premium income generated. As long as the underlying asset’s price doesn’t decline significantly, this strategy provides consistent returns, albeit limited in profit potential.

Another astute strategy involves the sale of DITM call options as a means of profiting from a stagnant or declining market. This tactic generates income from the premium received upfront, while mitigating the risk of the underlying asset’s price appreciating substantially.

Value of DITM Options

The value of DITM options lies not only in their reduced volatility and higher profitability potential, but also in their inherent hedging capabilities. By incorporating DITM options into a trading portfolio, traders can offset risk exposure in other positions. This hedging strategy stabilizes overall returns and helps navigate volatile market conditions.

Moreover, DITM options provide access to leverage. By employing a margin account, traders can control a significant position in the underlying asset with a relatively modest capital outlay. This leverage enhances profit potential, but it’s crucial to exercise caution and manage risk appropriately.

Image: investingwithoptions.com

Tips and Expert Advice

Harnessing the full potential of DITM options requires a combination of skill and strategy. Below are some invaluable tips from seasoned traders:

- Select options with ample time to expiration: DITM options have a shorter time decay compared to other options, so choosing those with a longer lifespan provides greater flexibility.

- Consider selling DITM options in volatile markets: When market volatility spikes, the premiums for DITM options increase substantially, creating lucrative opportunities for traders to sell.

- Monitor delta closely: Delta measures the sensitivity of an option’s price to fluctuations in the underlying asset’s price. DITM options have a delta close to 1, implying that they will largely mirror the movement of the underlying asset.

Remember, trading deep in the money options is not without its risks. Always exercise due diligence, manage your risk, and consult with financial professionals if necessary.

FAQ

Q: What are the benefits of trading deep in the money options?

A: DITM options offer reduced volatility, higher profitability potential, hedging capabilities, and leverage.

Q: What strategies can I use to trade deep in the money options?

A: Common strategies include buying DITM call options for bullish markets, selling DITM put options for bearish markets, and selling DITM call options for stagnant or declining markets.

Q: How can I minimize risk when trading deep in the money options?

A: Employ risk management techniques such as position sizing, stop-loss orders, and delta monitoring to mitigate potential losses.

Trading Deep In The Money Options

https://youtube.com/watch?v=aWGmMZ6dCs8

Conclusion

The intricacies of trading deep in the money options offer a smorgasbord of opportunities for discerning traders. By understanding the fundamentals, employing proven strategies, and adhering to sound risk management principles, you can harness the power of DITM options to enhance your trading performance. Embark on this journey today and elevate your trading prowess.

Are you intrigued by the world of deep in the money options? Share your thoughts and experiences below, let’s engage in a spirited discussion.