In the ever-evolving world of financial markets, swing trading has emerged as a lucrative strategy for seasoned traders seeking to capitalize on short-term price fluctuations. Among the various options trading strategies, deep in-the-money (DITM) options have gained significant popularity due to their potential to generate substantial profits with reduced risk. This definitive guide will delve deep into the intricacies of swing trading DITM options, empowering traders with the knowledge and techniques to navigate the dynamic options landscape.

Image: www.educba.com

Understanding Deep ITM Options: A Foundation for Success

Deep ITM options are options that have an intrinsic value significantly larger than zero. This意味着 the option is already in-the-money and has a high probability of expiring in-the-money. As a result, DITM options tend to exhibit lower volatility compared to their out-of-the-money (OTM) counterparts, making them a more stable and predictable asset class.

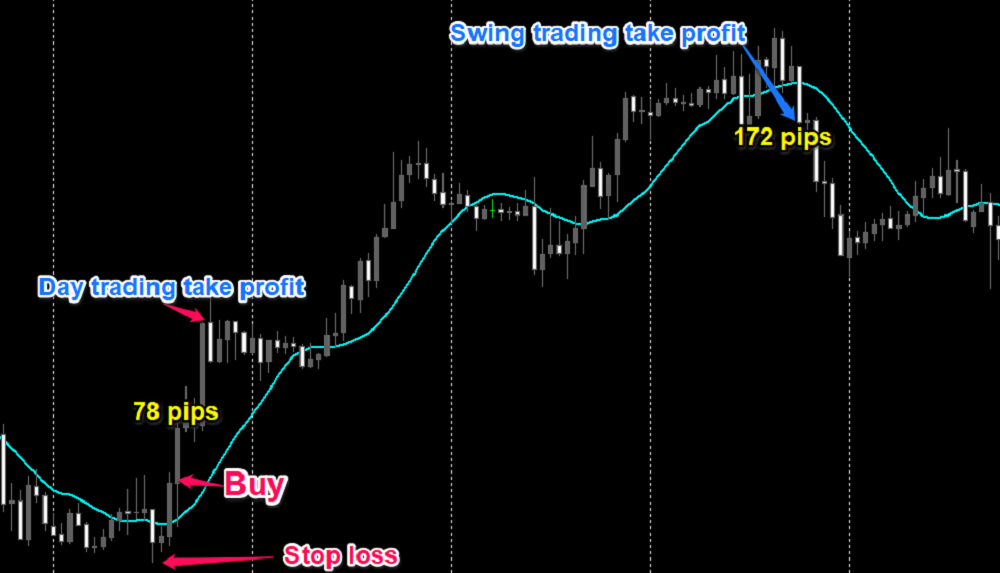

Swing trading involves holding options for a period of several days to several weeks, attempting to capture price swings within a defined timeframe. DITM options are particularly suited for swing trading due to their inherent stability and the reduced time decay they experience compared to OTM options.

Essential Elements of Swing Trading DITM Options: A Step-by-Step Approach

1. Market Selection and Analysis: The foundation of successful swing trading lies in identifying markets exhibiting strong trends and high volatility. A thorough analysis of historical price data, technical indicators, and market news can provide valuable insights into potential trading opportunities.

2. Option Selection: Once a suitable market has been identified, traders can begin selecting appropriate DITM options. Factors to consider include the option’s delta, time to expiration, and implied volatility. A higher delta indicates a stronger correlation between the option’s price and the underlying asset, while a longer time to expiration provides more flexibility and reduces the impact of time decay.

3. Position Sizing: Determining the optimal position size is crucial for risk management. Traders should consider their account balance, risk tolerance, and the potential profit and loss of the trade.

4. Entry and Exit Strategies: Swing trading DITM options requires disciplined entry and exit strategies. Entry points should be based on technical analysis, such as support and resistance levels, while exit points can be determined using profit targets or predefined stop-loss levels.

5. Risk Management: Risk management is paramount in swing trading. Traders should always define their risk tolerance and implement strategies such as stop-loss orders to limit potential losses.

Advanced Techniques for Enhanced Performance: Exploring the Nuances of Swing Trading DITM Options

1. Spreads: Spreads involve trading two or more options simultaneously to create a customized risk-reward profile. Vertical spreads, such as bull or bear spreads, can reduce risk while maintaining profit potential.

2. Volatility Analysis: Understanding implied volatility and its impact on option pricing is crucial. Traders can use volatility indicators, such as the VIX, to assess market volatility and adjust their trading strategies accordingly.

3. Hedging: Hedging techniques, such as using options to offset risk in an underlying portfolio, can further enhance risk management and protect profits.

Image: www.ebay.com

Swing Trading Ditm Options

Image: www.humbletraders.com

Conclusion: Embracing the Power of Swing Trading DITM Options

Swing trading DITM options presents a compelling opportunity for experienced traders to harness the potential of the options market. Through a thorough understanding of DITM options, strategic option selection, and disciplined risk management, traders can navigate market fluctuations and achieve consistent returns. Remember, financial markets are dynamic, and ongoing research and adaptation are essential for sustained success. By embracing the insights and techniques outlined in this guide, traders can elevate their swing trading skills and unlock the full potential of this rewarding strategy.