In the realm of investing, where the allure of quick profits intertwines with the sting of potential losses, there exists a sophisticated strategy that has tantalized traders for years: swing trading options. Swing trading, a hybrid approach that marries elements of both short-term and long-term trading, offers a unique path to financial freedom for those who master its intricacies. As we delve into the world of swing trading options, we will explore the intricacies of this captivating strategy, uncovering its fundamental concepts, examining its history, and empowering you with actionable insights to navigate the ever-evolving financial markets.

Image: www.weeklyoptionsusa.com

Options, financial instruments that grant traders the right to buy or sell an underlying asset at a predetermined price on or before a specific date, form the cornerstone of swing trading. By understanding the dynamics of options contracts and their interplay with the underlying asset’s price movements, swing traders seek to profit from price swings that typically span multiple days to several weeks. The allure of swing trading options lies in its potential to generate sizeable returns while mitigating risk, making it an attractive proposition for traders seeking a balance between income generation and risk management.

Unveiling the Nuances of Swing Trading Options

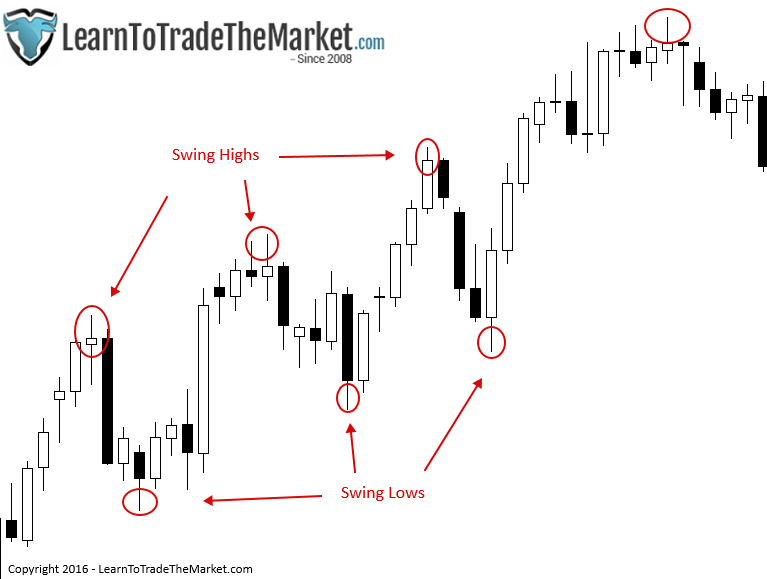

Swing trading options demands a comprehensive understanding of the underlying asset’s price action and the interplay of technical and fundamental factors that influence its trajectory. Traders employing this strategy meticulously analyze charts, discerning patterns and trends that can provide valuable insights into future price movements. Technical indicators, such as moving averages, support and resistance levels, and momentum oscillators, serve as valuable tools in this endeavor, helping traders gauge the direction and strength of the underlying trend.

In the world of swing trading options, patience and discipline reign supreme. Unlike day traders who execute multiple trades within a single trading day, swing traders remain steadfast in their positions for a more extended period, capitalizing on gradual price movements that align with their predefined trading plan. This patient approach allows swing traders to minimize the impact of short-term market fluctuations and the emotional roller coaster that often plagues less experienced traders.

Essential Strategies for Swing Trading Options

The realm of swing trading options encompasses a multitude of strategies, each tailored to the trader’s risk appetite, capital, and preferred trading style. Among the most popular approaches are long and short option strategies. Long option strategies involve buying an option contract with the expectation that the underlying asset’s price will rise, resulting in a potential profit upon exercise or sale of the option. Conversely, short option strategies involve selling an option contract with the belief that the underlying asset’s price will decline, generating profit if the option expires worthless or is bought back at a lower price.

Traders seeking a more conservative approach to swing trading options may gravitate toward covered calls or protective puts. Covered calls involve selling call options against an underlying asset you own, while protective puts involve purchasing put options to hedge against potential losses in the underlying asset. Both strategies aim to reduce downside risk while still offering the potential for profit.

Mastering the Art of Swing Trading Psychology

While technical proficiency is undoubtedly an essential aspect of swing trading options, the significance of mastering the psychological aspects of trading cannot be overstated. The financial markets are a tempestuous arena where emotions can run high, often leading to irrational decision-making and detrimental trading outcomes. Swing traders must cultivate mental fortitude, maintaining unwavering discipline and objectivity amid market volatility. Emotional detachment and adherence to a predefined trading plan serve as vital anchors in the turbulent waters of the markets.

Managing risk effectively underscores the importance of emotional control in swing trading options. Establishing clear stop-loss and take-profit levels before entering a trade allows traders to mitigate potential losses while locking in profits. Maintaining a level of discipline that ensures adherence to these predetermined parameters, even in the face of tempting market fluctuations, is paramount to long-term success in this demanding yet rewarding endeavor.

Image: www.learntotradethemarket.com

Embracing Technology to Enhance Swing Trading

In the modern era of trading, technology has emerged as an indispensable tool for swing trading options. Sophisticated trading platforms offer a comprehensive suite of tools to facilitate efficient trade execution, real-time market monitoring, and in-depth data analysis. These platforms often provide access to advanced charting capabilities, technical indicators, and algorithmic trading strategies, enabling traders to refine their decision-making process and enhance their overall trading experience.

Mobile trading apps extend the reach of swing trading, allowing traders to monitor their positions and execute trades from virtually anywhere with an internet connection. This added flexibility empowers traders to stay abreast of market developments and react to emerging opportunities in real-time, maximizing their chances of profiting from favorable market conditions.

Knowledge and Execution: Cornerstones of Swing Trading Success

Embarking on the path of swing trading options requires a relentless pursuit of knowledge and an unwavering commitment to refining one’s trading skills. Continuous education through books, online courses, and webinars is vital to staying abreast of the latest trading strategies, market trends, and regulatory changes. Active participation in trading forums and communities allows traders to interact with like-minded individuals, exchange ideas, and learn from the experiences of others.

Practice, discipline, and patience form the foundation of successful swing trading. Simulated trading accounts provide a safe environment for traders to hone their strategies and gain confidence before venturing into live trading. A structured approach to trade execution, underpinned by a well-defined trading plan, is instrumental in maintaining consistency and mitigating the impact of emotional decision-making.

Swing Trading Options For A Living

Embrace the Challenges: Embrace the Rewards

The path to swing trading success is not without its challenges. Patience, resilience, and the ability to adapt to changing market conditions are essential traits that traders must cultivate over time. Losses are an inevitable part of trading, and accepting them as learning opportunities rather than setbacks is crucial to maintaining a positive mindset and long-term profitability. The rewards of successful swing trading, however, can be substantial. With dedication, perseverance, and a willingness to embrace the challenges, swing traders can unlock the potential of the financial markets and embark on a path toward financial freedom.