Gold, a precious metal prized for its resilience, has captivated investors for centuries. Today, the COMEX gold options market offers traders a versatile platform to capitalize on the dynamics of gold prices. Understanding the specifics of COMEX gold options trading hours is essential for success in this market.

Image: marketoracle.co.uk

COMEX (Commodity Exchange) is a division of the Chicago Mercantile Exchange (CME) Group that offers futures and options contracts for a range of commodities, including gold. The COMEX gold options market provides traders with the flexibility to hedge against price fluctuations or speculate on future gold price movements.

**COMEX Gold Options Trading Hours Revealed**

The COMEX gold options market operates on a strict schedule for electronic trading and open outcry sessions. Electronic trading commences at 8:00 AM (CST) and concludes at 5:15 PM (CST) on weekdays. During this period, traders can place and execute orders electronically through the CME Globex platform.

Open outcry sessions, where traders engage in face-to-face trading on the exchange floor, are held from 7:20 AM (CST) to 2:15 PM (CST). These sessions allow traders to negotiate and execute trades directly with each other.

**Trading Suspensions and Intermissions**

The COMEX gold options market is subject to trading suspensions and intermissions throughout the trading day. Suspensions typically occur during market-moving events or technical issues and can last anywhere from a few minutes to several hours.

Intermissions, on the other hand, are scheduled breaks that occur at predetermined times. These intervals provide traders with an opportunity to reassess market conditions and adjust trading strategies.

**Implications for Traders**

Understanding COMEX gold options trading hours is crucial for traders to maximize their profitability and manage risk effectively. By knowing the precise timing of trading sessions and potential disruptions, traders can optimize their trading strategies.

For instance, traders may opt to place limit orders or utilize automated trading systems during electronic trading hours to ensure timely order execution. Conversely, those seeking more hands-on, personalized trading may prefer to participate in open outcry sessions.

Image: www.goldmoney.com

**Tips and Expert Advice for Enhanced Trading**

In the highly dynamic COMEX gold options market, it’s essential to leverage expert advice to enhance your trading decisions. Consider the following tips from seasoned traders:

- Monitor market news: Stay informed about economic events, geopolitical developments, and industry-specific news that can influence gold prices.

- Utilize technical analysis: Technical indicators and charts can provide valuable insights into price trends and potential trading opportunities.

- Diversify your portfolio: Trading gold options as part of a diversified portfolio helps manage risk and potentially improve overall returns.

- Manage risk prudently: Employ stop-loss orders and other risk management strategies to safeguard your trading capital.

- Seek professional guidance: Consider consulting with a financial advisor or experienced broker for personalized trading guidance.

**Frequently Asked Questions (FAQs)**

- Q: What are the open outcry trading hours for COMEX gold options?

A: Open outcry sessions are held from 7:20 AM (CST) to 2:15 PM (CST) on weekdays. - Q: Are there any trading holidays for COMEX gold options?

A: Yes, the COMEX gold options market is closed on designated holidays, including weekends and certain U.S. federal holidays. - Q: What is the maximum contract size for COMEX gold options?

A: The maximum contract size is 100 troy ounces of gold. - Q: How do I calculate the value of a COMEX gold options contract?

A: The contract value is determined by multiplying the number of ounces by the current spot price of gold and the contract multiplier. - Q: Is it recommended to trade COMEX gold options as a novice trader?

A: Gold options trading involves inherent risks and complexities. It’s advisable for novice traders to gain experience and knowledge before venturing into this market.

Comex Gold Options Trading Hours

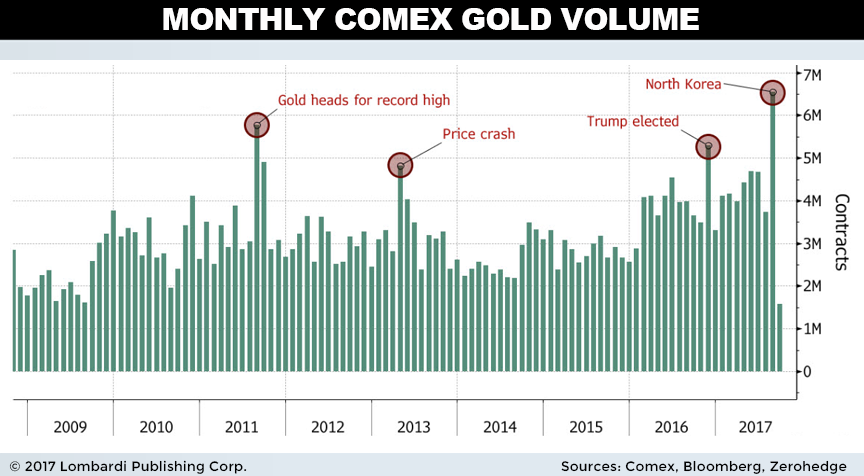

Image: www.lombardiletter.com

**Conclusion**

Navigating COMEX gold options trading hours requires a thorough understanding of the specific schedules and nuances associated with this market. By adhering to trading hours, utilizing expert advice, and implementing effective risk management measures, traders can increase their chances of success in the fast-paced and dynamic world of gold options trading.

If you’re captivated by the lure of gold trading, we invite you to delve deeper into the captivating world of COMEX gold options. Explore the vast resources available online, seek mentorship from seasoned traders, and immerse yourself in the intricacies of this fascinating market. Your dedication and unwavering focus will serve as your guiding light on the path to a potentially rewarding trading experience.