In the fast-paced world of investing, weekly options trading has emerged as a dynamic strategy that offers both opportunities and challenges. From volatile market conditions to the rapid decay of premiums, this approach requires a deep understanding of the underlying mechanics and potential risks.

Image: www.weeklyoptionsusa.com

Understanding Weekly Options Trading

Weekly options are contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a predetermined expiration date. Unlike traditional options that typically expire on a monthly basis, weekly options have shorter timeframes, ranging from one to four weeks.

This condensed timeframe presents unique advantages for traders seeking to capitalize on short-term market movements and volatility. Weekly options allow for greater flexibility, enabling traders to adjust their positions more frequently and adapt to changing market conditions.

Historical Evolution and Growing Popularity

Weekly options have been around for decades, namun the concept gained significant traction in recent years due to the rise of electronic trading and the increasing popularity of short-term trading strategies. Advanced trading platforms and real-time market data have made it easier for traders to analyze market trends and execute weekly options trades.

Exploring the Mechanics and Strategies

The mechanics of weekly options trading involve buying or selling a contract that gives the trader the right to buy (in the case of a call option) or sell (in the case of a put option) a specific number of shares of an underlying asset at a predetermined strike price on or before the expiration date.

Traders can employ various strategies with weekly options, such as outright purchases or sales, spreads, and combinations. Advanced strategies, such as iron condors and butterflies, require a higher level of understanding and risk management.

Image: www.warsoption.com

Time Decay and Implied Volatility

A key challenge in weekly options trading is the rapid decay of time premium. As the expiration date approaches, the value of the option decays, which can lead to significant losses if the underlying asset does not perform as anticipated.

Traders need to be mindful of implied volatility, which measures the expected price volatility of the underlying asset. Higher implied volatility results in higher option premiums, but also exposes traders to greater risk. Understanding implied volatility is crucial for effective trade management.

The Role of Volatility and Liquidity

Volatility plays a significant role in weekly options trading. Volatile markets amplify potential profits but also increase the risk of losses. High-volatility stocks offer greater opportunities for profit but come with corresponding risks.

Liquidity is another important consideration. Weekly options with higher trading volumes are more readily available and offer tighter bid-ask spreads. Traders should consider the liquidity of an option before entering a trade to ensure they can effectively manage their risk.

Tips and Expert Advice for Successful Weekly Options Trading

To succeed in weekly options trading, it’s essential to establish a sound risk management strategy. Always trade with capital you can afford to lose and define your risk tolerance before initiating any trade.

Approaching weekly options trading with a clear strategy and a disciplined approach is paramount. Conduct thorough research and due diligence before entering any trade, considering factors such as the underlying asset, market trends, and option pricing.

General FAQ on Weekly Options Trading

Q: What is the minimum trading capital for weekly options?

A: The minimum trading capital varies depending on the brokerage and the options you trade, but generally, it’s recommended to have at least $5,000 to start trading weekly options.

Q: How do I determine if an option is right for me?

A: Consider your trading goals, risk tolerance, and the underlying asset’s fundamentals and market trends. Analyze the option’s price, strike price, expiration date, and implied volatility to assess its suitability.

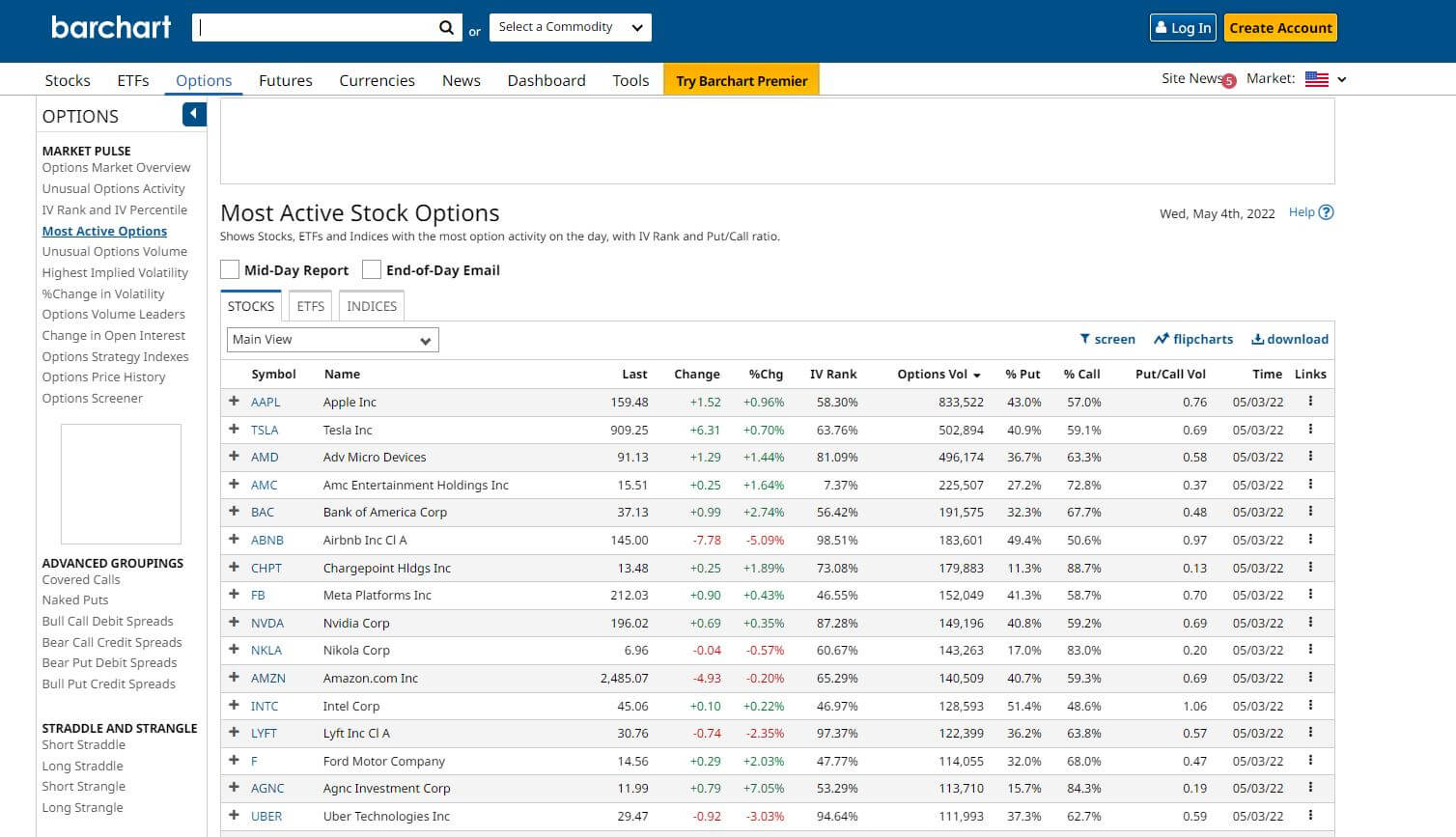

Stocks With Weekly Options Trading

Conclusion: Embark on the Path to Weekly Options Trading Mastery

Weekly options trading offers unique opportunities for market participation and potential capital growth. By understanding the mechanics, strategic considerations, and potential risks, traders can navigate this dynamic market environment and develop successful trading plans.

Are you ready to delve into the exciting world of weekly options trading? Begin your research, sharpen your analysis skills, and consider consulting with financial experts to maximize your chances of success.