The world of finance offers a labyrinth of investment opportunities, and among them, share option trading stands out as a compelling yet intricate strategy. Options contracts, embodying the right but not the obligation to buy or sell an underlying asset at a predefined price, empower investors with the potential to amplify gains or hedge against market volatility. This comprehensive guide will unravel the complexities of share option trading, equipping investors with the necessary knowledge to navigate this dynamic market.

:max_bytes(150000):strip_icc()/OPTIONSBASICSFINALJPEGII-e1c3eb185fe84e29b9788d916beddb47.jpg)

Image: flipboard.com

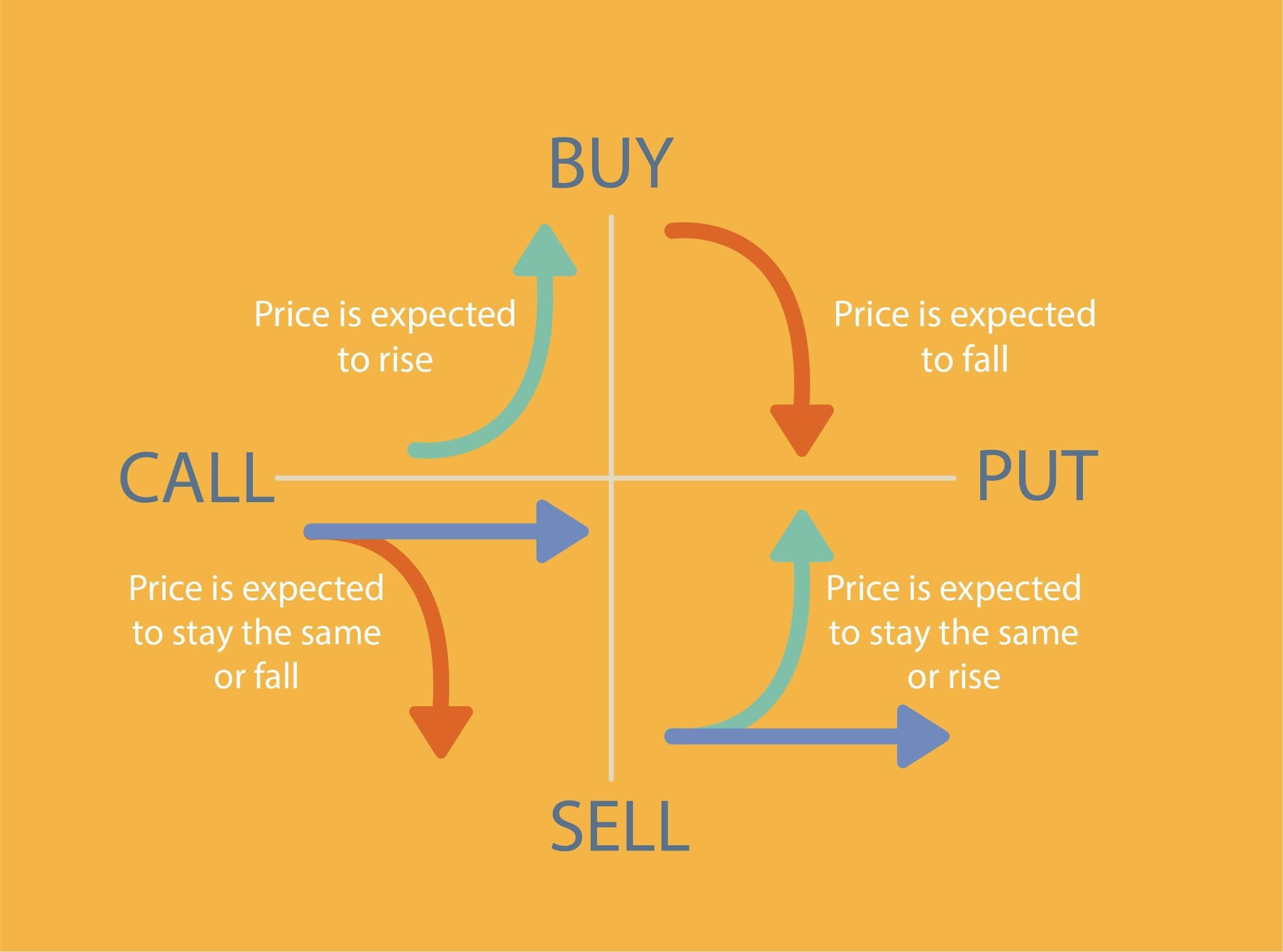

Understanding the Fundamentals: The essence of share option trading lies in its use of options contracts. These contracts grant investors the choice, not the mandate, to execute a trade at a set price (strike price) by a predetermined date (expiration date). Call options provide the purchaser with the prerogative to acquire the underlying asset, whereas put options confer the right to sell. The premium, essentially the price of the option, reflects the market’s assessment of factors such as the volatility of the underlying asset, interest rates, and time to expiration.

Strategies for Various Market Scenarios

- **Bullish Strategies:** When optimism prevails, call options empower investors to capitalize on rising share prices. Simple call buying involves purchasing a call option with the anticipation of selling it at a higher price or exercising the right to purchase the underlying asset as its value ascends.

- **Neutral Strategies:** In markets characterized by indecision, neutral strategies seek to generate profits from fluctuations within a specific range. The collar strategy involves selling an out-of-the-money call option and simultaneously buying an out-of-the-money put option at a higher strike price. This strategy yields a profit if the stock price remains within the range bounded by the strike prices, while losses are limited to the difference in premiums paid and received.

- **Bearish Strategies:** As pessimism permeates the market, put options provide investors with a safety net against potential losses or opportunities to profit from falling share prices. Simple put buying allows traders to sell the underlying asset at a predetermined price if its value declines. Put vertical spread involves buying a lower strike price put option and selling a higher strike price put option, profiting from a limited decline in the stock price while limiting potential losses.

Unveiling Risk Management Techniques

Recognizing and managing risk is a crucial aspect of share option trading. Options, though potent instruments, can embody significant risks. Implementing robust risk management practices is essential to mitigate these hazards:

- **Options Pricing Models:** Understanding option pricing models, such as the Black-Scholes model, empowers investors to estimate the fair value of options contracts. Valuing options accurately aids in making informed decisions, assessing potential risks, and identifying profitable trading opportunities.

- **Greeks: Measuring Risk Exposure:** Greeks, sensitivity metrics, quantify the impact of various factors on the price of an option. Understanding Delta, Gamma, Theta, Vega, and Rho allows traders to assess how changes in underlying asset price, time decay, volatility, and interest rates affect their option positions, enabling them to adjust their strategies accordingly.

- **Hedging Strategies:** Hedging techniques allow investors to mitigate risk exposure by offsetting the potential losses of one position with gains from another. Creating a synthetic position by combining options contracts or utilizing futures contracts can minimize the impact of adverse price movements, safeguarding investments.

The Psychology of Successful Option Trading

Besides technical expertise, mastering the psychological aspects of share option trading is vital for enduring success. Discipline, emotional control, and a sound understanding of one’s risk tolerance are essential traits of seasoned option traders:

- **Discipline and Patience:** Adhering to a disciplined trading plan, founded on thorough analysis and risk management strategies, prevents impulsive decisions driven by greed or fear. Patience is key, as market movements may not always align with immediate expectations.

- **Emotional Control:** Controlling emotions is paramount in option trading. Avoiding decisions influenced by elation or panic ensures rational thinking and adherence to the trading plan. Maintaining composure during market fluctuations fosters sound judgment and limits potential losses.

- **Risk Management Mindset:** Recognizing and accepting the inherent risks associated with share option trading is crucial. Establishing clear risk limits and adhering to them safeguards investments and prevents excessive losses. Prudent risk management fosters a healthy trading mindset, encouraging measured decision-making.

Image: www.reddit.com

Share Option Trading

https://youtube.com/watch?v=o8gTYwV14ss

Conclusion: Unveiling the World of Options Trading

Share option trading offers investors a potent tool for amplifying gains or mitigating risks in the equity markets. By delving into the intricacies of options contracts, implementing robust risk management strategies, and cultivating the psychological traits of successful traders, investors can harness the power of this dynamic market. Embracing thorough research, constant learning, and a prudent approach empowers investors to navigate the complexities of share option trading, maximizing their potential for success.

To further enhance your understanding and unlock the full potential of share option trading, delve into reputable resources, consult with experienced professionals, and engage in simulated trading platforms before venturing into real-world markets. Equipping yourself with the requisite knowledge and skills will empower you to make informed decisions, manage risk effectively, and capitalize on the opportunities presented by this enthralling investment arena.