Delve into the intricacies of Robinhood’s option trading extended hours, empowering you to navigate the realm of options trading with confidence.

Image: streetfins.com

Introduction

Robinhood has transformed the landscape of online trading, democratizing the financial markets and making investing accessible to a broader audience. Amongst its game-changing features is the offering of option trading extended hours, granting traders increased flexibility and strategic opportunities. Understanding these extended trading hours is pivotal for maximizing your trading prowess, as they extend the traditional trading day, allowing you to seize market opportunities beyond the regular market hours.

Extended Hours: A Game-Changer in Option Trading

The extended trading sessions provide a critical advantage for both savvy and novice traders alike. While the conventional trading hours confine trading activities to the core market hours of 9:30 AM to 4:00 PM EST, extended hours expand this window, allowing traders to execute option trades before and after the regular market hours. Robinhood’s extended trading hours commence at 7:00 AM EST and conclude at 8:00 PM EST, giving traders a three-hour head start and a two-hour extension, respectively.

The Strategic Value of Extended Hours

Harnessing the power of extended trading hours opens up a world of strategic possibilities for option traders. These expanded hours empower traders to:

- Capitalize on Pre-Market Momentum: The pre-market hours provide a glimpse into the market’s anticipated direction for the day, facilitating informed trading decisions. Traders can leverage this opportunity to position themselves strategically before the market opens, potentially capturing early gains or mitigating potential losses.

- React to Late-Breaking News: Market-moving news events often occur outside regular trading hours. Extended hours provide a platform for traders to respond swiftly to these events, adjusting their positions accordingly to minimize risk or seize emerging opportunities.

- Manage Positions Overnight: Holding option positions overnight can be a double-edged sword. Extended hours grant traders the flexibility to make adjustments to their positions, such as rolling them over or exiting them, based on changing market conditions, reducing overnight risk exposure.

- Increased Market Visibility: Extended trading hours broaden the trading window, increasing market visibility and providing traders with more data points to analyze market trends and make informed decisions. This expanded visibility enhances traders’ ability to identify trading opportunities and assess market sentiment.

Image: bethanblakely.blogspot.com

Understanding the Risks Involved

While extended trading hours offer numerous benefits, it is imperative to acknowledge the associated risks:

- Lower Liquidity: Trading volume tends to be lower during extended hours, potentially affecting the execution price and liquidity of option orders. Traders may encounter wider bid-ask spreads and experience delays in order execution.

- Increased Volatility: Extended hours coincide with periods of potentially higher market volatility, as fewer market participants are actively trading. This volatility can amplify price fluctuations, potentially exacerbating losses or diminishing gains.

- Limited Market Depth: The reduced trading volume during extended hours may result in limited market depth. This diminished depth can hinder traders from executing large orders at favorable prices.

Tips for Navigating Extended Hours

To effectively navigate the extended trading hours, consider these tips:

- Research and Education: Thoroughly understand the risks and benefits associated with extended hours trading. Educate yourself on option trading strategies and risk management techniques to mitigate potential losses.

- Start Cautiously: Gradually introduce extended hours trading into your trading strategy. Start with small trades and gradually increase your involvement as you gain experience and confidence.

- Monitor Market Conditions: Pay close attention to market conditions during extended hours, including news events, economic data releases, and pre-market and post-market price action. Adjust your trading strategy accordingly to minimize risk exposure.

- Manage Risk Effectively: Utilize stop-loss orders or other risk management tools to limit potential losses during extended hours, considering the increased volatility. Monitor your positions closely and be prepared to adjust or exit trades as needed.

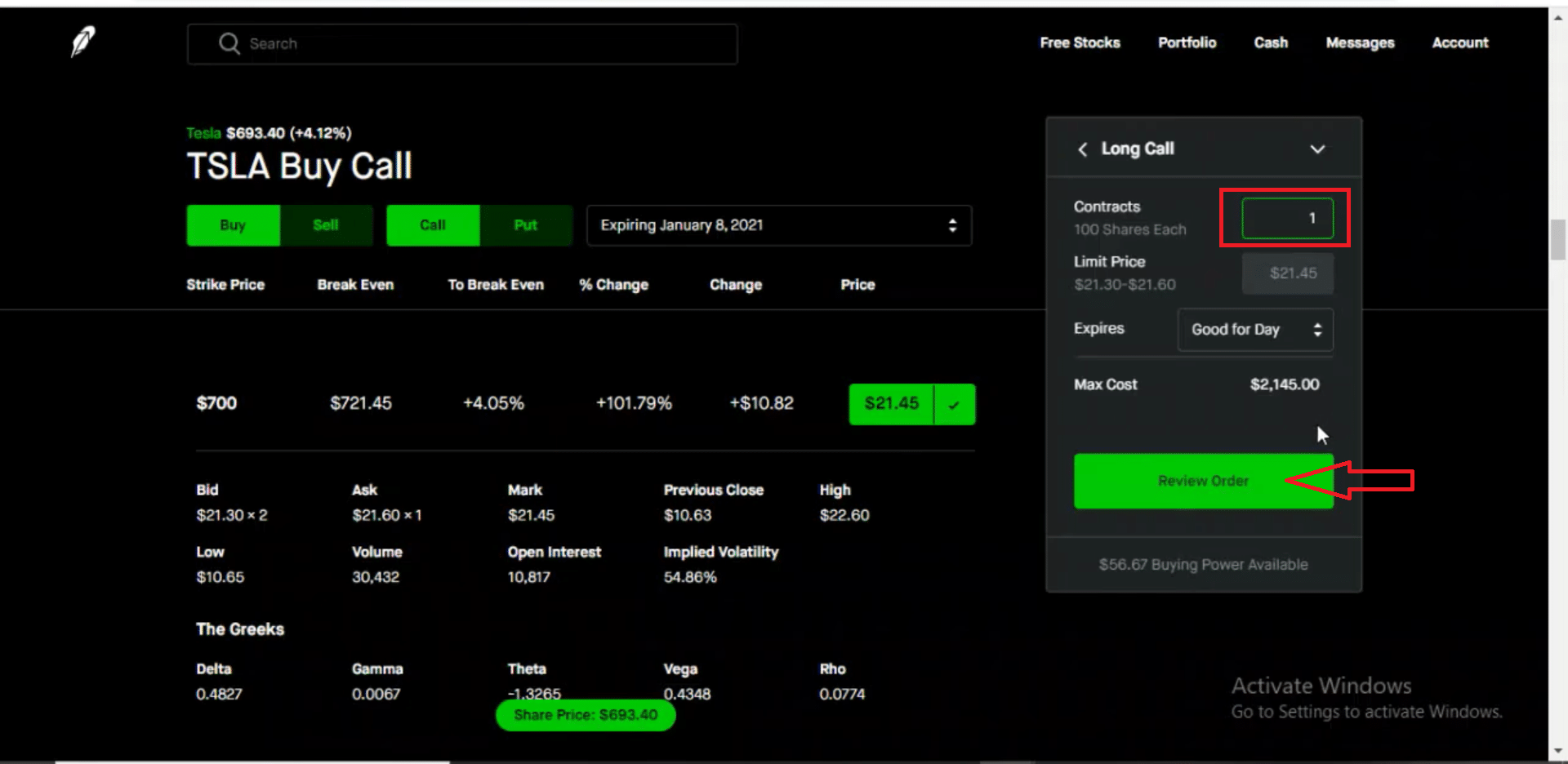

Robinhood Option Trading Hours

Conclusion

Understanding and utilizing Robinhood’s option trading extended hours can significantly elevate your trading strategy. While these extended hours present numerous strategic opportunities, it is essential to proceed with caution, recognizing the associated risks. By conducting thorough research, starting cautiously, and managing risk effectively, you can unlock the full potential of extended hours trading and enhance your profitability in the fast-paced world of options. Embrace the extended hours as a valuable tool in your trading arsenal, allowing you to navigate market opportunities beyond the confines of traditional trading hours and achieve greater success in your trading endeavors.