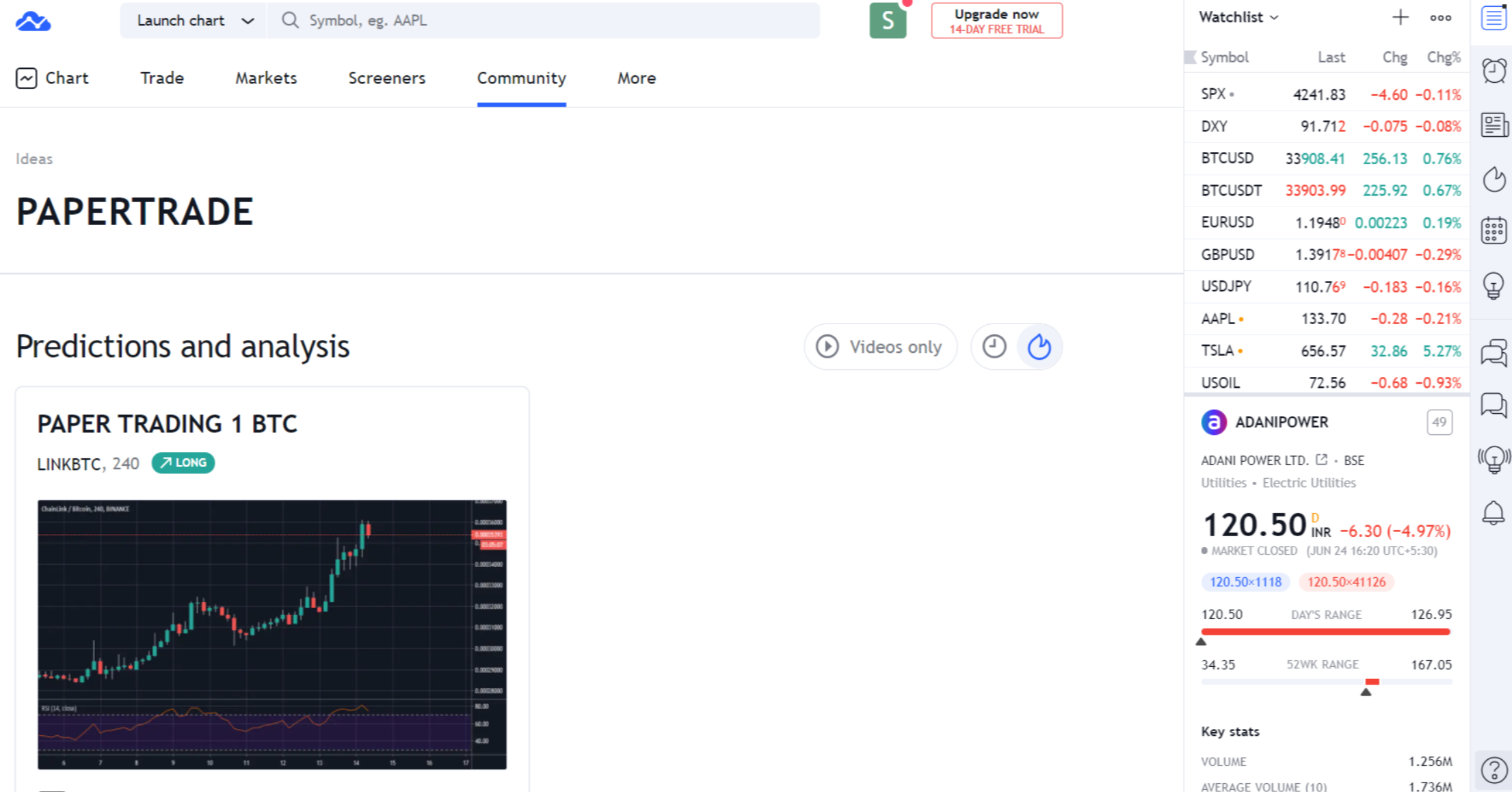

Imagine this: You’re sitting at your desk, sipping your coffee, and with a few clicks on your phone, you’re making trades on the stock market. No brokerage fees, no fancy financial jargon, and the ability to experiment without risking your hard-earned cash. This is the world of virtual options trading, a digital playground that’s attracting both seasoned investors and curious newcomers.

Image: investobull.com

While the real world of options trading can feel daunting and inaccessible, virtual trading offers a safe and accessible entry point. It allows you to learn the ropes, refine your strategies, and build confidence without the fear of losing actual capital. In this article, we’ll delve into the ins and outs of virtual options trading, exploring its benefits, challenges, and how it’s changing the landscape of financial education.

Understanding the Virtual Options Trading Landscape

What is Virtual Options Trading?

Virtual options trading is a simulated environment that mirrors real-time market conditions but utilizes virtual money instead of actual funds. Think of it like a stock market video game, but with real-world data and complexities. These platforms provide access to a vast library of instruments, including options, stocks, and even cryptocurrencies, allowing you to practice your trading skills, experiment with different strategies, and analyze market trends without any financial risk.

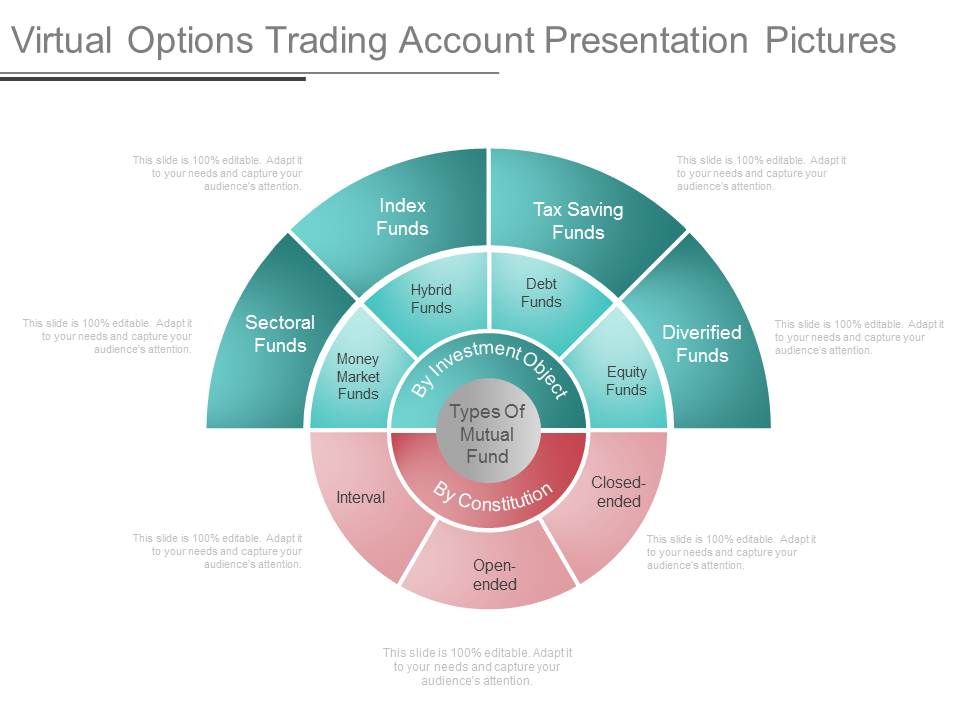

Why Choose Virtual Options Trading?

The beauty of virtual trading lies in its ability to bridge the gap between theory and practice. It offers a risk-free environment to:

- Develop your trading skills: Learn to read charts, understand market indicators, and execute trades without the fear of real-world losses.

- Test different trading strategies: Experiment with various approaches, from buy-and-hold to short-selling, to discover what works best for you.

- Build confidence before entering the real market: Gain practical experience and familiarity with the intricacies of options trading before making real-money investments.

- Explore different asset classes: Learn how to trade stocks, options, forex, and even cryptocurrencies in a controlled and safe environment.

Image: www.slideteam.net

What to Look for in a Virtual Options Trading Platform?

Choosing the right platform is crucial for a successful virtual trading experience. Look for features like:

- Real-time market data: Ensure the platform replicates real-world market conditions accurately.

- Realistic trading interface: A user-friendly platform that mimics the interface of real brokers.

- Comprehensive educational materials: Resources like tutorials, articles, and webinars to enhance your understanding.

- Detailed performance analytics: Track your trades, analyze your wins and losses, and identify areas for improvement.

- Community support: Forums and chat groups where you can connect with other traders and share knowledge.

Navigating the Virtual Options Trading World

The Evolution of Virtual Trading

Virtual trading has evolved significantly in recent years, driven by advancements in technology and a growing interest in financial education. Many platforms now offer advanced features and tools designed to provide a more immersive and realistic trading experience. The integration of artificial intelligence (AI) is transforming the way people learn about finance, with AI-powered bots offering personalized recommendations and insights to guide traders.

The Benefits and Drawbacks of Virtual Options Trading

While virtual options trading offers a plethora of advantages, it’s important to understand its limitations:

Benefits:

- Zero financial risk: Trade without fear of losing your own money.

- Hands-on learning: Develop trading skills and strategies through practical experience.

- Access to advanced tools and resources: Explore various analytical tools, charting applications, and market data.

- Learning from mistakes: Experiment with different strategies and learn from your losses in a safe environment.

Drawbacks:

- Lack of real-world emotions: Virtual trading doesn’t simulate the emotional pressures of real-money trading.

- Limited market depth and liquidity: The virtual environment may not reflect the full complexities of the real market.

- Potential for overconfidence: Success in virtual trading doesn’t guarantee success in real markets.

Tips and Expert Advice for Virtual Options Trading

Harnessing the Power of Virtual Trading

To make the most of your virtual trading journey, consider these tips:

- Start with a clear learning objective: Define what you want to achieve, whether gaining basic knowledge or mastering advanced strategies.

- Choose a reputable platform: Opt for platforms with a solid track record, user-friendly interface, and comprehensive educational resources.

- Practice consistently: Dedicate regular time to virtual trading, even if it’s just a few minutes each day.

- Track your performance: Analyze your trades, identify your strengths and weaknesses, and refine your strategies accordingly.

- Don’t be afraid to experiment: Virtual trading allows you to test different strategies and explore various asset classes without fear of financial loss.

- Remember it’s a learning process: Don’t get discouraged by initial losses. View them as opportunities for growth and learning.

Remember, virtual options trading is a valuable tool for learning and experimentation. It can provide you with the knowledge and confidence you need to navigate the complex world of options trading, but it’s essential to approach it with a realistic mindset and a clear understanding of its limitations.

Frequently Asked Questions

Q: What are the best virtual options trading platforms?

A: Some popular platforms include Investopedia’s Stock Simulator, TradingView’s Paper Trading, and Yahoo Finance’s Portfolio Tracker. Research different platforms to choose one that best suits your needs and learning style.

Q: How can I transition from virtual to real-world options trading?

A: Once you’ve gained confidence in your virtual trading skills, consider starting with a small real-money investment. Start with a small amount you’re comfortable losing and gradually increase your investments as you become more experienced.

Q: Is virtual options trading suitable for everyone?

A: While virtual trading is accessible to everyone, it’s not a suitable replacement for professional financial advice. If you’re new to investing, consider seeking guidance from a qualified financial advisor.

Virtual Options Trading

The Future of Virtual Options Trading

The world of virtual options trading is rapidly evolving. Expect to see more immersive experiences, advanced AI-powered tools, and perhaps even the integration of virtual reality (VR) to provide a more realistic and engaging learning environment. As financial education continues to democratize, virtual trading will play a key role in empowering individuals to navigate the complexities of the financial markets.

Are you interested in learning more about virtual options trading? Tell us in the comments below!