In the realm of finance, options trading presents a captivating realm of possibilities. It allows investors to navigate market fluctuations and potentially amplify profits by harnessing the intrinsic and extrinsic value of options. As an avid options trader, I’ve witnessed firsthand the transformative power of extrinsic value, and in this comprehensive guide, I’ll unravel its intricacies, empowering you to unlock its full potential.

Image: www.tastylive.com

Defining Extrinsic Value

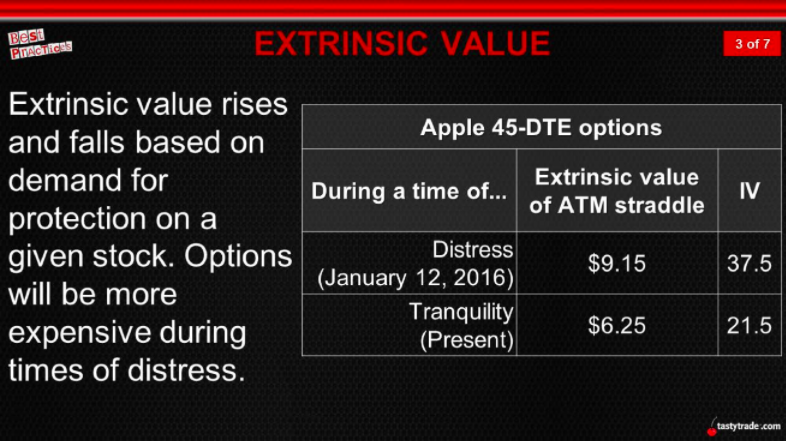

Extrinsic value, like a shimmering mirage in the investing horizon, represents the premium an option buyer pays beyond its intrinsic value. It encompasses the time value and volatility components that imbue options with their ephemeral yet alluring worth. Time value, as its name suggests, diminishes as the option nears expiration, accelerating the relentless march towards oblivion. Volatility, on the other hand, acts as a catalyst, inflating extrinsic value when market swings become more pronounced.

Unveiling the Implied Volatility Premium

At the heart of extrinsic value lies the implied volatility premium, a metric that encapsulates market participants’ collective judgment about the future volatility of the underlying asset. Like a crystal ball gazing into the future, options traders use implied volatility to gauge the potential range of price fluctuations within the option’s lifespan. A higher implied volatility translates into a more expensive option, as traders anticipate greater market turbulence.

Time’s Fleeting Impact

Time, like a relentless river, plays a pivotal role in shaping extrinsic value. As the clock ticks relentlessly towards expiration, time value withers away, leaving behind a dwindling premium. This inexorable erosion is particularly pronounced for short-term options, where the dwindling lifespan accelerates the premium’s decline. However, for longer-term options, time value enjoys a more leisurely pace, allowing it to retain a significant portion of its initial allure.

Image: www.slideserve.com

Volatility: The Unpredictable Catalyst

Volatility, a force as unpredictable as the vagaries of the wind, exerts a profound influence on extrinsic value. When markets gyrate wildly, volatility soars, inflating option premiums. Options traders, like surfers riding waves of uncertainty, seek to harness this volatility, exploiting the extrinsic value boost it provides. However, it’s crucial to remember that volatility, like a capricious mistress, can swiftly reverse course, leading to a rapid erosion of extrinsic value.

Time Value vs. Volatility: The Delicate Balance

Understanding the interplay between time value and volatility is paramount for options traders. As time’s relentless march whittles away time value, volatility emerges as the predominant factor determining extrinsic value. For short-term options, the diminishing time value exacerbates the impact of volatility swings, while longer-term options exhibit a more stable relationship between time value and extrinsic value.

Expert Insights and Advice

Harnessing extrinsic value effectively requires a blend of strategic insights and technical expertise. Here are some invaluable tips from seasoned options traders:

- Embrace Implied Volatility: Comprehend the role of implied volatility in shaping extrinsic value and use it to your advantage.

- Manage Time Wisely: Consider the time decay of options and align your trading strategies accordingly.

- Monitor Market Sentiment: Stay abreast of market news and events that may impact volatility and, consequently, extrinsic value.

- Diversify Your Portfolio: Spread your risk by trading a range of options with varying time frames and underlying assets.

FAQ on Options Trading and Extrinsic Value

Q: Can extrinsic value ever exceed intrinsic value?

A: Yes, extrinsic value can surpass intrinsic value, especially for options with high implied volatility and distant expiration dates.

Q: How can I calculate extrinsic value?

A: Extrinsic value = Option premium – Intrinsic value

Q: What factors influence implied volatility?

A: Implied volatility is influenced by factors such as market news, economic data, and geopolitical events.

Options Trading Extrinsic Value

Image: www.tastytrade.com

Conclusion

Options trading presents a thrilling avenue for investors seeking to amplify profits and navigate market fluctuations. Extrinsic value, an ephemeral yet alluring component of option premiums, offers a gateway to unlocking this potential. By understanding the interplay between time value and volatility, and by employing the insights and advice shared above, you can harness extrinsic value and elevate your options trading prowess to new heights. Are you ready to embark on this captivating journey and unlock the full potential of extrinsic value? Join the ranks of savvy options traders and explore the boundless possibilities that lie ahead.