Introduction

In the realm of financial markets, option trading presents a challenging yet lucrative opportunity for investors seeking to maximize returns. To navigate this complex landscape effectively, keeping a meticulous trading journal is paramount. Excel spreadsheets, with their versatility and customization options, provide an ideal platform for creating trading journals that empower traders to track, analyze, and refine their strategies.

The Importance of Trading Journals

A trading journal serves as a written record of your option trades, documenting every decision and outcome. By meticulously capturing this information, you gain invaluable insights into your trading behavior, allowing you to identify patterns, assess risk appetite, and optimize performance.

Getting Started with Excel Trading Journals

1.

Choose a Template or Create Your Own:

Numerous pre-designed Excel templates are available online tailored to option trading. Alternatively, you can create your own journal by customizing a blank Excel file to suit your preferences.

-

Essential Columns to Include:

– Trade Date: Record the date of each trade execution.

– Expiration Date: Note the expiration date for each option contract.

– Asset: Indicate the underlying asset being traded (e.g., AAPL, SPY).

– Option Type: Specify the option type, whether call or put.

– Strike Price: Document the strike price of the option.

– Premium Paid: Record the premium amount paid to purchase the option.

– Quantity: Indicate the number of option contracts traded.

– Entry Price: Capture the price at which the option was purchased.

– Exit Price: If applicable, record the price at which the option was sold.

– Profit/Loss: Calculate and document the profit or loss realized. -

Additional Columns for Advanced Tracking:

– Thesis: Briefly describe the rationale behind the trade.

– Risk Management: Outline the risk management strategies employed.

– Technical Analysis: Note any technical indicators or chart patterns used.

– Market Conditions: Record relevant market conditions at the time of trade execution.

Benefits of Using Excel Trading Journals

1.

Comprehensive Data Tracking:

Excel allows you to capture a wide range of data, enabling a thorough analysis of your trading history.

-

Customization:

Excel’s flexibility empowers traders to customize their journals according to their unique trading style and needs.

-

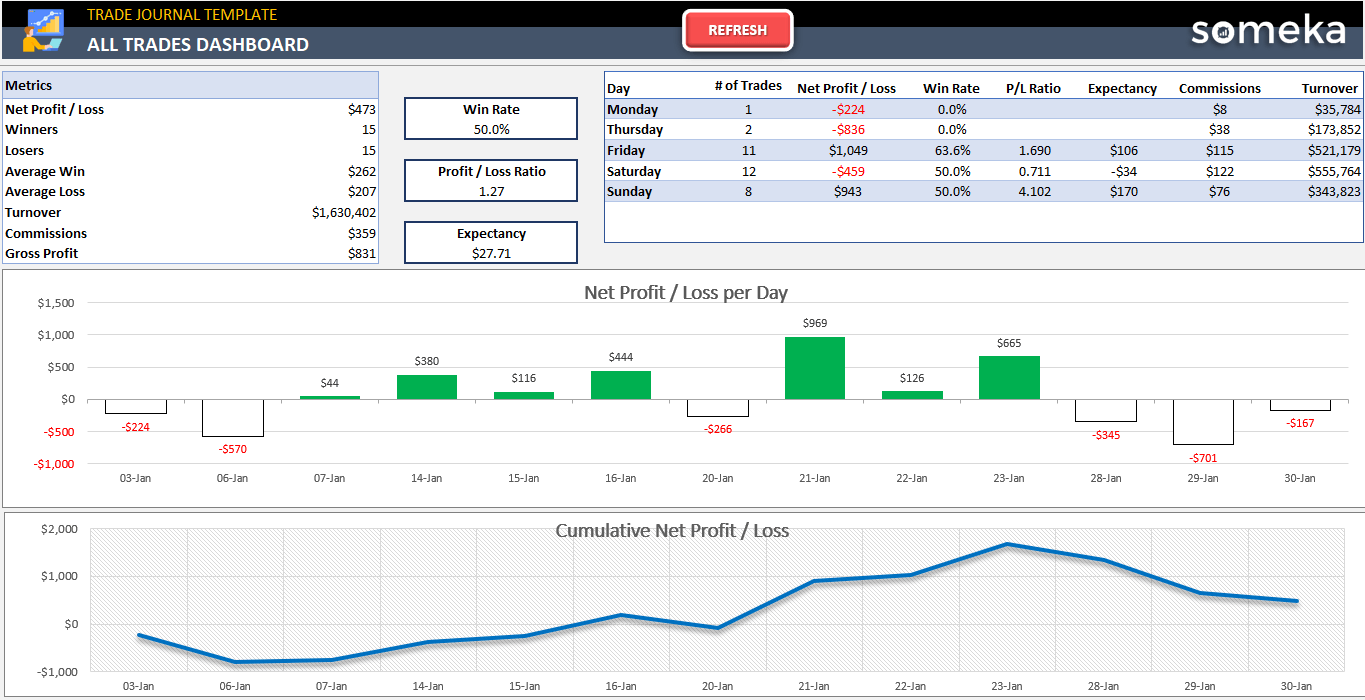

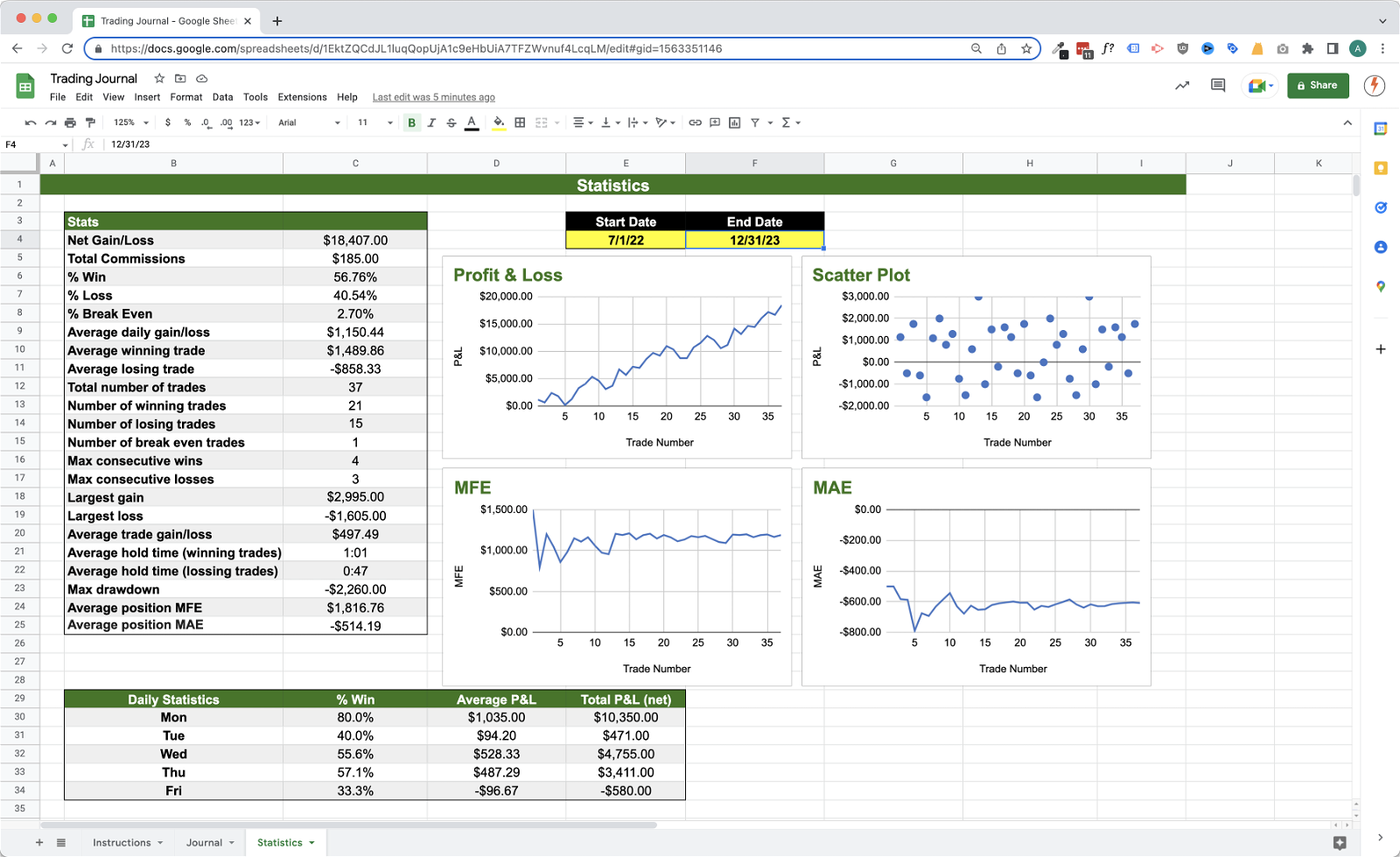

Visual Analysis:

With Excel’s charting capabilities, traders can visualize their trading performance, identifying trends and patterns more easily.

-

Historical Context:

Maintaining a historical record of trades provides valuable context for future decision-making and performance assessment.

Conclusion

Adopting an Excel trading journal is a transformative practice that empowers option traders to elevate their performance. By meticulously tracking trades, analyzing outcomes, and adapting strategies, they gain an unprecedented level of control over their trading journey, increasing their chances of long-term success in the dynamic financial markets.

Image: cashier.mijndomein.nl

Image: www.etsy.com

Trading Journals That Work In Excel For Option Trading

Image: www.jumpstarttrading.com