Introduction

Are you ready to dive into the fast-paced world of pocket option trading? This comprehensive guide will immerse you in the intricacies of this online trading sensation, equipping you with the knowledge and strategies to navigate its dynamic waters. Whether you’re a seasoned trader or just starting to explore the possibilities of pocket options, this guide will empower you to maximize your trading potential and reap the rewards that this market has to offer.

Image: www.pinterest.com

In the world of financial trading, pocket options stand out as a unique and accessible form of binary options trading. With pocket options, you’ll engage in short-term trades, predicting the up-or-down movement of an asset within a predetermined time frame. This rapid-fire approach offers traders the opportunity to profit from market fluctuations without the need for extensive research or complex trading strategies.

Key Concepts and Terminologies

Before delving into the intricacies of pocket option trading, it’s crucial to establish a solid foundation by understanding its key concepts and terminologies. Let’s begin by unraveling the essence of pocket options themselves.

Pocket Option:

A pocket option is a type of binary option that grants you the ability to speculate on the price movement of an underlying asset over a specific period. Unlike traditional binary options, pocket options offer greater flexibility, allowing you to trade in a matter of seconds or minutes, rather than being bound to expiration dates that can span days or weeks.

Expiration Time:

The expiration time of a pocket option represents the duration of the contract. This time frame is usually between 30 seconds to 5 minutes, although some platforms may offer extended expiration periods. Choosing the appropriate expiration time is crucial, as it directly influences your trading strategy and risk management.

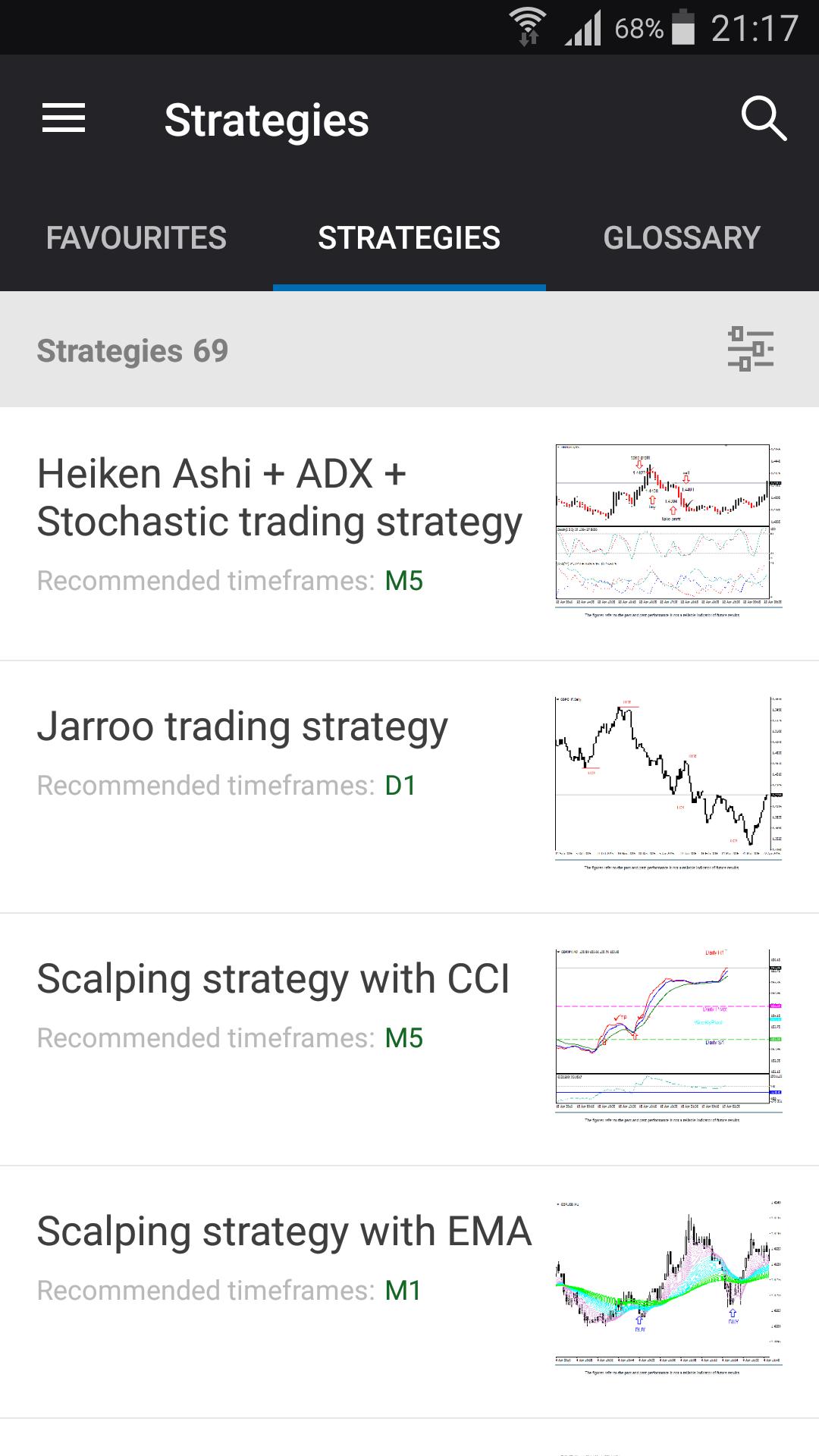

Image: apkpure.com

Asset:

In pocket option trading, you’ll encounter a diverse range of assets, including currency pairs (such as EUR/USD), commodities (such as gold or oil), indices (such as the S&P 500), and cryptocurrencies (such as Bitcoin). Selecting the right asset is key, as different assets exhibit unique price characteristics and volatility patterns.

Call and Put Options:

When trading pocket options, you’ll have the choice between two fundamental trade types: call options and put options. A call option conveys your prediction that the price of an asset will rise within the specified time frame, while a put option reflects your belief that the price will fall.

Understanding Market Analysis

Developing a solid understanding of market analysis is paramount if you’re serious about succeeding in pocket option trading. By studying market trends and patterns, you’ll have a more informed basis for making informed decisions about your trades.

Technical Analysis:

Technical analysis involves analyzing historical price data to identify market trends, patterns, and potential trading opportunities. Common technical indicators include moving averages, support and resistance levels, and candlestick patterns, each offering insights into the price behavior of an asset.

Fundamental Analysis:

Fundamental analysis focuses on evaluating the intrinsic value of an asset by examining economic and financial factors that influence its price. This may include economic data, financial statements, industry news, and geopolitical events. By understanding the fundamental drivers of price movements, you can make better-informed trading decisions.

Risk Management: A Vital Aspect

Managing risk is an indispensable aspect of pocket option trading, as it helps preserve your capital and protect your profits. Here are some essential risk management strategies:

Establishing Stop-Loss Levels:

A stop-loss order is a predefined level at which your trade will be automatically closed to limit potential losses. This ensures that you don’t lose more than you’re willing to risk on any given trade.

Setting Trade Sizes:

Managing trade size is critical, as it determines the amount of capital you’re arries on each trade. Never risk more than you can afford to lose, and adjust your trade size according to your trading strategy.

Diversifying Trades:

Diversifying your trades across different assets, expiration times, and trading strategies reduces your overall risk exposure. By not putting all your eggs in one basket, you minimize the impact of any adverse market movements.

Tips for Maximizing Success

While success in pocket option trading requires dedication and practice, there are specific tips that can enhance your chances of profitability.

Start with a Demo Account:

Before risking real capital, it’s highly recommended to practice trading with a demo account. This provides a risk-free environment where you can develop your trading skills and experiment with different strategies.

Develop a Trading Plan:

A well-defined trading plan is the backbone of successful trading. It outlines your trading strategy, risk management guidelines, and trading goals. By adhering to a plan, you’ll remain disciplined and focused, avoiding impulsive decisions.

Manage Emotions:

Emotions can cloud your judgment and lead to irrational trading decisions. Learn to control your emotions, and don’t let fear or greed influence your trades. Maintain a level head and base your decisions on objective analysis.

Pocket Option Trading Live

Conclusion

Navigating the dynamic world of pocket option trading requires a combination of knowledge, skill, and risk management. By embracing the concepts and strategies outlined in this guide, you’ll be well-equipped to embark on your trading journey and potentially reap the rewards that this fast-paced market has to offer. Remember, successful trading is a continuous process of learning, adaptation, and consistent self-improvement. By embracing this mindset, you’ll be on the path to unlocking your true trading potential.