In the realm of option trading, the strike price stands as a pivotal concept, commanding the utmost attention of discerning investors. It serves as the demarcation line that separates the options’ inherent value from extrinsic factors, bestowing upon them a unique characteristic that merits thorough comprehension.

Image: club.ino.com

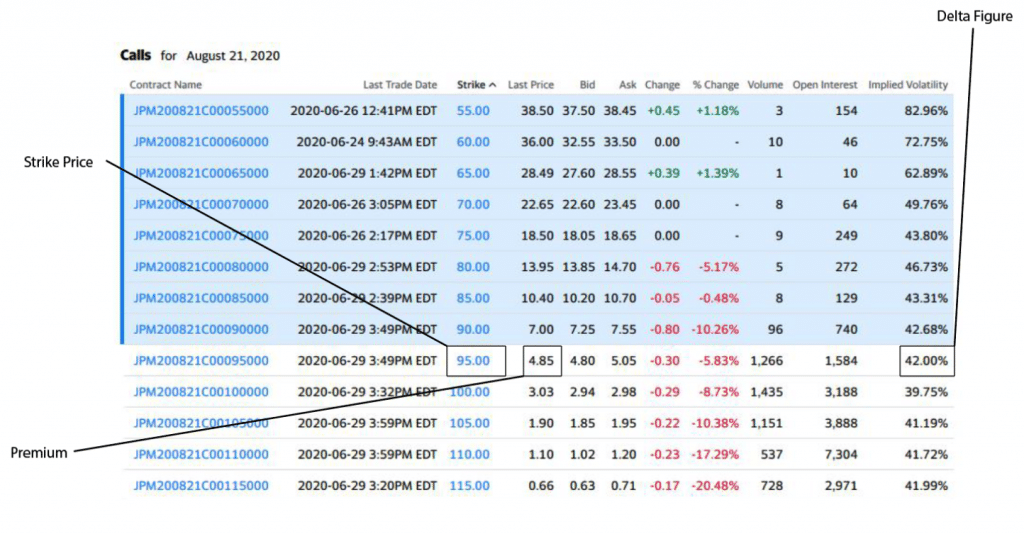

The strike price holds sway as the predetermined level at which an option contract grants the holder the privilege to exchange the underlying asset. For call options, it represents the price at which the investor can purchase the asset, while for put options, it symbolizes the price at which they can sell it.

Comprehending the nuances of strike price is akin to navigating a labyrinth of boundless possibilities. It unveils the spectrum of risk and reward associated with each option contract, empowering traders to make informed decisions aligned with their investment objectives.

Navigating the Strike Price Landscape

Investors embark on a perilous journey as they navigate the landscape of strike prices. A judicious choice can propel their options strategies to unprecedented heights, while an imprudent selection can lead to calamitous consequences.

Out-of-the-money options strike a prudent balance between risk and reward. Their strike prices deviate significantly from the current market price, minimizing the potential for immediate profitability, yet enticing investors with their lower premiums.

At-the-money options, on the other hand, take a bolder stance, pinning their strike price in close proximity to the prevailing market price. This proximity enhances their intrinsic value, translating into higher premiums, but also amplifying the potential risks.

In-the-money options exude an air of confidence, with strike prices comfortably positioned below (for call options) or above (for put options) the market price. They offer intrinsic value from the get-go, commanding higher premiums, yet their prospects for exponential returns may be tempered by their elevated cost.

A Tapestry of Applications

The strike price weaves its influence across a diverse tapestry of applications, extending far beyond its fundamental role in option pricing. Astute investors leverage it as a strategic tool, unlocking a treasure trove of trading opportunities.

Income-generating strategies, such as covered calls and secured puts, hinge upon the judicious selection of strike prices. These strategies harness the power of out-of-the-money options to generate a steady stream of income while maintaining a defensive posture in the face of market volatility.

Speculators, driven by an insatiable thirst for adrenaline, embrace the allure of in-the-money options and their potential for explosive returns. Directional trades, predicated on the anticipation of price movements, become a playground for these risk-tolerant individuals, who deploy strike prices to amplify their potential gains.

Hedgers, driven by a keen instinct for risk mitigation, turn to out-of-the-money options as their steadfast allies. Protective puts and defensive calls provide them with a safety net against unforeseen market downturns, safeguarding their precious portfolios from the vagaries of an ever-unpredictable market.

Striking the Right Chord

Mastering the art of strike price selection lies at the heart of successful option trading. It requires a discerning eye, a keen understanding of market dynamics, and an unwavering commitment to continuous learning.

Beginners are well-advised to tread cautiously, venturing into the realm of out-of-the-money options with their lower premiums and reduced risk profile. As they gain experience and confidence, they can gradually progress towards in-the-money and at-the-money options, embracing both the rewards and risks that come with them.

Seasoned traders often incorporate a tactical blend of strike prices into their strategies, diversifying their portfolios to mitigate risk and capitalize on a wider range of market conditions. From conservative to aggressive approaches, the strike price serves as their pliable instrument, shaping the destiny of their trades.

Image: tradingxplained.com

Option Trading Strike Price

Conclusion

The strike price, a seemingly innocuous component of option trading, reveals itself upon closer examination as a multifaceted concept that wields immense power over option contracts and their ultimate profitability. From the moment of its inception to its pivotal role in various trading strategies, it presents a symphony of opportunities and challenges for discerning investors.

As you embark on your option trading journey, may this comprehensive exploration of the strike price serve as your guiding beacon, illuminating your path towards informed decision-making and the fulfillment of your financial aspirations.