Have you ever wondered what it would be like to trade stock options like a Wall Street pro but without the associated risks? Paper trading provides a unique opportunity to do just that. By utilizing this simulated trading platform, you can gain invaluable hands-on experience without exposing your hard-earned money to market fluctuations.

Image: tradeschooltuitionrurichibo.blogspot.com

Paper trading simulates the real-life trading environment, allowing you to execute trades using virtual funds. This risk-free approach enables you to practice various strategies, test your knowledge, and refine your skills before venturing into the actual market. Whether you are a complete novice or an experienced trader looking to enhance your expertise, paper trading stock options offers several compelling advantages.

Understanding Stock Options

Before delving into the nuances of paper trading stock options, it is crucial to comprehend the basics of this financial instrument. Stock options are derivative contracts that confer the right, not the obligation, to buy or sell a certain number of shares of an underlying stock at a specified price within a particular timeframe. Call options allow you to buy the stock, while put options afford you the opportunity to sell it.

When trading stock options, two key factors to consider are the strike price, which is the predetermined price at which you can buy or sell the stock, and the expiration date, which sets the limit for exercising the option.

How Paper Trading Stock Options Works

Paper trading platforms provide virtual funds that simulate a real trading account. You can use these virtual funds to trade stock options just as you would in an actual brokerage account. The platform will track your trades, including your entry and exit points, profit and loss, and overall performance. However, unlike real-time trading, your virtual funds are not subject to market risks, and your profits or losses are not actualized. This risk-free environment allows you to experiment and learn without fear of losing capital.

Paper trading platforms often provide comprehensive tools and resources to facilitate your learning. You can access real-time market data, historical charts, and analysis tools to enhance your decision-making process. Some platforms even offer educational materials and webinars to help you further your understanding.

Benefits of Paper Trading Stock Options

Engaging in paper trading stock options offers numerous benefits that can significantly accelerate your trading journey.

- Risk-Free Environment: Paper trading eliminates the financial risks associated with real trading, empowering you to try different strategies and make mistakes without fearing monetary losses.

- Practical Learning: Paper trading provides hands-on experience that cannot be obtained solely through theoretical knowledge. You can implement your understanding in simulated trades and observe the consequences in real-time.

- Refine Trading Strategies: Paper trading allows you to test and refine your trading strategies without committing to actual market orders. You can experiment with various strike prices, expiration dates, and market conditions to identify tactics that align with your risk tolerance and investment objectives.

- Enhance Decision-Making: By simulating the real-world trading environment, paper trading stock options helps you make more sound decisions. You can incorporate technical and fundamental analysis to evaluate market conditions and identify opportunities.

- Build Confidence: Accumulating successful trades in a paper trading environment can significantly boost your confidence as a trader. It allows you to develop a winning mindset and overcome the fear of making real trades.

Image: equlogosat.web.fc2.com

Conclusion

Paper trading stock options is an invaluable tool for aspiring and experienced traders alike. It provides a risk-free environment to hone your skills, test strategies, and gain practical knowledge before venturing into the actual market. By harnessing the benefits of paper trading, you can significantly increase your chances of success when trading stock options for real. Embrace the opportunity to learn and practice without monetary risks and embark on your trading journey with confidence and preparedness.

Navigating the Nuances of Paper Trading Stock Options: A Comprehensive Guide

Paper trading stock options presents a unique opportunity to foray into the world of options trading without risking capital. However, embarking on this simulated trading journey requires a thorough understanding of its nuances to maximize its benefits.

In this comprehensive guide, we will delve into the fundamentals of paper trading stock options, exploring its intricacies and providing practical tips to enhance your experience and maximize your learning potential.

Choosing a Paper Trading Platform

Selecting the right paper trading platform is crucial to ensure a seamless and comprehensive learning experience. Consider the following factors when choosing a platform:

- Variety of Assets: Opt for a platform that offers a diverse range of stock options to trade, ensuring that you can practice with different underlying stocks.

- Real-Time Market Data: Choose a platform that provides real-time market data to simulate the actual trading environment and enable accurate decision-making.

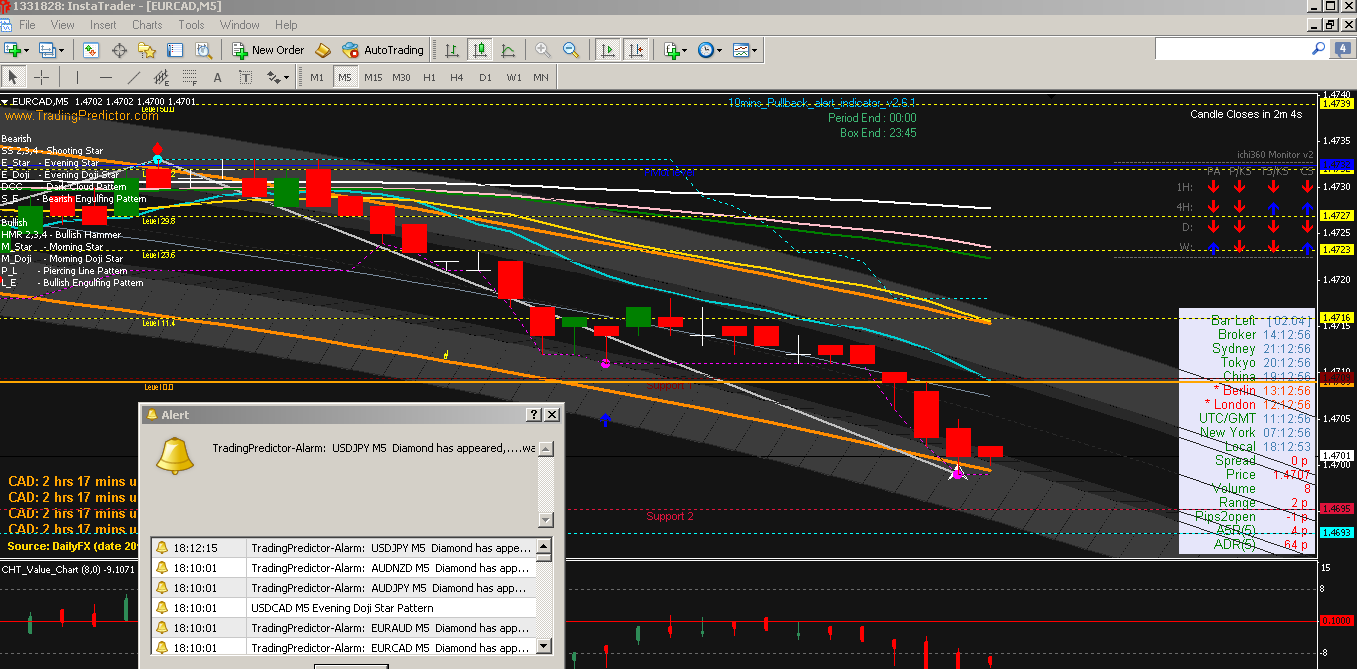

- Trading Tools: Assess the platform’s trading tools, such as charting capabilities, technical indicators, and order types. These tools can enhance your analysis and execution capabilities.

- User Interface: The user interface should be intuitive and user-friendly, enabling you to navigate the platform efficiently and focus on trading.

- Educational Resources: Consider platforms that provide educational resources, such as articles, webinars, and tutorials, to support your learning process.

Developing a Trading Plan

Before actively trading stock options, it is essential to establish a comprehensive trading plan that outlines your trading strategy and risk management guidelines. This plan should define:

- Trading Strategy: Determine the specific options trading strategies you will employ, such as call or put options, covered calls, or straddles.

- Risk Tolerance: Establish your risk tolerance level and adhere to it strictly to prevent excessive losses.

- Trade Management: Outline your rules for entering and exiting trades, including entry and exit points, profit targets, and stop-loss levels.

- Performance Tracking: Set up a system to track your trades and monitor your performance, identifying areas for improvement.

Executing Trades and Managing Risk

When executing trades, focus on maintaining discipline and adhering to your trading plan. Remember these key principles:

- Proper Position Sizing: Determine the appropriate position size for each trade based on your risk tolerance and account size.

- Market Analysis: Conduct thorough market analysis to assess market trends, company fundamentals, and technical indicators before making trading decisions.

- Risk Management: Employ risk management techniques, such as stop-loss orders and position limits, to mitigate potential losses.

- Emotional Control: Avoid impulsive trading and emotional decision-making. Stick to your trading plan and manage your emotions effectively.

Continuous Learning and Refinement

Paper trading is an ongoing learning process. Continuously refine your knowledge and skills by:

- Studying Market Dynamics: Monitor market news, economic data, and industry trends to stay abreast of market movements.

- Testing New Strategies: Experiment with different options trading strategies in simulated trades to identify approaches that align with your objectives.

- Seeking Feedback: Share your trading experiences with fellow traders or mentors to gain valuable insights and improve your decision-making process.

- Adapting to Market Changes: The market environment is constantly evolving. Regularly assess your trading plan and strategies and make adjustments to adapt to changing market conditions.

Transitioning to Live Trading

Once you have gained proficiency in paper trading stock options and achieved consistent results, you can consider transitioning to live trading. Remember these key considerations:

- Capital Management: Determine the amount of capital you are willing to risk and strictly adhere to it.

- Real Market Impact: Understand that actual trading involves real money, and emotions can run high. Maintain discipline and manage your emotions.

- Market Volatility: Be prepared for market volatility and unexpected events. Adjust your trading strategies and risk management techniques accordingly.

- Ongoing Education: Continue educating yourself about the market and options trading strategies to adapt to changing conditions.

Mastering Stock Option Trading: Strategies for Success

Stock option trading offers substantial profit potential, but it also entails a significant degree of risk. To achieve consistent success in this field, traders must employ well-defined strategies and exercise sound risk management practices.

In this comprehensive guide, we will delve into the realm of stock option trading, exploring proven strategies and insightful tips to enhance your trading acumen and maximize your profit-making opportunities.

Paper Trading Stock Options

Understanding the Basics of Stock Options

Before exploring strategies, let us recap the basics of stock options:

- Calls: Grant the buyer the right to buy an underlying stock at a specified price (strike price) on or before a certain date (expiration date).

- Puts: Grant the buyer the right to sell