Have you ever watched the stock market surge with excitement, only to see it plummet the next day? The roller coaster ride of financial markets can be both exhilarating and daunting. But what if I told you there’s a powerful tool at your disposal, a way to potentially profit even amidst market fluctuations? Enter the world of options trading, a realm where savvy investors can leverage their insights and shape their financial destiny. And with E*TRADE at your side, this journey becomes a whole lot smoother.

Image: thebrownreport.com

Options trading, quite simply, presents a unique opportunity to gain exposure to an underlying asset – be it stocks, ETFs, or even indexes – without actually owning it. It’s like holding a special ticket that grants you the right but not the obligation to buy or sell the asset at a predetermined price, within a specific timeframe. Imagine the possibilities: you could ride the wave of a rising stock’s price, hedge against potential losses in your existing portfolio, or even generate income through strategic selling. But remember, before you dive headfirst into this exciting world, it’s vital to understand the intricacies and potential risks. E*TRADE, with its intuitive platform and wealth of educational resources, can be your trusted guide, empowering you to make informed decisions and navigate the options trading landscape with confidence.

Your Options Trading Journey Begins with E*TRADE

Before we embark on this exploration, let’s address the elephant in the room: options trading isn’t for the faint of heart. It requires a deep understanding of financial markets, risk management strategies, and a willingness to embrace volatility. But hold on, because E*TRADE offers a welcoming and informative environment, making this seemingly complex world surprisingly accessible.

*Unveiling the ETRADE Platform:**

E*TRADE’s user-friendly platform is designed to cater to both seasoned traders and newcomers alike. Its intuitive interface boasts a plethora of tools and features specifically tailored for options trading:

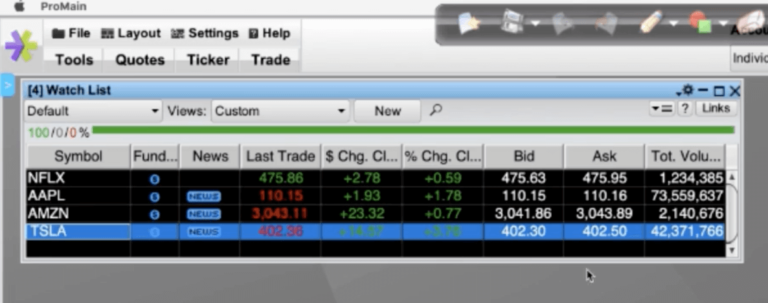

- Real-Time Quotes and Charts: Stay ahead of the curve with real-time market data, allowing you to track price movements and identify potential opportunities.

- Advanced Options Analysis: E*TRADE provides sophisticated analysis tools, empowering you to delve deeper into options contracts, pricing models, and potential payoffs.

- Interactive Tutorials and Courses: E*TRADE’s educational resources are a treasure trove of knowledge, covering everything from basic options concepts to advanced strategies. You can learn at your own pace, starting with the fundamentals and gradually deepening your understanding.

- Paper Trading: Before putting real money at risk, E*TRADE’s paper trading environment gives you the chance to practice your skills and test different strategies in a risk-free setting. This allows you to develop your trading acumen and refine your approach before venturing into the real market.

Navigating the World of Options:

Understanding the different options strategies is crucial before engaging in actual trading. Here’s a simplified breakdown:

- Call Options: Essentially, a call option gives you the right to buy an underlying asset at a specified price (strike price) within a certain timeframe. Imagine a scenario where you believe a stock will rise in value. Buying a call option allows you to potentially profit from this upward price movement, even if you don’t own the stock directly.

- Put Options: On the flip side, a put option grants you the right to sell an underlying asset at a specific price within a predefined time period. Imagine being concerned about a potential market downturn. Buying a put option could serve as a safety net, offering protection against potential losses in your portfolio.

- Covered Calls: This strategy involves selling call options while simultaneously holding the underlying asset. By doing so, you can potentially generate income, but this also limits your potential upside gains if the asset’s price rises significantly.

- Cash-Secured Puts: This involves selling a put option, with the intention of selling the underlying asset if the price falls below the strike price. This can potentially generate income, but if the price drops drastically, you might end up obligated to buy the asset at a lower price than the current market rate.

- Straddles and Strangles: These are more complex options strategies involving multiple options contracts (both calls and puts). They can provide leverage and potential for higher profits, but they also expose you to greater risk.

*Building a Solid Foundation with ETRADE:**

E*TRADE doesn’t just provide the tools and platforms; it equips you with the knowledge and confidence to navigate this world. Their dedicated educational resources, ranging from video tutorials to interactive guides, are designed to demystify options trading, empowering you to make informed decisions.

- Options Trading Basics: Start with the fundamentals, learning about call and put options, their individual characteristics, and how they interact with each other.

- Understanding Options Contracts: Understand the essential components of an options contract, including the strike price, expiration date, premium, and how they influence its value.

- Option Pricing Models: Dive into the world of Black-Scholes and binomial models – the tools used to calculate the theoretical value of options contracts.

- Risk Management Strategies: Learn about different risk management techniques to protect your investments and navigate the inherent volatility associated with options trading.

Expert Opinions and Best Practices: Unlocking Options Trading Success

Options trading, while potentially lucrative, requires a strong understanding of risk management and a disciplined approach. Here are some key insights from seasoned traders:

- Start Small and Focus: Begin with a small investment and focus on a single strategy, mastering it before venturing into more complex setups.

- Define Your Risk Tolerance: Before you start trading, determine your risk tolerance and limit your potential losses.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your portfolio across different options strategies and underlying assets.

- Stay Informed: Keep up-to-date on market trends, economic news, and events that could impact the underlying assets you’re trading.

- Monitor Your Positions: Regularly check your positions, monitor performance, and make adjustments as needed.

Image: www.stockbrokers.com

Options Trading Etrade

Harnessing the Power of Options Trading with E*TRADE

By equipping yourself with the right knowledge and utilizing the resources available through E*TRADE, you can navigate the exciting world of options trading with confidence and clarity. Remember, it’s about making informed decisions, managing risk effectively, and harnessing this dynamic market to your advantage.

Embrace the journey, explore the endless possibilities, and unlock the potential of options trading with E*TRADE as your trusted partner.