Introduction

In the dynamic world of options trading, meticulous record-keeping is paramount to success. An options trading log spreadsheet emerges as an indispensable tool, providing traders with a comprehensive and organized repository to track their trades and analyze their performance. Delve into this comprehensive guide to master the art of creating and utilizing an options trading log spreadsheet, unlocking its potential to enhance your trading strategies and maximize your profits.

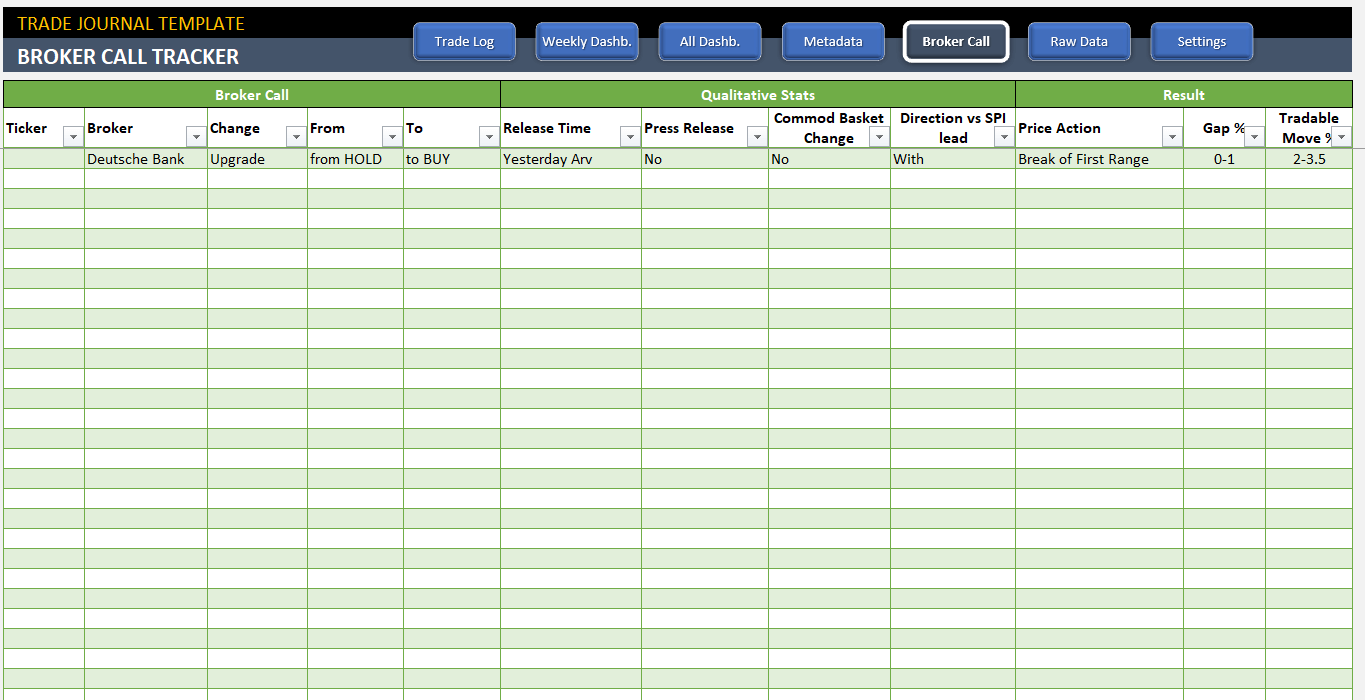

Image: www.simitome.co

What is an Options Trading Log Spreadsheet?

An options trading log spreadsheet is a digital record that documents all aspects of your options trades. From the initial trade details to the final settlement, this spreadsheet captures critical information that facilitates in-depth analysis and performance evaluation. Maintaining an up-to-date log is essential for traders seeking to refine their strategies, manage risk effectively, and identify areas for improvement.

Benefits of Using an Options Trading Log Spreadsheet

-

Trade Tracking: Accurately record every trade, including the underlying asset, strike price, expiration date, and trade type (buy or sell). This detailed recording provides a comprehensive overview of your trading activity, enabling you to track your progress and identify potential patterns.

-

Performance Analysis: Evaluate your trading performance by analyzing key metrics such as profit/loss, win rate, and average return. By identifying winning and losing trades, you can pinpoint areas for improvement and optimize your strategies.

-

Risk Management: Monitor your risk exposure by tracking your positions and calculating your delta and theta sensitivities. This information allows you to adjust your trades proactively, minimizing potential losses.

-

Tax Reporting: Maintain an organized record for tax reporting purposes, ensuring accuracy and compliance. The log spreadsheet provides a complete history of your trades, making tax preparation seamless.

-

Learning and Improvement: Use the log spreadsheet as a valuable learning tool. Review your past trades to identify areas for improvement, adjust your strategies, and refine your trading plan continuously.

How to Create an Effective Options Trading Log Spreadsheet

-

Choose a Spreadsheet Software: Select a spreadsheet software that meets your specific needs. Consider features such as data entry, formulas, and charting capabilities.

-

Define Column Headers: Determine the essential data points to track for your options trades. Common headers include Trade Date, Symbol, Strike Price, Expiration Date, Trade Type, Entry Price, Exit Price, Profit/Loss, and Notes.

-

Customize the Spreadsheet: Tailor the spreadsheet to your trading style by including additional columns or sections for specific strategies or analysis techniques.

-

Use Formulas: Leverage formulas to automate calculations and enhance efficiency. For instance, create formulas to calculate profit/loss, annualized return, and delta exposure.

-

Regular Maintenance: Maintain your log spreadsheet diligently by updating it after each trade and periodically reviewing your performance. Regular maintenance ensures accurate and comprehensive data for analysis.

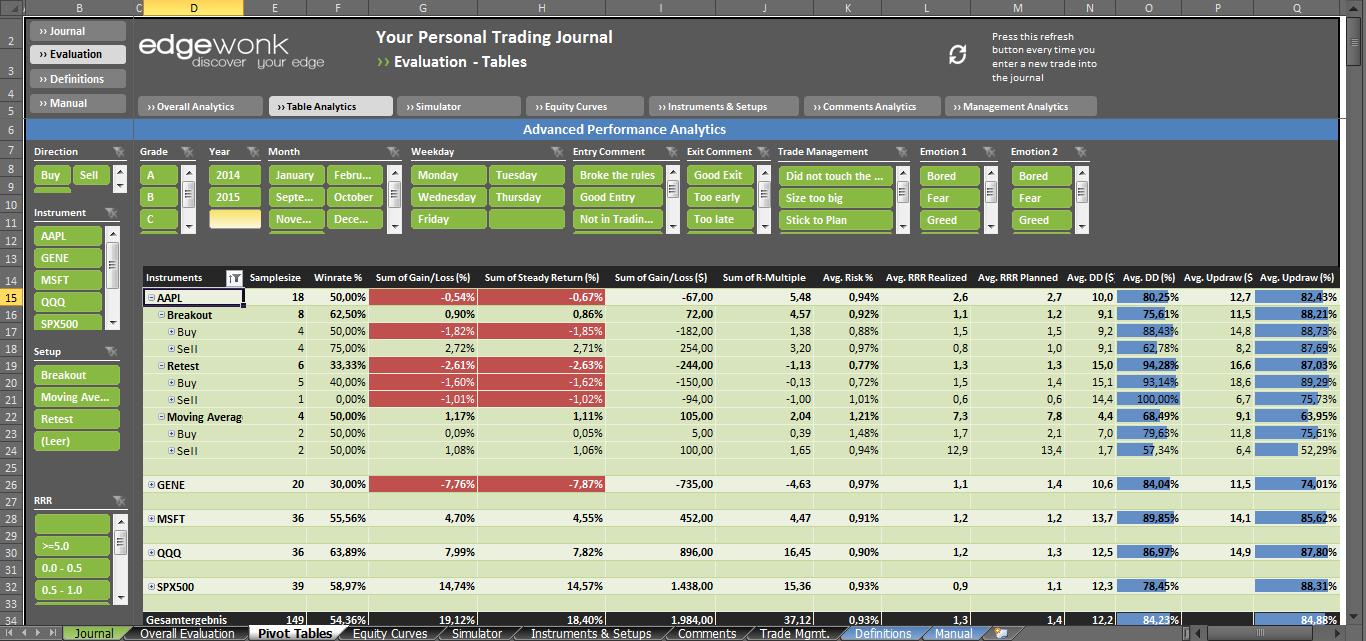

Image: db-excel.com

Advanced Features of Options Trading Log Spreadsheets

-

Position Calculator: Use the spreadsheet to monitor your open positions, including long and short options, and calculate the delta and theta sensitivities in real-time.

-

Risk Analysis Tools: Incorporate risk analysis tools into your spreadsheet to assess your overall portfolio risk, identify potential losses, and make informed trading decisions.

-

Option Greeks Calculator: Integrate a built-in Greek calculator to analyze option Greeks such as delta, gamma, theta, vega, and rho. This information empowers you to gauge the impact of market movements on your positions.

-

Charts and Graphs: Visualize your trading data using charts and graphs. Track profit/loss over time, analyze win rates, and identify trading patterns with ease.

-

Historical Data Import: Import historical option prices into your spreadsheet to backtest strategies, analyze volatility, and optimize your trading decisions based on past data.

Options Trading Log Spreadsheet

Conclusion

An options trading log spreadsheet is an indispensable tool that provides traders with an organized and comprehensive view of their trading activity. By meticulousl