Unveiling the Art of Emulating Top-Notch Traders

In the ever-evolving financial landscape, copy trading has emerged as a compelling strategy, particularly for options trading. Options copy trading empowers aspiring traders to mirror the trades of experienced professionals, gaining access to their knowledge and expertise without extensive knowledge or trading skills. In this article, we will delve into the intricate nuances of options copy trading, exploring its historical roots, contemporary practices, and the benefits it offers to traders seeking financial success.

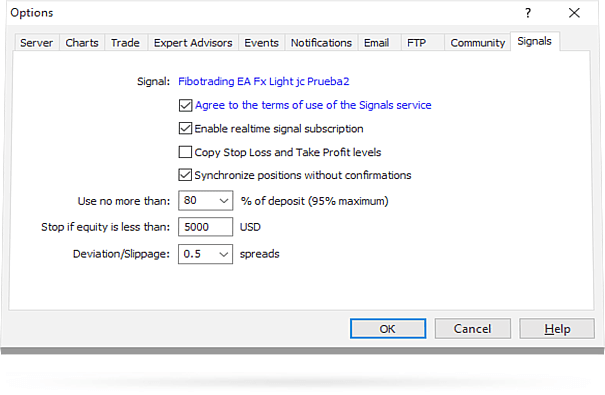

Image: www.metatrader5.com

Exploring Options Trading and Its Dynamic Landscape

Options trading involves agreements between parties that confer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. This complex yet rewarding trading strategy requires in-depth market understanding and risk management skills, making it an ideal arena for copy trading. By observing and replicating the trades of skilled traders, aspiring individuals can accelerate their learning curve and potentially reap significant profits.

Deciphering the History and Evolution of Copy Trading

Copy trading is a recent fintech innovation that gained prominence in the mid-2010s with the emergence of online trading platforms. Prior to this digital revolution, aspiring traders had limited opportunities to access the strategies employed by experienced professionals. Copy trading leveled the playing field, granting traders of all levels the ability to emulate the trades of top performers, regardless of their financial stature or knowledge.

Unveiling the Benefits of Options Copy Trading

Options copy trading offers a plethora of advantages for both novice and experienced traders alike:

- Simplified learning: Mimicking the trades of experienced traders provides a valuable learning experience, expediting the process of acquiring market insights and trading strategies.

- Access to Expertise: Traders can gain exposure to the strategies and techniques of top-notch professionals, broadening their knowledge base and improving their decision-making abilities.

- Risk Management: By emulating the trades of experienced traders, traders can leverage their risk management expertise, potentially reducing financial losses and maximizing returns.

- Increased Efficiency: Copy trading automates the trade execution process, saving traders time and allowing them to focus on other aspects of their trading endeavors.

- Transparency and Trust: Reputable copy trading platforms offer transparent performance records of signal providers, empowering traders to make informed decisions and build trust over time.

Image: issuu.com

Navigating the Tips and Expert Advice for Options Copy Trading

To optimize your options copy trading experience, consider the following tips and expert advice:

- Choose the Right Signal Provider: Conduct thorough research to identify signal providers with proven track records, reputable platforms, and alignment with your trading objectives and risk tolerance.

- Start Small and Gradually Increase: Begin with small investments to manage risk and gradually increase your investment size as you gain confidence and experience.

- Diversify Your Trades: Emulate the trades of multiple signal providers with varying strategies to spread your risk and capture potential opportunities in diverse market conditions.

- Practice Risk Management: Implement robust risk management strategies, such as stop-loss orders and position sizing, to protect your portfolio from adverse market fluctuations.

- Monitor and Re-evaluate Regularly: Continuously review your copy trading performance and make adjustments as needed to optimize your portfolio and align it with your overarching trading goals.

Frequently Asked Questions (FAQ)

Q: Is options copy trading a viable strategy for beginners?

A: Options copy trading can be suitable for both novice and experienced traders. Beginners can leverage it to enhance their learning curve and accelerate knowledge acquisition.

Q: How much capital do I need to start options copy trading?

A: The required capital depends on the signal provider you choose and your desired investment size. It’s advisable to start with a small amount and gradually increase your investment as you gain experience.

Q: What are the risks associated with options copy trading?

A: Options copy trading carries the same risks inherent in options trading, such as market volatility, time decay, and the potential for losses. It’s crucial to implement risk management strategies and invest within your tolerance levels.

Options Copy Trading

Conclusion

Options copy trading is a transformative strategy that has democratized access to financial expertise and enhanced the profitability potential for traders of all experience levels. By following the tips and expert advice outlined above, you can navigate the options copy trading landscape with confidence and unlock the path to financial success.

We invite you to explore the world of options copy trading further and embark on a journey of financial growth. Whether you’re a seasoned trader seeking to refine your skills or a novice eager to delve into the exciting realm of trading, options copy trading offers an exceptional opportunity to learn, grow, and achieve your financial objectives.