In the dynamic realm of options trading, open interest holds a pivotal position, offering valuable insights into market sentiment and potential trading opportunities. Comprehending its significance can empower traders to make informed decisions and navigate this complex financial landscape with greater confidence. This article delves into the intricate world of open interest, unraveling its components, exploring its implications, and showcasing its practical applicability in options trading.

Image: www.mohitjakhotiablogspot.com

Delving into Open Interest: The Anatomy of Market Position

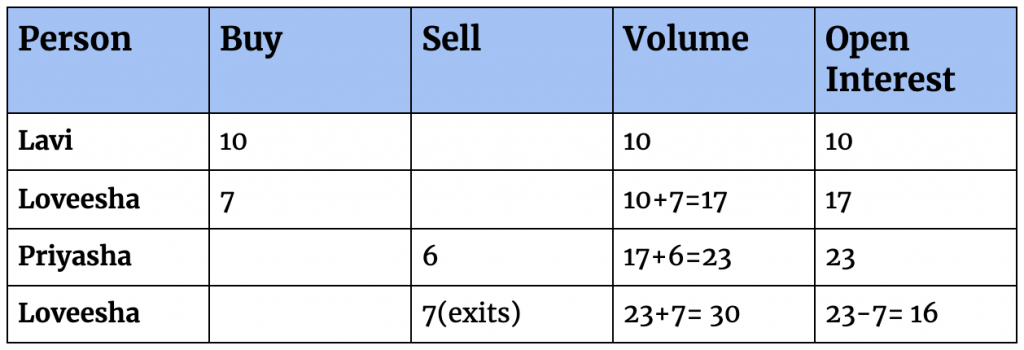

Open interest represents the total number of outstanding contratos de opciones at a given point in time. These contracts have been initiated but not yet exercised, closed, or expired. It serves as a real-time snapshot of the current market position for a particular option, indicating the degree of involvement and speculative bets placed by market participants. Open interest can be categorized into long and short positions, reflecting the market’s overall sentiment towards a specific underlying asset.

Significance of Open Interest: Gleaning Market Sentiments

Open interest plays a crucial role in gauging market sentiment and predicting future price movements. A high level of open interest suggests that a substantial number of traders are actively involved in the market, which can lead to increased volatility and decreased liquidity. Conversely, low open interest indicates a lack of market interest and reduced market participation, potentially signifying potential price consolidation or a shift in trend.

Devising Trading Strategies: Leveraging Market Insights

Open interest is a valuable tool for traders to formulate effective trading strategies. By closely monitoring open interest over time, traders can identify potential market turning points, anticipate price movements, and adjust their positions accordingly. For instance, a sudden surge in open interest often precedes a breakout or reversal in the underlying asset’s price.

Image: www.financestrategists.com

Tracking Historical Trends: Uncovering Market Patterns

Historical open interest data provides traders with a roadmap of past market behavior and sentiment. By studying how open interest has fluctuated over time, traders can identify recurring patterns and establish a better understanding of market cycles. This historical analysis aids in making informed decisions about entry and exit points, increasing the probability of successful trades.

Utilizing Sentiment Analysis: Gauging Collective Market Opinion

Open interest, in conjunction with other market indicators like volume and implied volatility, offers a comprehensive view of market sentiment. When all these elements align, it strengthens the reliability of trading signals and enhances risk management strategies. By combining open interest analysis with sentiment analysis, traders can align their positions with the prevailing market consensus, boosting their overall trading performance.

Define Open Interest Options Trading

Image: www.adigitalblogger.com

The Bottom Line: Harnessing Knowledge for Trading Success

A thorough understanding of open interest is a cornerstone of successful options trading. It empowers traders to interpret market sentiment, forecast price movements, and execute strategic trades. By leveraging the insights gained from open interest analysis, traders can make informed decisions, maximize profit potential, and mitigate risks in this ever-evolving financial arena.