Have you ever dreamt of amplifying your investment returns, or perhaps hedging your portfolio against potential market downturns? If so, the world of options trading might just be your ticket to achieving these goals. But before diving into the exciting realm of options, it’s crucial to understand the role of option trading brokers, the key players who provide the platform and tools you need to navigate this dynamic market.

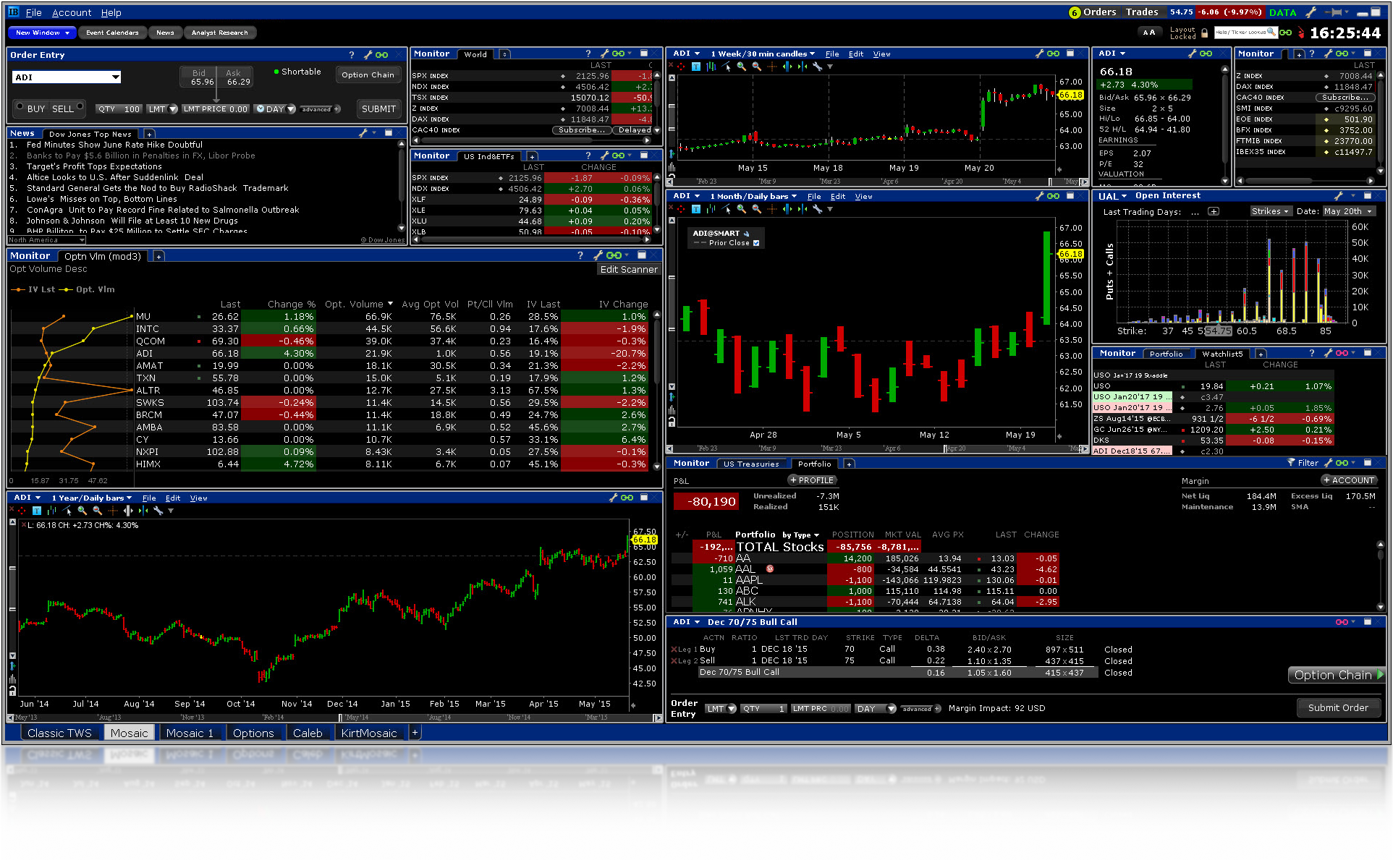

Image: www.interactivebrokers.ca

This guide is your comprehensive journey into the world of option trading brokers, covering everything from the basics of option trading to choosing the right broker, and everything in between. We’ll delve into the different types of brokers, their features, pricing strategies, and even the regulatory framework that governs them. By the end of this article, you’ll have the knowledge and understanding to make informed decisions about your option trading journey.

Understanding the Fundamentals of Option Trading

Before we dive into the world of brokers, let’s establish a foundational understanding of what options are and why they’re so popular.

What are Options?

Options are financial contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (the strike price) on or before a specific date (the expiration date). By purchasing an option, you’re essentially purchasing the right to profit from potential price fluctuations in the underlying asset.

Types of Options

There are two primary types of options:

- Call options: Give the holder the right to buy the underlying asset at the strike price.

- Put options: Give the holder the right to sell the underlying asset at the strike price.

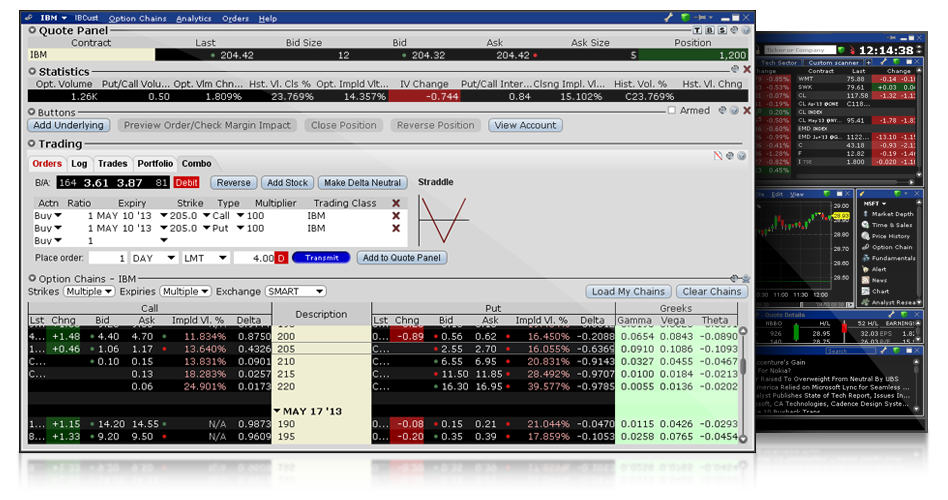

Image: www.interactivebrokers.com.hk

Why Trade Options?

Traders choose options for a variety of reasons:

- Leverage: Options offer the potential for high returns with a relatively low investment, as a small price change in the underlying asset can generate significant profits.

- Limited risk: Unlike buying or selling the underlying asset outright, option contracts have a limited risk as the maximum loss is generally the premium paid.

- Flexibility: Options provide flexibility in managing risk, enabling traders to customize strategies according to their individual needs and market outlook.

The Role of Options Trading Brokers

Option trading brokers act as the intermediaries between traders and the exchanges where options contracts are traded. They provide the platform, tools, and resources that allow individuals to buy and sell options. But how do you find the right broker for your specific needs?

Selecting the Right Option Trading Broker: Key Considerations

Choosing an option trading broker is a crucial step for any aspiring options trader. Here are some key factors to consider:

1. Trading Platform

- User-friendliness: The trading platform should be intuitive and easy to navigate for both novice and experienced traders.

- Real-time data: Access to accurate and real-time market information is essential for making informed decisions.

- Order types: A wide range of order types allows for greater precision in executing trades and managing risks.

- Charting tools: Robust charting capabilities are essential for analyzing market trends and identifying potential trading opportunities.

- Mobile accessibility: The ability to trade options on the go via a mobile app can greatly enhance convenience and responsiveness.

2. Fees and Pricing

- Commission fees: Some brokers charge per-trade commissions, while others offer commission-free trading.

- Contract fees: These are fees associated with each option contract traded.

- Data fees: Some brokers may charge additional fees for access to real-time market data.

- Inactivity fees: Some brokers charge fees if your account remains inactive for an extended period.

3. Account Minimums and Margin Requirements

- Account minimums: Some brokers require a minimum deposit to open an account, while others have no minimum.

- Margin requirements: This refers to the amount of capital you need to maintain in your account to cover potential losses. Margin requirements can vary widely between brokers.

4. Security and Regulation

- Security: Ensure the broker utilizes industry-standard security measures to protect your financial information.

- Regulation: Look for brokers that are regulated by reputable authorities, such as the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA).

5. Trading Education and Resources

- Educational resources: A reputable broker will offer a variety of educational resources, such as tutorials, articles, and webinars, to help traders learn about options trading.

- Customer support: Ensure the broker provides responsive customer support channels such as phone, email, and live chat.

Popular Option Trading Brokers: A Comparative Analysis

Now that we’ve outlined the key considerations, let’s explore some of the leading option trading brokers in the market and compare their features and offerings.

1. Interactive Brokers

Interactive Brokers is a well-established broker known for its advanced trading platform, extensive global market access, and low commissions. Their platform caters to both experienced and novice traders, offering a wide range of order types and tools.

-

Pros:

- Advanced trading platform

- Extensive global market access

- Low commissions

- Robust research and educational resources

-

Cons:

- Can be overwhelming for novice traders

- High account minimums

2. Tastyworks

Tastyworks is a popular choice among options traders, known for its user-friendly platform and educational resources focused on options trading. It offers a unique and visually appealing platform with powerful analysis tools.

-

Pros:

- User-friendly platform

- Focus on options education

- Affordable commissions

- Excellent customer support

-

Cons:

- Limited global market access

- Fewer research tools compared to Interactive Brokers

3. TD Ameritrade

TD Ameritrade is a well-known broker that offers a comprehensive range of brokerage services, including options trading. Its platform, thinkorswim, is highly regarded for its powerful charting tools and advanced analysis capabilities.

-

Pros:

- Powerful trading platform (thinkorswim)

- Extensive research and educational resources

- Wide range of account types

- Excellent customer support

-

Cons:

- Higher commissions on options trades compared to some competitors

- Some features require a higher account balance

4. Fidelity

Fidelity is a well-respected brokerage firm that provides a user-friendly trading platform and a wide range of investment products including options. Their platform offers straightforward features and tools for both beginner and experienced traders.

-

Pros:

- User-friendly platform

- Low commissions

- Extensive investment options

- Strong financial security

-

Cons:

- Limited research tools compared to some competitors

- Fewer advanced features for experienced traders

The Latest Trends in Option Trading Brokerage

The options trading brokerage landscape is constantly evolving, with new technologies and features emerging all the time. Here are some of the latest trends:

- Commission-free trading: The rise of commission-free brokers has driven down trading costs in recent years.

- Mobile trading apps: Brokers are increasingly investing in sophisticated mobile trading apps to provide traders with 24/7 access to markets.

- Artificial intelligence (AI): AI is playing a growing role in options trading, helping traders to identify opportunities, manage risks, and optimize investment strategies.

- Social trading: Brokers are incorporating social elements into their platforms, allowing traders to connect, share ideas, and learn from one another.

Navigating the Risks and Rewards

It’s important to recognize that options trading involves inherent risks. The potential for profit is accompanied by the potential for significant losses. Here are some things to keep in mind:

- Market volatility: Options prices can fluctuate rapidly in response to market events, making it difficult to predict outcomes.

- Time decay: The value of options contracts can diminish as they approach their expiration date.

- Limited risk versus limited reward: While option contracts have a limited potential for loss, they also have limited potential for gain.

However, despite these risks, options trading can be a powerful tool for generating returns and managing risk. By choosing the right broker, taking a proactive approach to learning, and managing your risk effectively, you can increase your chances of success.

Option Trading Broker

Conclusion

Option trading brokers play a crucial role in enabling individuals to participate in the world of options. By providing the platform, tools, and resources needed to buy and sell options, these brokers serve as the key catalysts for your trading journey.

Choosing the right broker is essential for maximizing your success. Carefully assess your trading needs, the broker’s features, fees, and regulatory standing. Don’t forget to explore the various educational resources many brokers offer to gain mastery of this complex but potentially rewarding trading strategy.

As you embark on this journey into the world of options, remember that knowledge is power. By understanding the intricacies of options trading, embracing a disciplined approach, and choosing the right tools, you can unlock the potential of this exciting investment strategy to achieve your financial goals.