Introduction:

Image: www.pinterest.com

In the ever-evolving world of finance, options trading stands as a formidable instrument capable of unlocking immense opportunities and risks. Whether you’re an experienced investor seeking to enhance returns or a novice eager to delve into the captivating realm of derivatives, grasping the fundamentals of options trading is paramount. This article embarks on a comprehensive journey, unraveling the enigmatic world of options trading with lucid explanations and practical examples, empowering you to make informed decisions and navigate the labyrinthine financial markets with confidence.

Pillars of Options Trading: History, Concepts, and Types

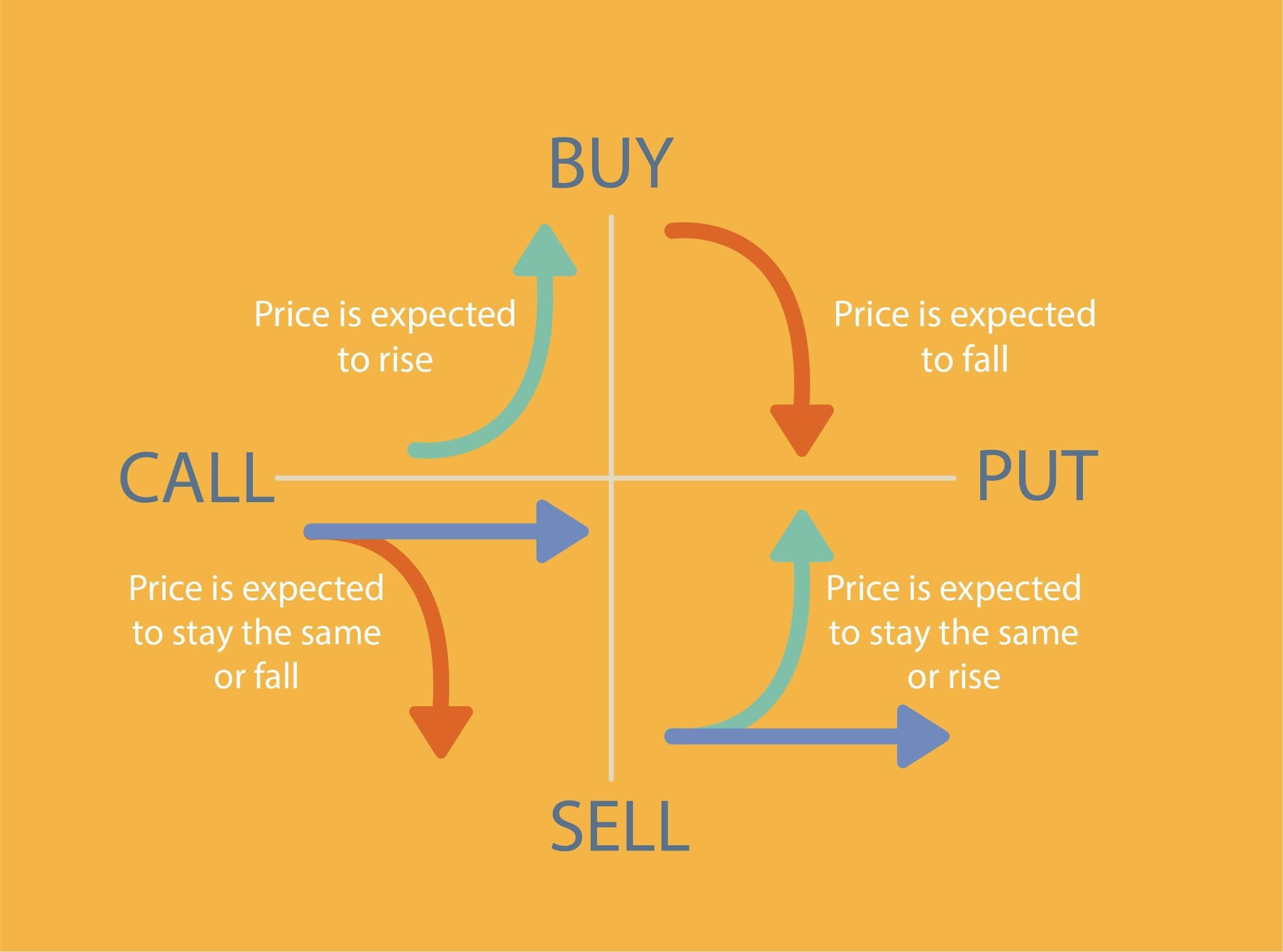

Tracing its origins to the 18th century, options trading has evolved into an indispensable tool for risk management and speculation. An option contract grants the holder the right, but not the obligation, to buy or sell an underlying asset (stock, bond, currency) at a specified price (strike price) on or before a specified date (expiration date). By understanding the distinct types of options, calls and puts, you can tailor strategies aligned with your investment objectives.

Call Options: A Bullish Bet with Limitless Upside

A call option grants you the right to acquire a specific quantity of an underlying asset at the strike price. When exercised, call options provide an opportunity to profit from expected increases in the underlying’s value. As the asset’s price rises above the strike price, the potential gains become boundless, making call options a potent instrument for bullish investors.

Example: Imagine purchasing a call option on Google stock with a strike price of $100 and an expiration date of three months. If Google’s share price climbs to $120 during that period, you have the right to claim the spread of $20 per share. By exercising your call option, you could reap a significant profit.

Put Options: Hedging Against Market Downturns

Put options, on the other hand, endow you with the right to sell an underlying asset at the strike price. They are often employed for hedging purposes, allowing investors to safeguard their portfolios against potential declines in the asset’s value. As the underlying’s price falls below the strike price, the value of the put option correspondingly increases.

Example: Suppose you own a substantial amount of shares in Tesla and apprehend a market downturn. By buying a put option with a strike price of $200, you secure the right to sell your shares at that price even if Tesla’s stock plummets. This strategy limits your potential losses in the event of an adverse market movement.

Advanced Options Strategies: Elevating Returns and Mitigating Risk

While basic options strategies provide a solid foundation, advanced techniques unlock even more sophisticated risk and return profiles. Strategies like spreads combine multiple options contracts to create customized positions, enabling investors to amplify potential profits while simultaneously managing risk. Moreover, sophisticated hedging strategies, such as collar and straddle techniques, empower traders to navigate turbulent markets with greater finesse and poise.

Practical Applications and Real-World Scenarios

Options trading extends beyond theoretical concepts into the vibrant realm of real-world applications. From speculative ventures to risk mitigation, options play a pivotal role in the decision-making arsenal of savvy investors. A seasoned hedge fund manager may utilize call options to capitalize on anticipated price surges in technology stocks, while a portfolio manager could employ put options to safeguard client assets against market volatility. Options trading offers boundless possibilities, beckoning investors to explore its nuances and harness its power.

Conclusion

Understanding the intricacies of options trading is the key that unlocks a world of financial possibilities. By mastering the concepts, strategies, and applications outlined in this comprehensive guide, you can empower yourself to navigate the financial markets with confidence and make informed decisions that drive your investment success. Remember, the realm of options trading is a dynamic and evolving frontier, necessitating continuous learning and adaptation to its ever-changing landscape. Embrace this journey of discovery, explore the vast resources available online and through trusted financial institutions, and become a master of this captivating financial instrument. The world of options trading awaits your exploration, offering infinite opportunities to enhance returns, mitigate risk, and achieve financial freedom.

Image: www.markettradersdaily.com

Understanding The Options Trading With Examples

Image: successfultradings.com