Introduction

In the tumultuous world of financial markets, options trading presents a high-stakes yet potentially lucrative opportunity. Among the various options strategies, straddles have emerged as a versatile tool for both seasoned traders and aspiring investors. If you’re eager to navigate the complexities of options trading and harness the power of straddles, this comprehensive guide will empower you with a deep understanding of this technique.

Image: uzodocymujyb.web.fc2.com

What is a Straddle?

In essence, a straddle is an options strategy that involves purchasing both a call and a put option with the same expiration date but different strike prices. The call option gives the holder the right to buy an underlying asset at a predetermined price, while the put option provides the right to sell that asset at another predetermined price.

How Does a Straddle Work?

The profit potential of a straddle lies in its ability to capitalize on significant price fluctuations in the underlying asset. When the price of the asset moves sharply in either direction, one of the two options will gain value while the other loses value. This allows traders to profit regardless of whether the asset’s price goes up or down.

Example:

Let’s consider an example of a straddle on Apple stock. Suppose the stock’s current price is $150. A trader could purchase both a call option with a strike price of $155 and a put option with a strike price of $145, both expiring in one month. If the stock’s price rises above $155, the call option will gain value while the put option loses value; conversely, if the stock’s price falls below $145, the put option will gain value while the call option loses value.

Types of Straddles

There are two main types of straddles:

- Long Straddle: In this scenario, the trader simultaneously buys both a call and a put option. The maximum profit potential is limited to the difference between the strike prices, minus the combined premium paid for both options.

- Synthetic Straddle: This involves creating a straddle by buying a long option and selling naked options. This strategy provides higher potential returns but also carries a higher level of risk.

Benefits of Straddles

- Profit Potential: Straddles offer the opportunity to generate profits in both rising and falling markets.

- Limited Loss: In a long straddle, the maximum loss is capped at the combined premium paid for the options.

- Flexibility: Straddles can be customized to suit different volatility expectations and investment horizons.

Risks of Straddles

- Premium Cost: Straddles can require a significant upfront investment, especially for higher-priced assets.

- Time Decay: The value of options erodes over time, so straddles must be timed correctly to maximize profitability.

- Potential Loss: While straddles offer limited loss protection, it’s still possible to lose money if the asset’s price remains within a narrow range.

Expert Insights

“Straddles can be a powerful tool for experienced traders who understand the risks and can identify opportunities where significant price movements are anticipated,” says Mark Richards, a veteran options trader. “However, it’s crucial to approach this strategy with caution and a well-defined trading plan.”

Actionable Tips

- Research and Due Diligence: Thoroughly research the underlying asset and market conditions before implementing a straddle.

- Choose the Right Strike Prices: Careful consideration should be given to selecting strike prices that align with your volatility expectations.

- Monitor the Market Closely: Regular monitoring of the asset’s price and market news is essential for successful straddle trading.

Conclusion

YouTube Options Trading Basics: Mastering Straddles provides a comprehensive overview of this versatile strategy. Whether you’re a seasoned trader or an aspiring investor, this guide has equipped you with the knowledge to confidently navigate the ups and downs of options trading. But remember, investing involves risk, so it’s always advisable to consult with a financial advisor before making any investment decisions. Embrace the world of options trading with a sound understanding and let straddles become a potent weapon in your financial arsenal.

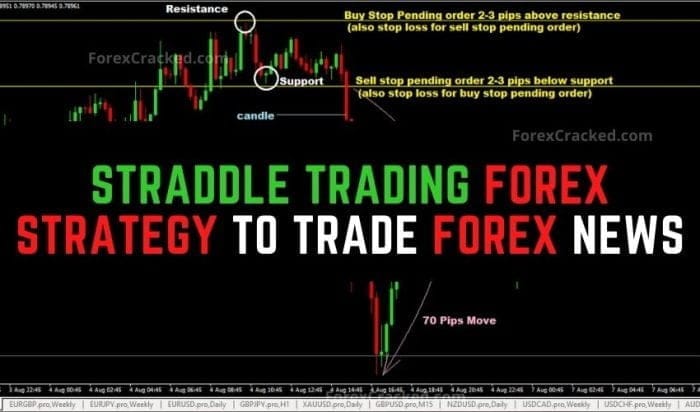

Image: www.forexcracked.com

Youtube Options Trading Basics Straddles

Image: www.stockradar.in