The Ultimate Guide to Winning with Futures Options

When it comes to options on futures trading, there are countless strategies to choose from. But which ones are the best? And more importantly, which ones will dominate 2023? In this blog post, I’ll share with you some of the most effective options on futures trading strategies that I believe will give you an edge in the rapidly evolving markets.

Image: derivfx.com

Trading the Volatility Index (VIX)

The Volatility Index (VIX) measures the market’s expectations of volatility for the next 30 days. When the VIX is high, it means that traders are expecting a lot of volatility, and when the VIX is low, it means that traders are expecting relatively little volatility. One way to trade the VIX is to buy VIX futures options when the VIX is low and sell them when the VIX is high.

Prepare for High Volatility

Think about this: when the VIX is low, that means the market is complacent and not anticipating significant price swings. But history has taught us that calm often precedes the storm. Dlatego, buying VIX futures options when the VIX is low allows you to capitalize on potential spikes in volatility. As the market awakens to unexpected events or economic shifts, volatility will rise, driving up the value of your options.

Conversely, when the VIX is high, indicating heightened fear and anticipation of turbulence, it’s time to sell your VIX futures options. As volatility subsides and the market regains its composure, the demand for VIX options dwindles, leading to a decline in their value. By selling at this peak, you lock in your profits and avoid holding onto options that may lose value as tranquility returns.

Pair Trading to Reduce Risk

Pair trading is a technique used to reduce risk by simultaneously taking two correlated positions in different markets. In the case of options on futures trading, you can pair trade two futures contracts with a high correlation, such as the E-mini S&P 500 and the E-mini NASDAQ 100. This strategy involves buying one futures contract and selling another, while also purchasing options on both contracts.

The objective of pair trading is to profit from the spread between the two futures contracts while mitigating the risks associated with individual contract movements. By selecting highly correlated contracts, you enhance the likelihood that the contracts will move in tandem, thus reducing the volatility of your overall portfolio.

Image: www.youtube.com

Hedge Against Unexpected Market Fluctuations

Hedging with options on futures is a defensive strategy employed to protect against potential losses in your underlying portfolio. Consider this scenario: you hold a long position in a stock index futures contract, and you’re concerned about a potential market downturn. To hedge against this risk, you could buy a put option on the same futures contract.

If the market does indeed decline, the value of your put option will increase, offsetting some of the losses incurred in your futures position. This strategy allows you to limit your downside risk while maintaining exposure to potential market gains. By hedging with options, you effectively create a safety net for your investments.

FAQ

- Q: What is the most important factor to consider when choosing an options on futures trading strategy?

A: The most important factor to consider is your own risk tolerance and investment objectives. - Q: Can I trade options on futures with a small account?

A: Yes, you can trade options on futures with a small account. However, you need to be aware of the risks involved and manage your risk accordingly. - Q: What is the best way to learn about options on futures trading?

A: There are many resources available to learn about options on futures trading. You can find books, articles, and online courses on the topic.

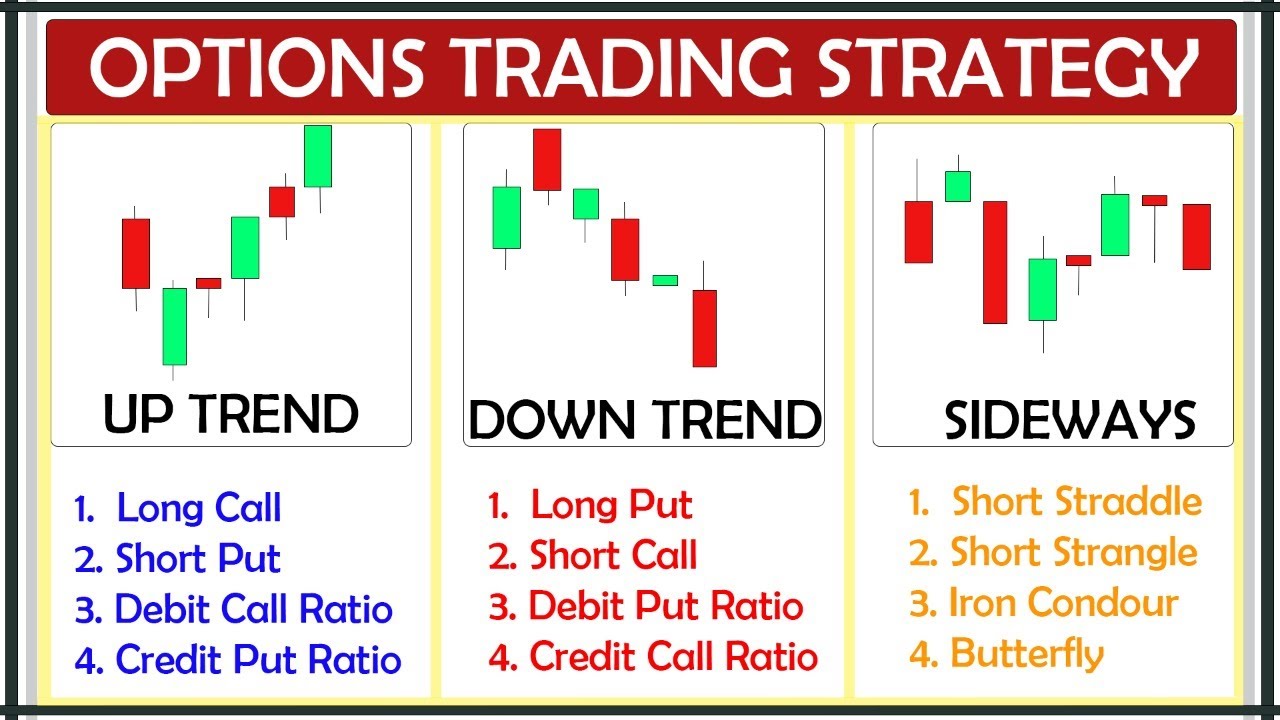

Options On Futures Trading Strategies

Image: www.warriortrading.com

Conclusion

These are just a few of the most effective options on futures trading strategies that I believe will dominate 2023. As always, it’s important to do your own research and choose strategies that fit your own risk tolerance and investment objectives. If you’re new to options trading, I encourage you to start with a small account and paper trade until you get the hang of it. With a little practice, you’ll be well on your way to profiting from this exciting and rewarding market.

Are you interested in learning more about options on futures trading? Let me know in the comments below!